[ad_1]

Information reveals the Bitcoin Web Taker Quantity has turned considerably optimistic not too long ago, an indication which may be bullish for the asset.

Bitcoin Web Taker Quantity Has Risen To Constructive Values Not too long ago

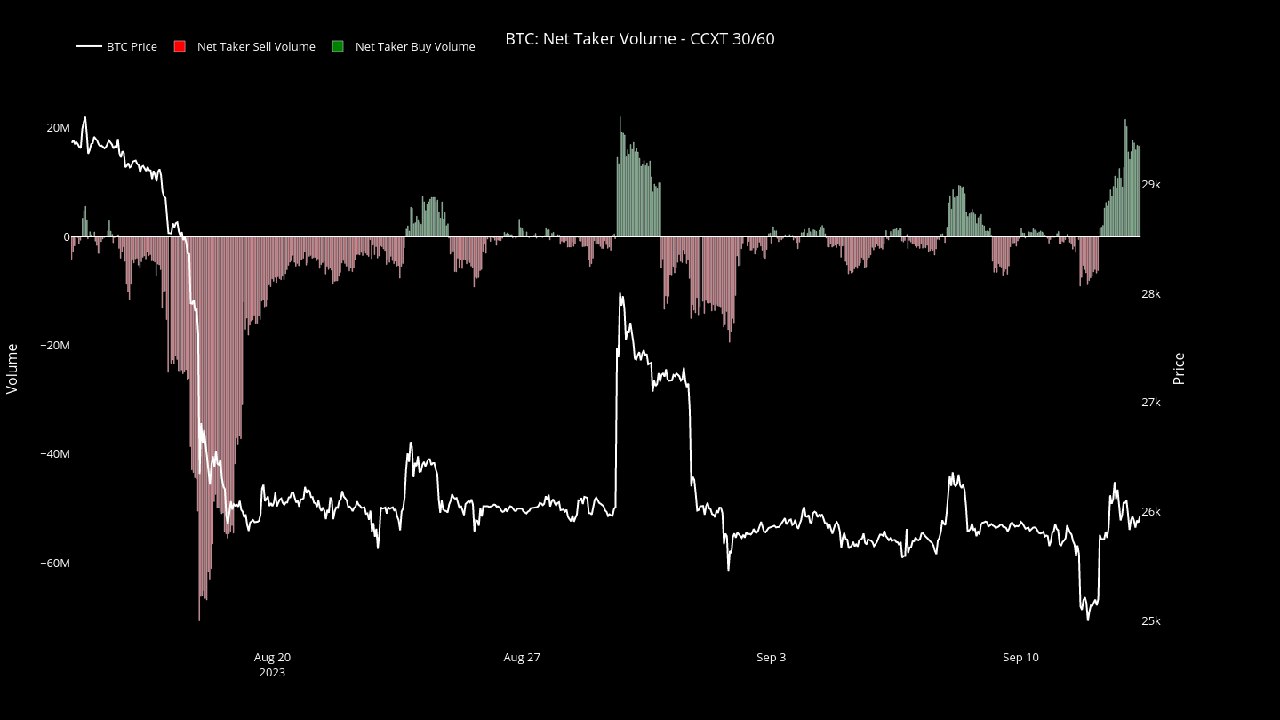

In a brand new put up on X, the CryptoQuant Netherlands Neighborhood Supervisor, Maartunn, identified that purchasing exercise seems to be occurring available in the market. The related indicator right here is the “Web Taker Quantity,” which measures the distinction between the Bitcoin taker purchase and taker promote volumes.

When this metric has a optimistic worth, the taker’s purchase quantity is larger than the taker’s present gross sales quantity. This implies that the traders are prepared to pay greater than the spot worth to purchase the asset; thus, nearly all of the market is bullish.

Then again, detrimental values suggest a bearish mentality is the dominant pressure within the BTC sector, because the holders are prepared to promote cash at a cheaper price.

Now, here’s a chart that reveals the pattern within the Bitcoin Web Taker Quantity over the previous couple of weeks:

Seems like the worth of the metric has been inexperienced in latest days | Supply: @JA_Maartun on X

As displayed within the above graph, the Bitcoin Web Taker Quantity had a detrimental worth when the dip towards the $25,000 stage occurred a number of days again. Nonetheless, earlier than lengthy, the indicator had registered an increase and entered optimistic territory.

With this change in direction of a bullish mentality, the BTC spot worth had noticed a pointy restoration beneath the $26,000 mark. The chart reveals that the metric’s worth has solely grown extra optimistic because the surge, suggesting that vital shopping for could possibly be occurring proper now.

The value, nevertheless, has solely consolidated sideways whereas this has occurred. As for what this may occasionally imply, the analyst notes, “both restrict sellers are taking management, or this factor will explode quickly.”

Indicators of dropping values of the Web Taker Quantity could also be value watching out for, because the Grayscale rally final month had initially seen a pointy surge within the indicator. Nonetheless, quickly sufficient, the metric had began to slip again down, doubtlessly ensuing within the asset’s retrace.

Just a few days again, one other analyst shared a chart displaying that the miners had made vital deposits to the spot exchanges.

The metric had noticed a spike a few days again | Supply: @IT_Tech_PL on X

Typically, miners switch their cash to those platforms for promoting functions, so this spike may have been an indication that these chain validators had been gearing up for a dump.

The spike had occurred after BTC’s drop to $25,000, implying that the miners had maybe panicked on the drop, and, therefore, had made the deposits as a response.

It could seem that the market outweighed the promoting strain attributable to this cohort ultimately, as the online taker quantity had turned optimistic, and the market had registered a profitable rebound.

BTC Worth

Whereas Bitcoin has registered some uptrend up to now two days, the general image hasn’t modified for the cryptocurrency; its worth stays in tight consolidation.

BTC is floating across the $26,200 stage proper now | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link