[ad_1]

Knowledge exhibits the Bitcoin month-to-month common buying and selling quantity has now surpassed the yearly common one. Right here’s why this can be bullish for the asset.

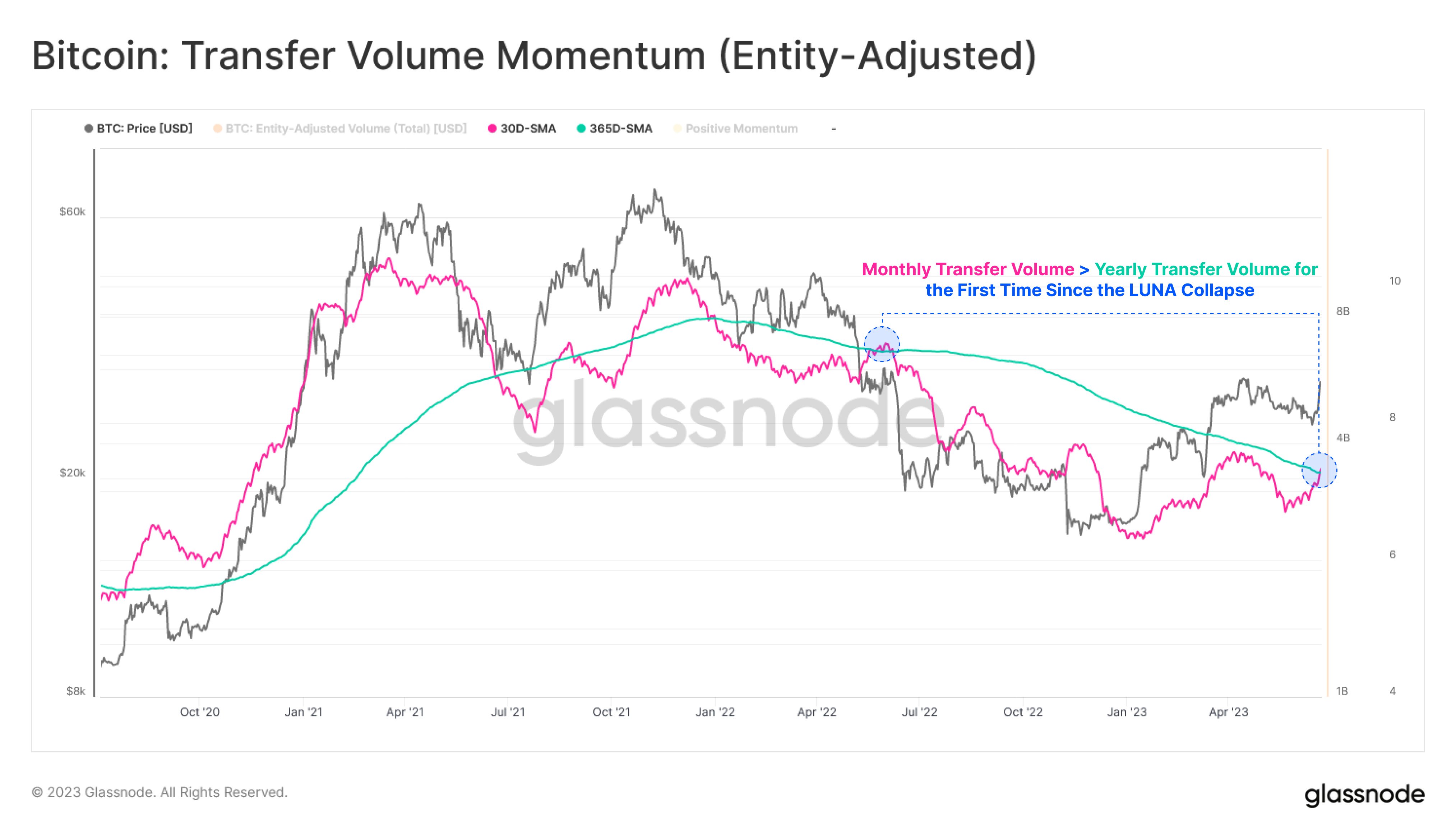

Bitcoin 30-Day SMA Quantity Has Crossed Above The 365-Day SMA

Based on knowledge from the on-chain analytics agency Glassnode, that is the primary time because the LUNA collapse that this sample has shaped for the cryptocurrency. The “buying and selling quantity” right here refers back to the whole quantity of Bitcoin the traders are transferring round on the blockchain.

When the worth of this metric is excessive, it signifies that many cash are getting concerned in transactions on the community. Such a development is normally an indication that the merchants are at the moment energetic available in the market.

Alternatively, low indicator values suggest that the chain is observing little exercise at the moment. This development can trace that the overall curiosity within the asset is low amongst traders.

Now, here’s a chart that exhibits the development within the 30-day easy transferring common (SMA) Bitcoin buying and selling quantity, in addition to the 365-day SMA of the identical, over the previous few years:

Seems just like the strains of the 2 metrics have come collectively in current days | Supply: Glassnode on Twitter

The above graph exhibits that the 30-day SMA Bitcoin buying and selling quantity has risen not too long ago. This could counsel that the exercise on the community has been seeing an uplift.

The ramp-up within the variety of cash being shifted across the community has come because the cryptocurrency has noticed a pointy rally, which has now taken the worth above the $31,000 degree.

Usually, rallies appeal to consideration to the asset, as traders normally discover such worth motion thrilling. Thus, it’s not sudden that the amount has gone up with this worth surge.

With this newest rise, the metric has caught up with the 365-day SMA and has simply barely crossed above it. The formation of this sample implies that the month-to-month common buying and selling quantity of the asset has lastly surpassed the common for the previous 12 months.

The chart exhibits that the final time the 2 strains confirmed this conduct was across the time of the LUNA collapse. Apart from this temporary interval, the 30-day SMA of the indicator has been below the 365-day SMA for everything of the bear market and the rally up to now, displaying how low the asset’s exercise has been on this interval.

Nonetheless, this development may lastly be altering if the most recent crossover between these two strains sticks this time, not like the one seen across the time of the LUNA crash.

Growing community exercise is normally a constructive signal for Bitcoin, because it suggests development in utilization. Notable rallies within the asset have traditionally accompanied rising volumes, as such worth strikes require many energetic merchants to be sustainable.

Because the chart exhibits, the month-to-month and yearly SMAs of the BTC buying and selling quantity additionally confirmed an identical crossover throughout the buildup in direction of the 2021 bull run.

BTC Value

On the time of writing, Bitcoin is buying and selling round $31,200, down 18% within the final week.

BTC has been sharply going up not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link