[ad_1]

On-chain knowledge reveals that Bitcoin miners have been depositing massive quantities to exchanges. Right here’s what this might imply for the asset’s worth.

Bitcoin Miners Have Been Depositing Massive To Exchanges Just lately

An analyst in a CryptoQuant publish identified that BTC miners have been transferring cash out of their wallets lately. The related indicator right here is the “miner outflow,” which measures the entire quantity of Bitcoin miners withdraw from their mixed provide.

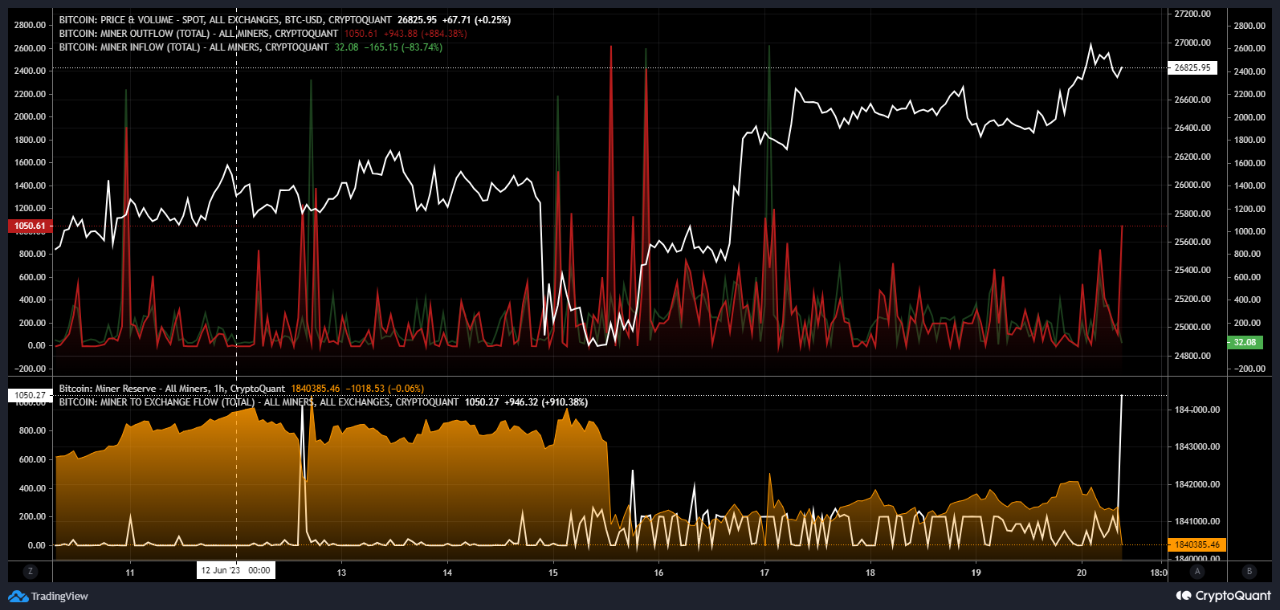

The counterpart metric, the “miner influx,” naturally retains monitor of the reverse circulation of cash. Here’s a chart that reveals the development in each the Bitcoin miner outflow and the influx over the previous few days:

Appears like the worth of one of many metrics has been elevated in latest days | Supply: CryptoQuant

The above graph reveals that the Bitcoin miner outflow has noticed a spike throughout the previous day, whereas the influx has remained comparatively low. This may indicate that the miners have transferred a internet quantity of cash from their wallets on this interval.

Usually, at any time when miners withdraw cash from their wallets, there may be at all times a danger that they’re doing so to promote stated cash. Such promoting can naturally have a bearish impact on the cryptocurrency’s worth.

One strategy to higher guess the intent behind these withdrawals is by checking whether or not the vacation spot of the cash is a centralized trade platform.

The chart additionally reveals the info for the Bitcoin miner to trade circulation. This indicator particularly retains monitor of the cash flowing from these chain validators’ holdings to trade wallets.

This indicator has additionally seen a pointy spike similtaneously the miner outflow surge. The magnitude of each spikes can also be just about the identical; each are barely above 1,000 BTC. Thus, virtually all of the outflows from the previous day seem to have headed towards exchanges.

Understanding that there have been deposits to exchanges solely tells us part of the story, nevertheless, because the indicator used right here doesn’t specify which kind of platforms the inflows have been in direction of.

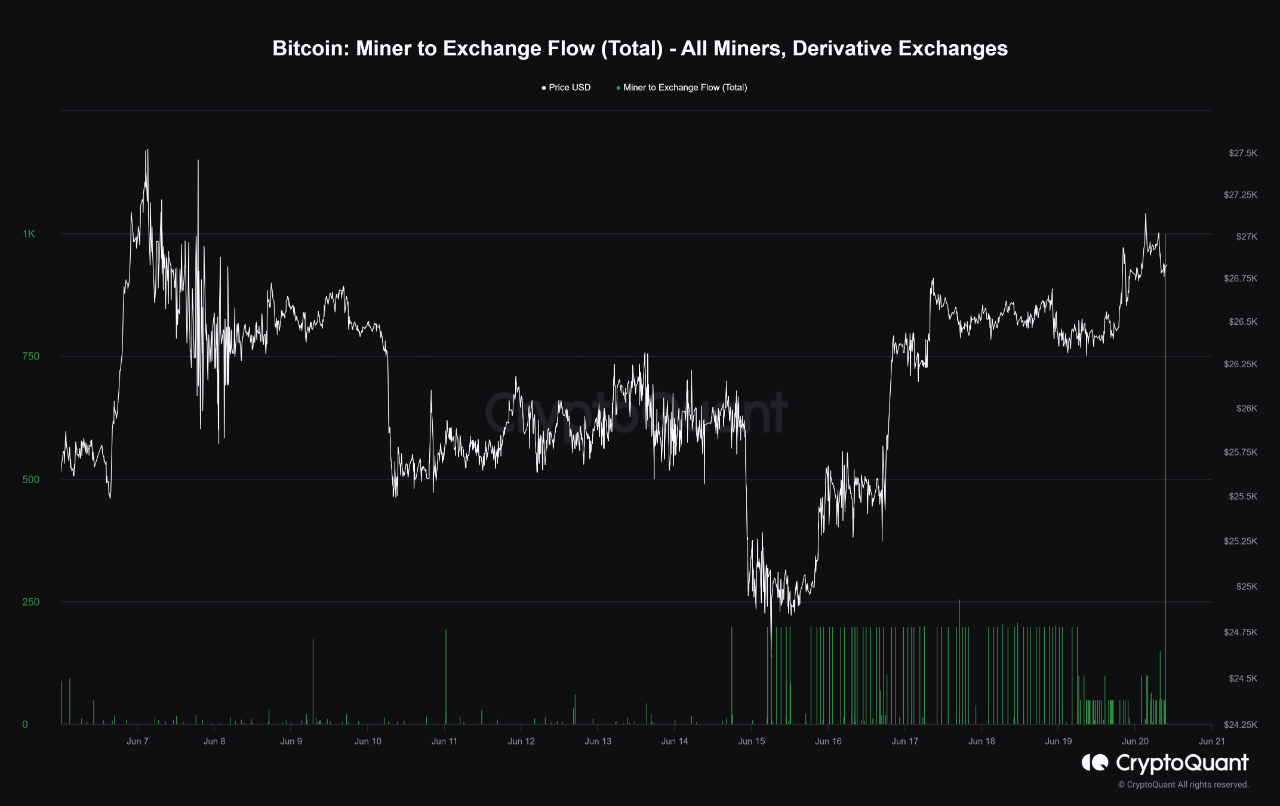

A modified model of the indicator, which solely tracks deposits to by-product exchanges, reveals that the transfers have been virtually solely towards the by-product platforms.

The worth of the metric appears to have spiked lately | Supply: CryptoQuant

When miners plan to promote their cash, they make deposits to identify exchanges. Since they’ve despatched their Bitcoin to by-product platforms as a substitute this time, it will appear possible that the intent behind their transfers might not have been promoting in spite of everything.

As for what impact this might need available on the market; often extra by-product positions being opened often ends in greater worth volatility. Nonetheless, this volatility can go both bullish or bearish, relying on the broader sentiment.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,400, up 6% within the final week.

BTC has noticed an uplift as we speak | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link