[ad_1]

On-chain information reveals that Bitcoin miners have been depositing to exchanges not too long ago, an indication that may be troubling for the asset’s worth.

Bitcoin Miners Proceed To Ship Giant Quantities To Exchanges

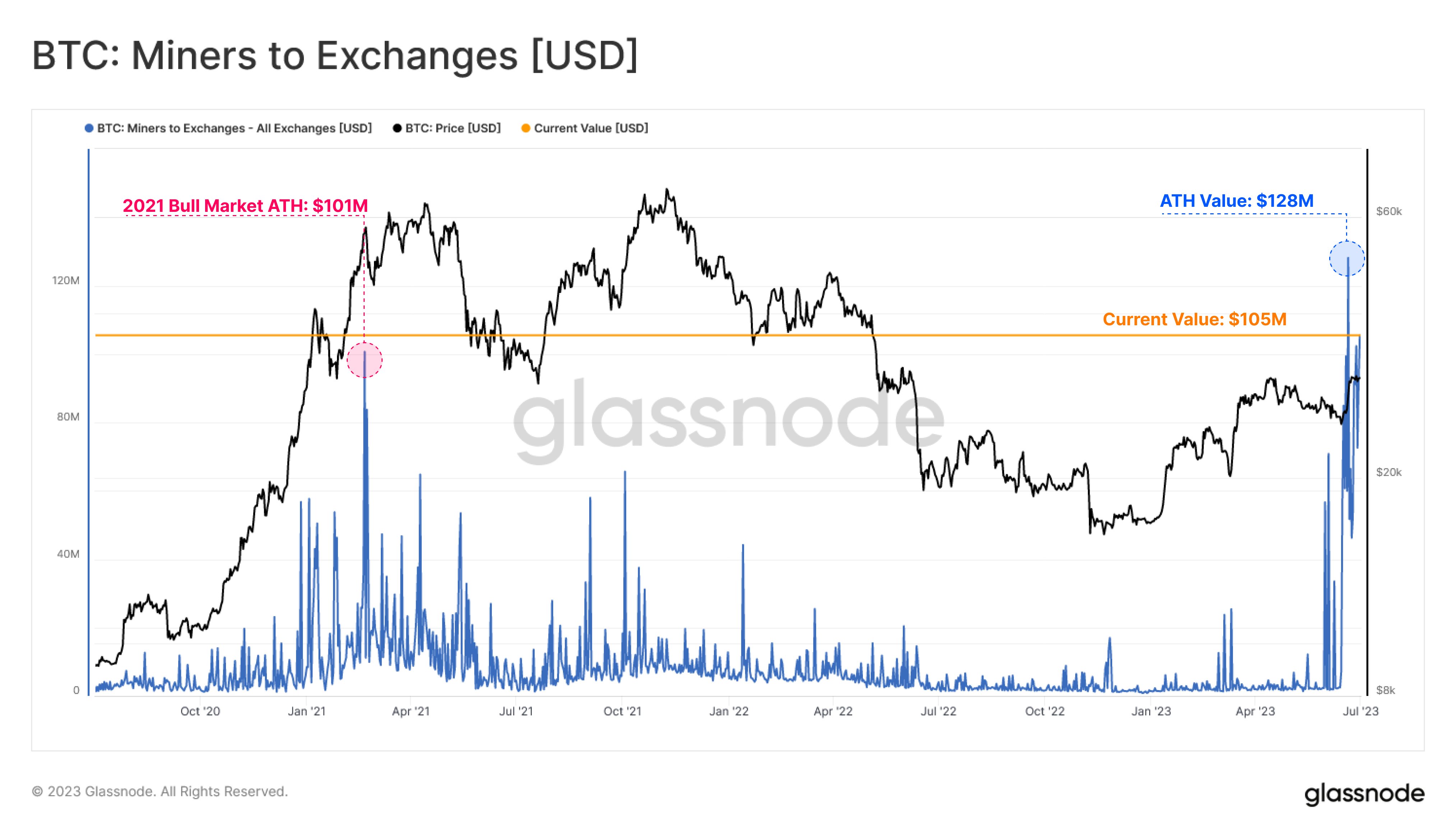

In accordance with information from the on-chain analytics agency Glassnode, the BTC miners have not too long ago deposited $105 million within the asset to centralized exchanges. The indicator of curiosity right here is the “miners to exchanges,” which measures the full quantity of Bitcoin (in USD) that the miners are transferring to the wallets of all centralized exchanges at present.

When the worth of this metric is excessive, it implies that these chain validators are sending giant numbers of cash to exchanges proper now. Usually, this cohort deposits to those platforms for selling-related functions, so this type of pattern generally is a signal of elevated promoting stress from these holders.

However, low values indicate the miners aren’t sending any extraordinary quantities to exchanges in the intervening time. Such a pattern generally is a trace that there isn’t a lot promoting stress coming from these traders at present.

Now, here’s a chart that reveals the pattern within the Bitcoin miners to exchanges metric over the previous few years:

The worth of the metric appears to have been fairly excessive in current days | Supply: Glassnode on Twitter

Because the Bitcoin miners have continued operating prices like electrical energy payments, they make common deposits to exchanges in order that they’ll withdraw their BTC into fiat and make these funds.

Such deposits are, nevertheless, often comparatively small in scale. From the above graph, it’s seen that the Bitcoin miners to exchanges indicator have shot up not too long ago. These newest giant deposits actually don’t appear like they’ve been made merely paying off the miners’ operation prices.

A few of these current excessive spikes had come whereas the market had been below a spell of FUD from the SEC lawsuits in opposition to Binance and Coinbase, suggesting that these traders had probably been panic promoting.

The bigger and more moderen spikes, although, have include the rally within the cryptocurrency’s worth past the $30,000 mark. Naturally, these excessive values of the indicator generally is a signal of mass profit-taking from these chain validators.

The spike within the indicator that got here proper after the rally measured round $128 million. This spike is just not solely the biggest one of many newest collection of spikes however is in actual fact the very best the metric has been within the asset’s historical past.

Bitcoin, nevertheless, efficiently shrugged off these all-time excessive deposits from the miners, because the asset’s worth continued to take care of above the $30,000 stage. Miners don’t appear to have completed their spherical of promoting simply but, although, because the graph reveals.

One other large spike got here simply a few days again as this cohort deposited $105 million price of the asset to those platforms. Whereas this worth is smaller than the ATH spike, it’s nonetheless bigger than the height seen through the 2021 bull run.

To this point, Bitcoin has nonetheless not noticed any noticeable unfavourable impact from this potential promoting stress from the miners, because the coin has continued to take care of above $30,000. It stays to be seen, nevertheless, if the cryptocurrency can do the identical within the coming days if miners do proceed to additional their promoting.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,600, up 1% within the final week.

BTC has been holding robust above the $30,000 mark not too long ago | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link