[ad_1]

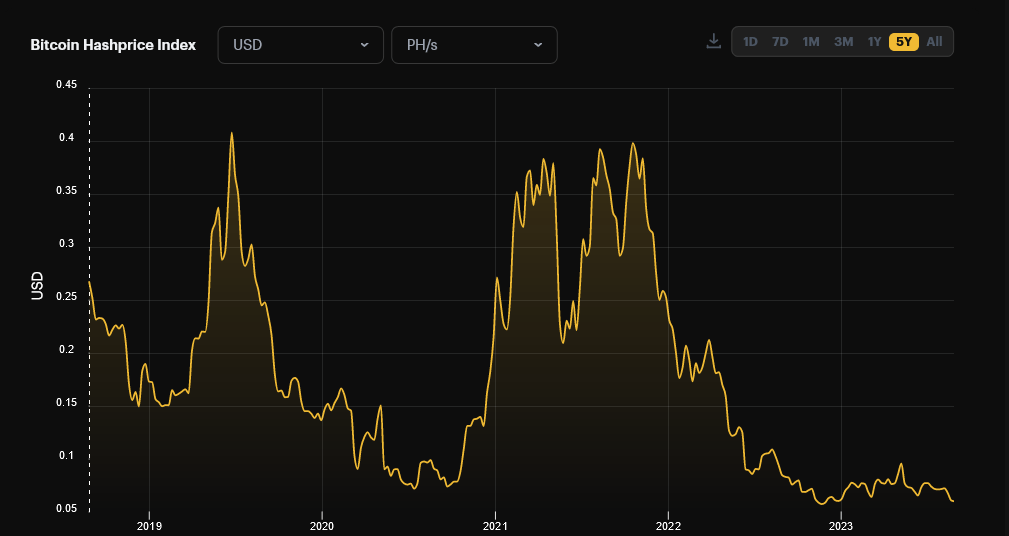

Bitcoin miners are churning much less in income, taking a look at trackers on August 28. In accordance with Hashrate Index information, a platform that tracks the correlation between hash fee and income accrued by miners over time, revenue generated from Bitcoin mining operations is at close to document lows.

Bitcoin Miner Income Declining

At $0.059 per Tera Hash (TH) each day, the development doesn’t look thrilling for Bitcoin miners as it’s cents away from $0.056, a degree recorded in late November 2022.

On the depth of final yr’s crypto winter when costs fell, cracking beneath $16,000, hash worth, which measures the potential income anticipated from deploying 1 Tera Hash of hash fee to the Bitcoin community per day, crumbled to the bottom level in three years.

Whereas BTC supporters are optimistic, anticipating costs to recuperate within the second half of 2023, miners should cope with decrease income. How this impacts their operations is but to be seen as a result of miners depend upon revenue generated from deploying hash fee to cater for operational bills and typically pay shareholders.

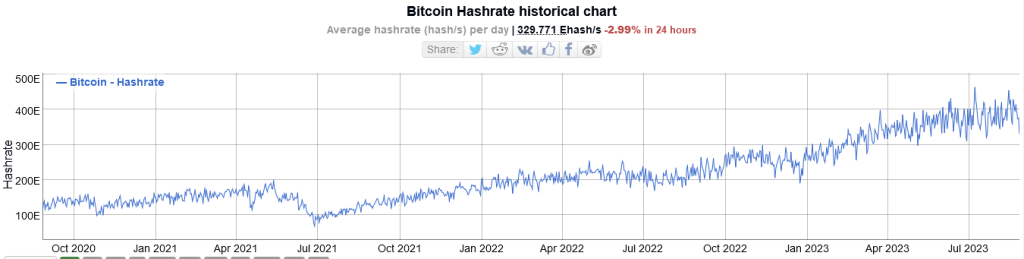

On Might 8, the hash worth rose to $0.095, the best degree in 2023, however has since contracted, dropping by over 40%. Because the hash worth falls, it may imply miners are having a tough time competing. The development, as it’s seen, comes when the hash fee has been rising to document ranges as extra miners energy up their mining rigs.

All through 2023, the entire Bitcoin hash fee, a metric measuring the computing energy channeled to the community, rose from 269 EH/s in early January 2023 to 465 EH/s in early July 2023. The hash fee has since dropped round 329 EH/s, a degree that’s nonetheless greater than 2022 highs.

Extra Rigs, Increased Hash Price

With a rising hash fee, the Bitcoin community robotically adjusted the mining problem to the best degree final week. Trackers present the community’s problem is now at 55.62 T, following a 6% increment.

For the higher a part of the yr, problem ranges have been rising amid a rise in hash fee. As costs recovered in January and the hash fee rose, the community elevated problem ranges by 10%, the best spike this yr.

Hash fee will probably proceed rising within the months forward. Tether Power, an affiliate of Tether Holdings, points USDT, plans to attach their rigs in Latin America. Their launch interprets to extra competitors for present miners, together with Riot Blockchain.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link