[ad_1]

Fast Take

A number of key metrics within the Bitcoin market counsel a neighborhood backside, an inflection level indicating a possible reversal from the latest downward pattern.

Open curiosity, a metric that tracks the full variety of excellent derivatives contracts, has been reset, indicating that gamers are repositioning themselves for a possible market shift. In the meantime, the perpetual funding fee has remained adverse for 3 consecutive days, suggesting a contraction of leveraged positions out there.

Furthermore, the miner capitulation part, a interval the place smaller or inefficient miners promote their holdings attributable to unfavorable market circumstances, seems to have handed. That is strengthened by the continual offloading of cash from cryptocurrency exchanges. Brief-term holders (STHs) reportedly capitulated and bought at a loss final Thursday, usually an indication of market bottoming.

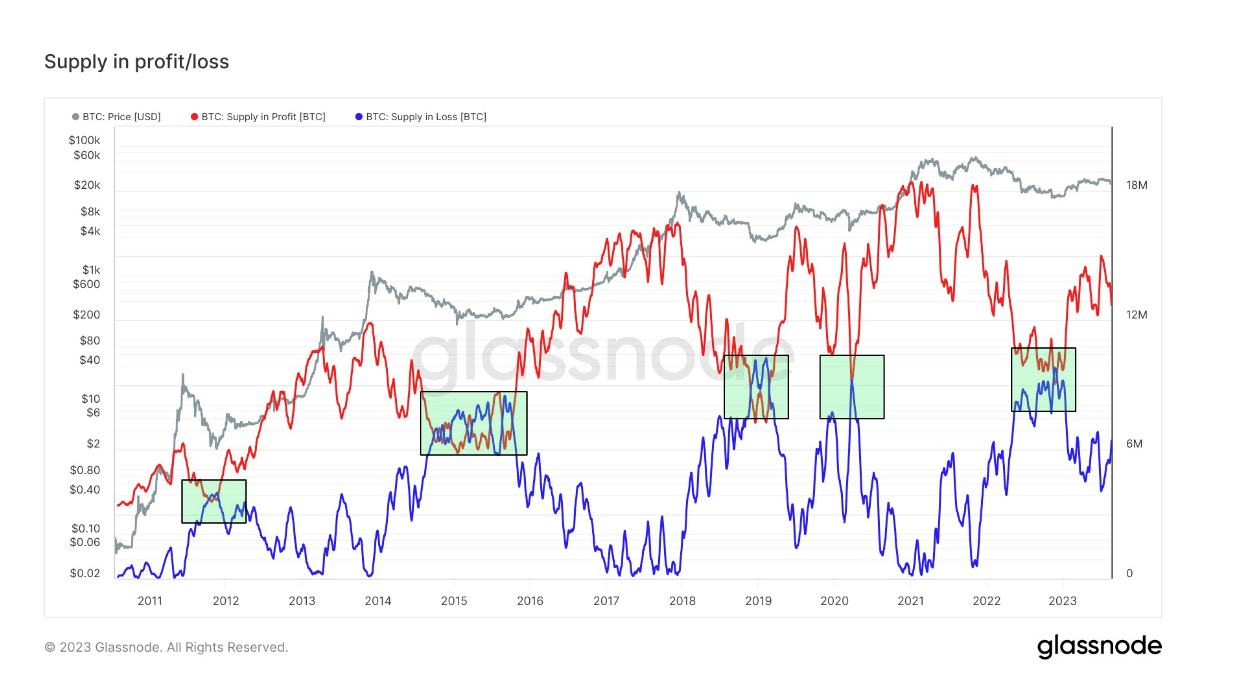

Nonetheless, one indicator continues to be absent from this potential bottoming state of affairs – the availability in revenue/loss. This metric swings in direction of a ‘backside’ when extra Bitcoin is at a loss than revenue. This indicator exhibits a discrepancy of 6 million, suggesting that the market has not but reached the underside based on this particular metric.

The submit Bitcoin market indicators native backside as key indicators counsel potential reversal appeared first on CryptoSlate.

[ad_2]

Source link