[ad_1]

On-chain knowledge reveals that Bitcoin long-term holders have remained adamant not too long ago as their actions stay at low ranges.

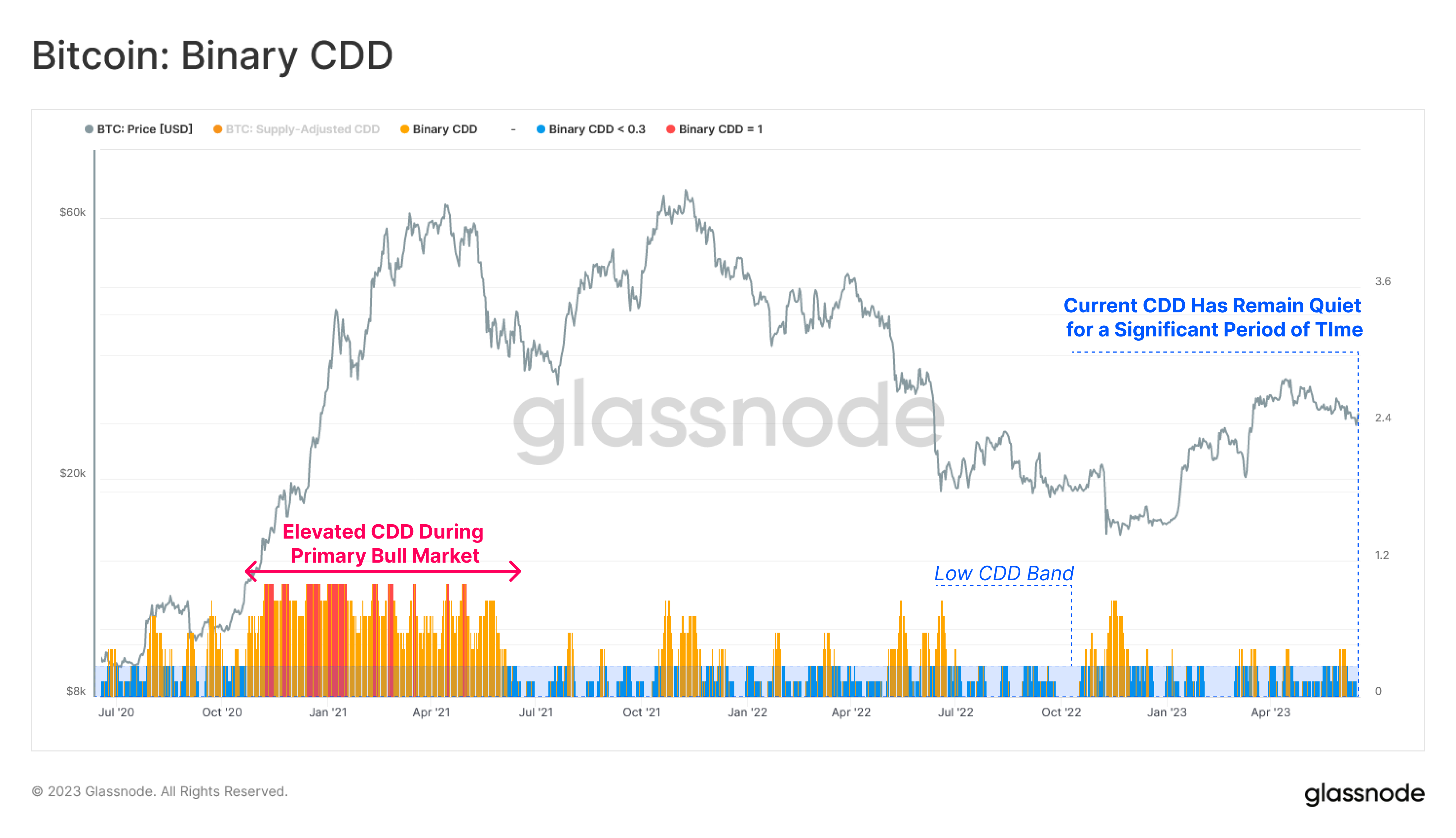

Bitcoin Binary CDD Has Continued To Be At Low Values Not too long ago

In line with knowledge from the on-chain analytics agency Glassnode, mature cash aren’t displaying a lot motion regardless of the latest volatility within the asset’s worth. The related indicator right here is the “Coin Days Destroyed” (CDD), which, to know the idea of “coin days,” must be checked out first.

A coin day is a amount that 1 BTC accumulates when it stays dormant on the blockchain for 1 day. When any coin that has remained dormant for some variety of days, and therefore, has accrued some coin days, is lastly transferred on the community, its coin days counter naturally resets again to zero.

The coin days that the coin on this instance had beforehand been carrying are mentioned to be “destroyed.” The BTC CDD retains observe of the overall variety of such coin days being destroyed or reset all through the blockchain on any given day.

The traditional model of the CDD isn’t the one among curiosity right here, nevertheless; a modified model known as the “binary CDD” is. This metric compares the present CDD worth with the long-term pattern.

As its identify already suggests, this indicator can solely have two values: 0 and 1. When its worth is 0, it means the CDD is lower than the long-term common proper now, whereas it being equal to 1 implies the CDD is increased in the meanwhile.

Now, here’s a chart that reveals the pattern within the 7-day SMA Bitcoin binary CDD over the previous couple of years:

The worth of the metric appears to have been fairly low in latest days | Supply: Glassnode on Twitter

As displayed within the above graph, the 7-day SMA Bitcoin binary CDD has had fairly low values for some time now. This suggests that there haven’t been many cash with a excessive age transferring not too long ago.

Typically, every time the CDD has elevated values, it’s an indication that the long-term holders (LTHs) are on the transfer. The LTH group consists of all of the buyers who’ve been holding their cash since at the very least 155 days in the past.

As these buyers have a tendency to remain dormant for lengthy intervals, they naturally accumulate massive quantities of coin days. Thus, every time these buyers present any important exercise, the CDD spikes as their excessive numbers of coin days are reset.

From the chart, it’s seen that the 7-day SMA Bitcoin binary CDD had been elevated in the course of the bull market within the first half of 2021, suggesting that the LTHs had been taking part in profit-taking again then.

In latest months, nevertheless, neither the rally nor the latest volatility because of elements just like the SEC fees towards Binance and Coinbase has been in a position to drive the Bitcoin LTHs into making any important strikes.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,500, up 2% within the final week.

BTC has made some restoration not too long ago | Supply: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link