[ad_1]

Bitcoin’s illiquid provide has reached a brand new all-time excessive as hodlers spend lower than they accumulate.

The surge in illiquid provide is a testomony to the resolve of Bitcoin traders in a time of excessive FIAT inflation and macroeconomic issues.

Historically ‘illiquid provide’ refers back to the quantity of Bitcoin held by entities and isn’t available for buying and selling or promoting.

Glassnode takes a extra nuanced strategy to find out illiquid provide and makes use of statistical strategies to differentiate between entities which can be primarily sending/promoting or receiving/shopping for Bitcoin and the way a lot time has handed since an entity has spent Bitcoins. It considers Bitcoin illiquid if it’s held by entities that traditionally spend or promote solely a small portion of their obtained Bitcoin.

Illiquid provide reached an unprecedented excessive, with 15.110 million Bitcoin now held by such entities. This determine represents a major enhance from final month’s document of 15.056 million, accounting for roughly 78% of the circulating provide.

What’s inflicting the diminished liquidity?

The rise in Bitcoin’s illiquid provide will be attributed to numerous elements. Some of the vital is the conduct of short-term holders who’ve held Bitcoin for lower than six months. This cohort at present holds over 20% of the provision, and their holdings have seen a notable uptick in latest weeks. This development means that short-term holders, lots of whom bought Bitcoin in This autumn 2022 and Q1 2023, are transitioning into long-term holders. As these people proceed to carry onto their Bitcoin, the illiquid provide is anticipated to rise additional.

The rise in Bitcoin’s illiquid provide comes throughout heightened inflation in fiat currencies worldwide. As central banks print cash in response to financial pressures, the worth of conventional currencies is diluted. In distinction, Bitcoin, with its capped provide and stuck emissions, is usually thought to be a hedge towards inflation. Furthermore, the rise in illiquid provide means that extra people acknowledge Bitcoin’s potential as a retailer of worth and are selecting to carry onto their property relatively than buying and selling or promoting them.

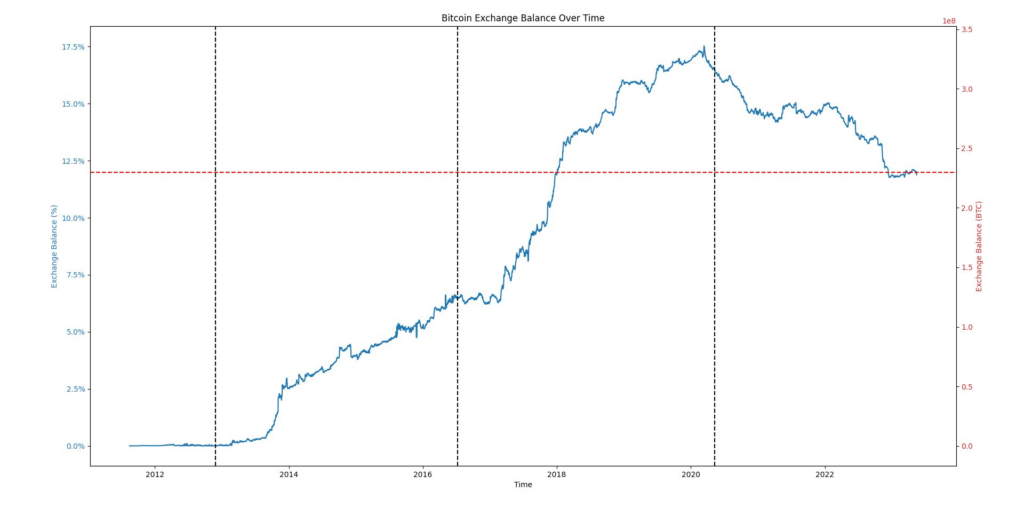

The thesis can be considerably supported by the correlation to a lower in Bitcoin held on exchanges because the illiquid provide rises. Firstly of 2020, exchanges held 17.5% of the Bitcoin provide. This determine has since fallen to round 12%, indicating that extra people are selecting to carry their Bitcoin in non-public wallets.

The collapse of main crypto exchanges in 2022 additional expedited Bitcoin leaving exchanges. Nevertheless, it additionally could have impacted the illiquid provide to some extent, as liquidators nonetheless maintain billions of {dollars} value of crypto in chapter hearings for the failed exchanges.

The rise in Bitcoin’s illiquid provide is a testomony to the rising recognition of Bitcoin as a hedge towards inflation and a retailer of worth. As extra people select to carry onto their Bitcoin, the illiquid provide will rise. This development contrasts starkly with FIAT economies, as diminished spending is linked to increased dwelling prices relatively than accumulating wealth. You will need to be aware that, with a number of nations such because the UK present process a ‘value of dwelling disaster,’ spending on crypto may additionally lower as individuals in the reduction of on non-essentials.

The put up Bitcoin illiquid provide hits all-time excessive as hodlers’ resolve fastens appeared first on CryptoSlate.

[ad_2]

Source link