[ad_1]

On-chain information exhibits that Bitcoin buyers have shifted in the direction of aggressive accumulation lately, one thing that will assist maintain the rally longer.

Bitcoin Accumulation Development Rating Has Tended In the direction of 1 Just lately

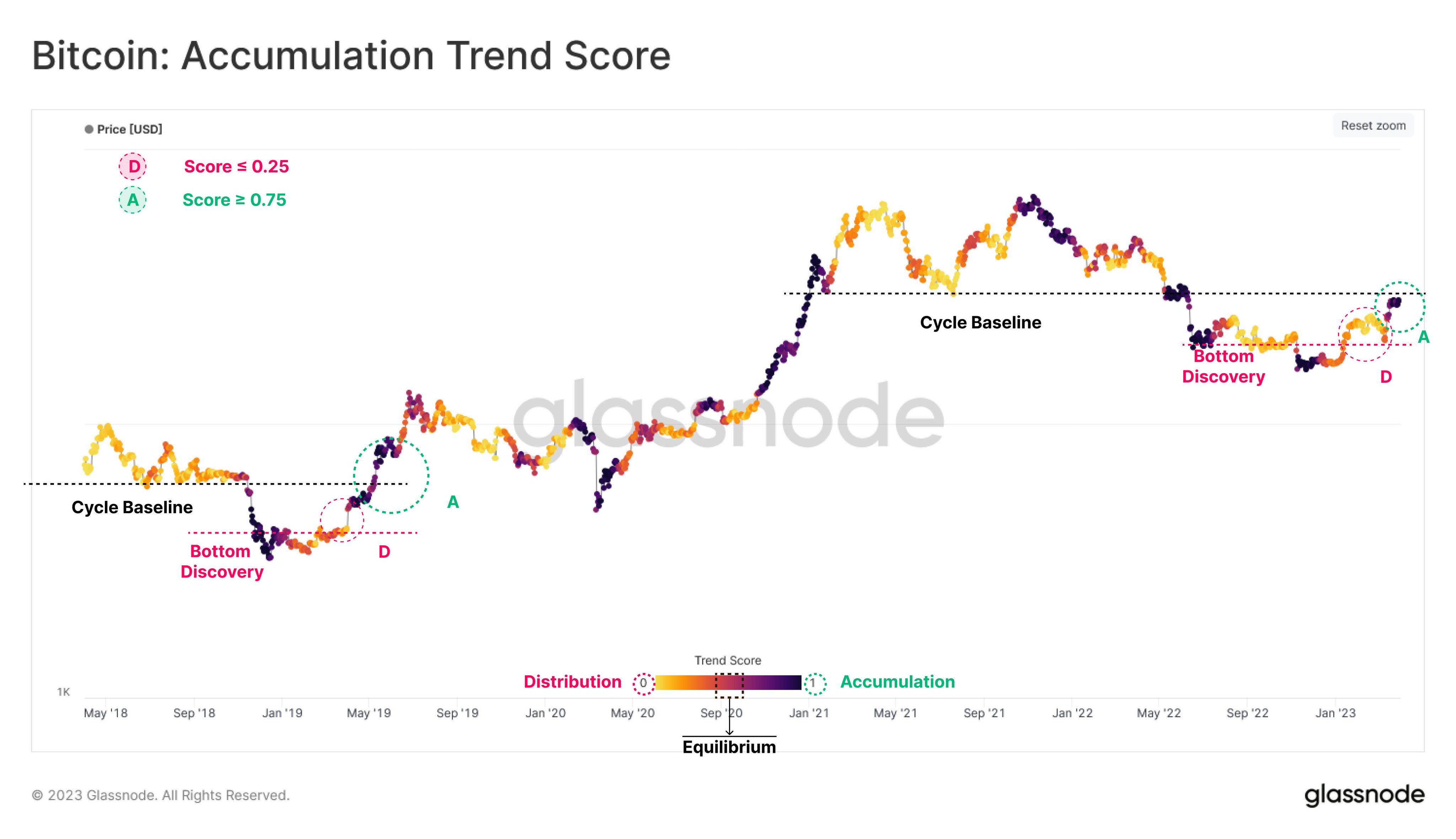

In response to information from the on-chain analytics agency Glassnode, there’s a structural similarity forming between the present and 2018-2019 BTC cycles. The indicator of curiosity right here is the “accumulation development rating,” which tells us whether or not Bitcoin buyers have been accumulating or distributing over the previous month.

This metric’s worth represents not solely the variety of cash that the holders are promoting or shopping for but in addition the pockets sizes of the entities which are collaborating within the accumulation or distribution traits.

When the buildup development rating has a worth close to the 1 mark, it means the massive entities (or an enormous variety of small buyers) are accumulating the asset at present.

However, the indicator having values near the 0 ranges suggests holders are distributing (or alternatively, simply not accumulating a lot) in the intervening time.

Now, here’s a chart that exhibits the development within the Bitcoin accumulation development rating over the previous few years:

The worth of the metric appears to have been near the one mark lately | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin accumulation development rating had assumed yellow/orange shades through the first couple of months of the most recent rally. Which means that the metric had values near 0 then, implying a considerable amount of distribution was going down from the massive entities.

This implies that the buyers might not have thought this rally would go on for too lengthy so that they have been harvesting their income whereas they nonetheless may. The development, nevertheless, has modified through the newest stretch of the rally, which has taken the worth near the $30,000 stage.

Apparently, the development that the present rally is following appears to be much like what was seen through the April 2019 rally. This different rally began out of bear market lows, similar to the present one (if certainly the worst of the bear is behind the asset for this cycle), and it additionally confronted heavy distribution in its preliminary phases.

When the April 2019 rally neared the “cycle baseline” (a worth that supported the asset a number of occasions all through that cycle), the investor conduct shifted in the direction of heavy accumulation because the indicator turned darkish purple (values very near 1).

From the chart, it’s seen that the April 2019 rally gained some sharp upwards momentum after this accumulation started. As talked about earlier than, the most recent Bitcoin rally has additionally shifted in the direction of accumulation lately as the worth has approached the $30,000 mark.

The $30,000 stage occurs to be the baseline of the present cycle, which implies that this construction that the market is observing proper now’s harking back to what was seen within the 2018-2019 cycle.

If the remainder of the rally additionally exhibits the same sample to the April 2019 one, then the most recent shift in the direction of accumulation from the buyers could possibly be optimistic information for the worth surge.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $28,300, up 1% within the final week.

BTC has largely moved sideways lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link