[ad_1]

On-chain knowledge reveals that Bitcoin HODLers have continued to purchase extra of the asset not too long ago, regardless of the worth hitting stagnation.

Bitcoin HODLers Proceed To Present Sturdy Accumulation Conduct

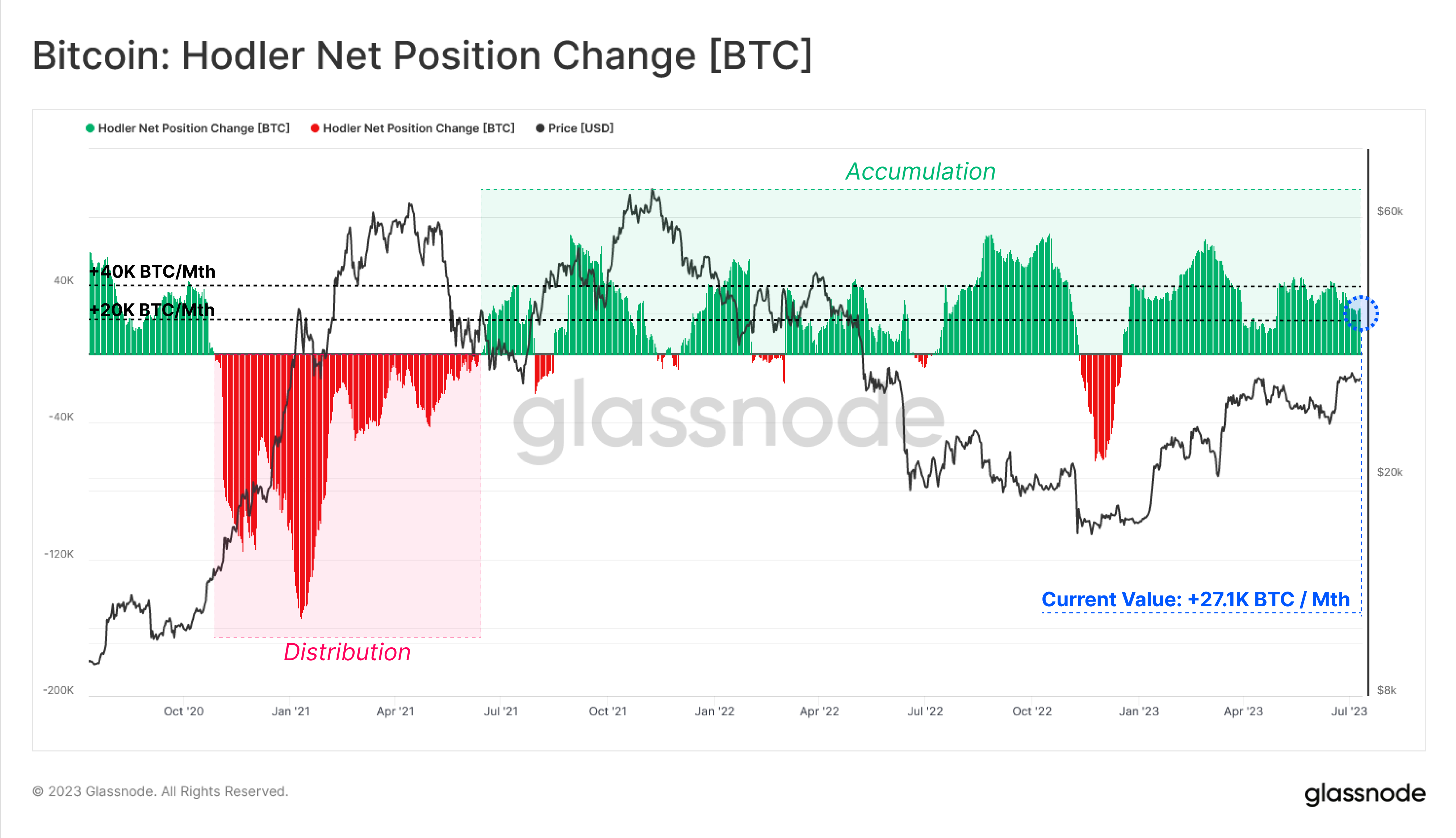

In line with knowledge from the on-chain analytics agency Glassnode, the BTC HODLers are filling up their wallets at a charge of 27,100 BTC per 30 days. The “HODLers” right here confer with the buyers who have a tendency to carry onto their Bitcoin for prolonged intervals.

These buyers usually don’t simply promote, no matter whether or not there’s FUD occurring available in the market or a pointy surge within the value is happening. As such, they’re generally known as the diamond palms of the cryptocurrency.

The conduct of those buyers might be one thing to observe for, because the occasions that the HODLers do find yourself promoting generally is a signal of wider weak point within the sector. An indicator that may be helpful in monitoring this cohort’s conduct is the “HODLer internet place change.”

This metric measures the web quantity of Bitcoin that these buyers have added or subtracted from their mixed holdings/addresses throughout the previous thirty days.

To find out the addresses of those HODLers, Glassnode has used its evaluation to search out addresses on the blockchain which have little to no historical past of promoting.

Naturally, this technique would solely present an estimation for the “HODLer provide,” because it’s not sure that these buyers can even purchase within the current or sooner or later with a long-term view in thoughts.

Now, here’s a chart that reveals the pattern within the Bitcoin HODLer internet place change over the previous couple of years:

The worth of the metric appears to have been inexperienced in latest days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin HODLer internet place change has been constructive for some time now. Which means these buyers have been always shopping for a internet quantity of the asset.

The final time this indicator had assumed a adverse worth was again within the November 2022 FTX crash, the place seemingly even these diamond palms have been pushed in the direction of capitulation.

Previous to this crash, the earlier event during which they have been distributing at comparable or greater ranges was the primary half 2021 bull run. These holders had determined that the rally was the time to promote and harvest their features.

For the reason that newest rally began this January, the Bitcoin HODLer internet place change has stayed fully constructive, implying that these buyers are persevering with to purchase strongly sufficient that the promoting of the few HODLers who could also be taking earnings right here is barely making a dent.

In line with the present worth of the metric, these buyers are shopping for at a charge of 27,100 BTC per 30 days. This accumulation is a constructive signal for the coin, because it means that these buyers don’t suppose the worth has rallied sufficient to promote but and that they consider the most recent stagnation isn’t the top of the surge.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,600, up 1% within the final week.

BTC is displaying no indicators of breaking its consolidation | Supply: BTCUSD on TradingView

Featured picture from Mariia Shalabaieva on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link