[ad_1]

On-chain knowledge exhibits the divergence between the Bitcoin long-term holders and short-term holders has grown to file ranges not too long ago.

Bitcoin Market Has Been Persevering with Its Shift In the direction of HODLing

As an analyst in a submit on X defined, the hole between the speculators and HODLers available in the market has solely grown wider not too long ago. The “short-term holders” (STHs) and the “long-term holders” (LTHs) are the 2 major cohorts that your complete Bitcoin market might be divided into.

The STHs check with all these buyers who bought their cash lower than 155 days in the past, whereas the LTHs embody the holders who’ve been holding onto their tokens past that interval.

Statistically, the longer an investor retains their cash dormant, the much less possible they grow to be to promote them at any level. On account of this purpose, the STHs are normally the group with the weaker conviction of the 2.

The LTHs typically maintain by risky intervals within the asset with out shifting an inch, which has earned them the favored title “diamond palms.” The STHs, then again, are likely to promote shortly at any time when FUD emerges within the sector, or a worthwhile promoting alternative seems.

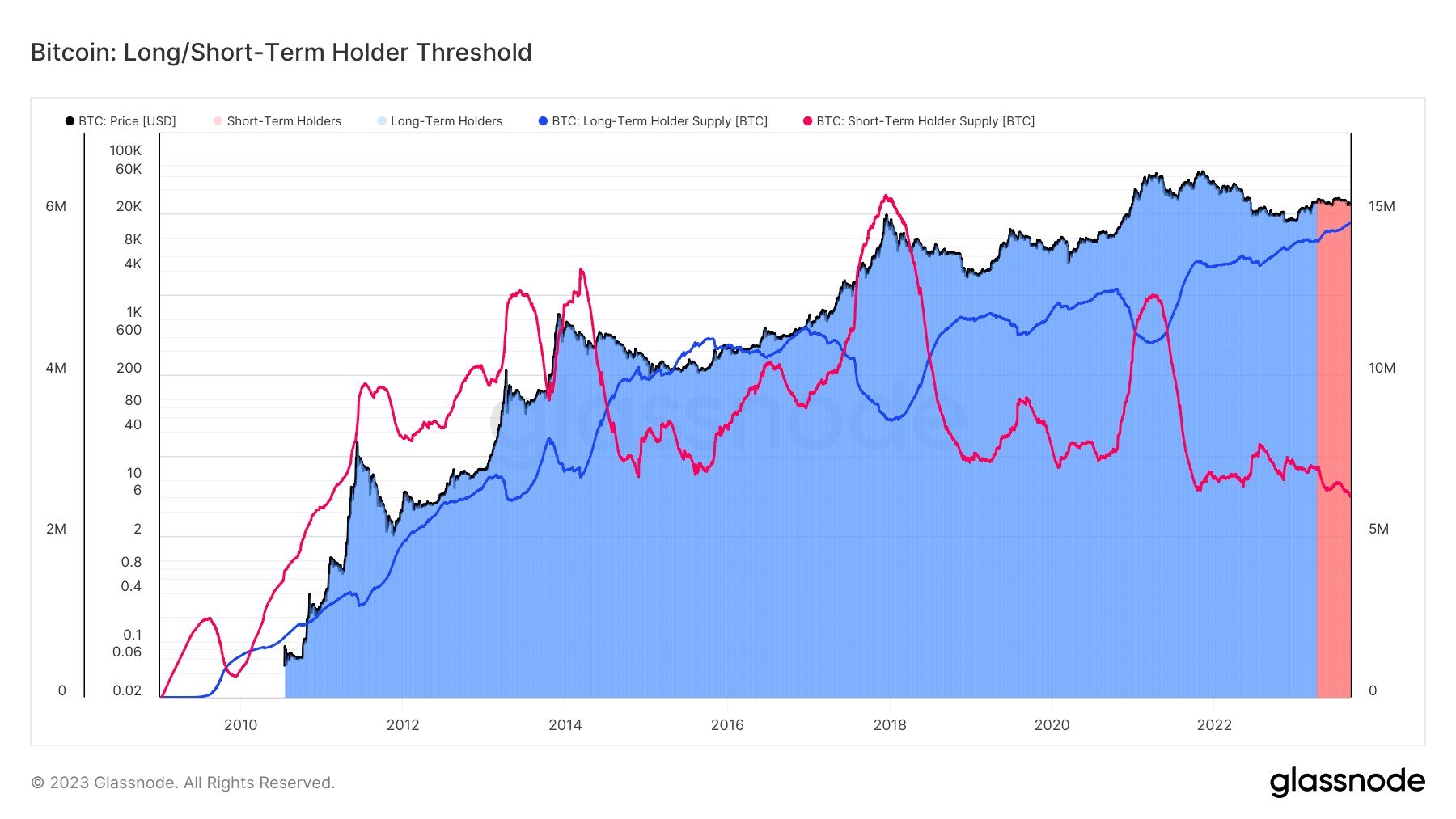

Now, here’s a chart that exhibits the development within the provides of those BTC investor teams all through the historical past of the cryptocurrency:

Appears like the 2 metrics have been getting in reverse instructions to one another | Supply: @jimmyvs24 on X

The graph exhibits that the Bitcoin LTH provide has been on an uptrend in the course of the previous couple of years, whereas the STH provide has been taking place not too long ago. This might counsel that the general provide of the cryptocurrency is repeatedly turning into extra dormant.

The hole between these teams is the widest it has ever been, because the LTH provide is nearing the 15 million BTC mark, whereas the STH provide has dropped beneath the two.5 million BTC degree.

The latter’s newest worth is the bottom it has ever been since 2011 when the asset was nonetheless in its infancy. It will seem that short-term speculators available in the market have thinned to file lows.

Final month, Bitcoin witnessed a pointy crash from above the $29,000 degree to under the $26,000 mark, and the asset has not recovered. As is clear from the chart, although, the LTHs haven’t cared concerning the asset’s battle in any respect, as their provide has solely continued to move up whereas the STHs have shrunken down additional.

The LTH group remaining sturdy and persevering with its development might not have an effect on the market within the short-term, however throughout longer intervals, the provision persevering with to grow to be locked within the wallets of those HODLers might have a bullish influence because of how supply-demand dynamics work.

BTC Worth

On the time of writing, Bitcoin is floating across the $25,700 mark, registering a dip of 6% over the previous week.

BTC stays unable to point out a break in both path | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link