[ad_1]

Bitcoin (BTC) has formally dipped beneath the $26,000 degree and is at the moment buying and selling at $25,800, which coincides with its 200-week Exponential Shifting Common (EMA). This EMA has served as an important help degree, because it performed a job in Bitcoin’s rebound on June 15, resulting in its yearly excessive of $31,800.

Bitcoin Consolidation Conundrum

The present scenario seems to be barely totally different for BTC. On the one hand, Bitcoin has been experiencing an prolonged consolidation part simply above this important degree for over seven days.

Extra regarding is that the cryptocurrency has been forming decrease lows throughout this consolidation, indicating a downward strain development.

Furthermore, throughout Bitcoin’s rally on June 15, it had the benefit of holding its key 200-day Shifting Common (MA), which has been influential in figuring out its prospects and upward beneficial properties. Nonetheless, this identical shifting common presents a possible hurdle for BTC, performing as a resistance on the $27,100 degree, probably impeding a restoration rebound.

As highlighted by crypto market analyst Michael Van De Poppe, the essential query is whether or not Bitcoin will keep its place above the 200-week EMA.

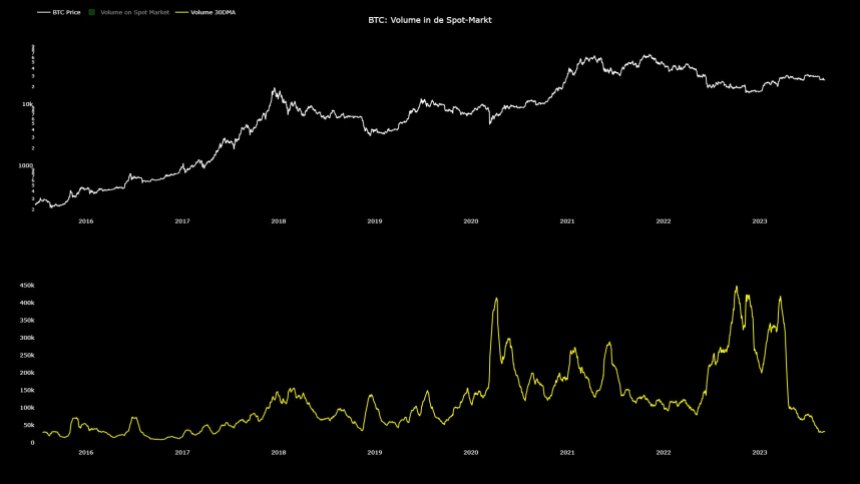

Abnormally Low Buying and selling Quantity In Spot Market Raises Issues

On this matter, CryptoQuant creator and crypto analyst Maartunn has recognized an intriguing phenomenon within the BTC market that will make clear the cryptocurrency’s current stagnant state and low volatility.

Maartunn has noticed an irregular sample: the buying and selling quantity within the Bitcoin-spot market has reached its lowest degree since 2017. This discovering has important implications for understanding the dynamics of BTC’s value and market habits.

The Bitcoin spot market performs an important position within the cryptocurrency ecosystem. It’s the place buyers and merchants purchase and promote precise Bitcoins for speedy supply as a substitute of spinoff merchandise or futures contracts.

Spot market buying and selling quantity displays the extent of participant exercise and liquidity out there, offering insights into the provision and demand dynamics of Bitcoin.

The unusually low buying and selling quantity within the BTC-spot market suggests decreased market exercise and engagement amongst merchants.

This lack of participation can contribute to stagnation and low volatility in BTC’s value. With fewer patrons and sellers getting into the market, there could also be restricted value motion and a lowered probability of serious value swings.

Such situations can have implications for buyers and merchants. Low volatility might discourage short-term speculative buying and selling methods because the potential for fast earnings diminishes.

Moreover, it might point out a scarcity of market confidence or uncertainty amongst contributors, resulting in a cautious method and potential hesitation in making important funding selections.

Monumental First Half Of 2024 For BTC?

In accordance to crypto analyst Miles Deutscher, the primary half of 2024 is shaping to be a monumental interval for the cryptocurrency market. A number of key occasions and deadlines are anticipated throughout this timeframe, which may profoundly affect the trade and its main gamers.

Beginning in January by March, the highlight shall be on Bitcoin as the ultimate deadline for approving the Bitcoin spot exchange-traded funds (ETFs) method.

The crypto neighborhood has lengthy awaited the introduction of a Bitcoin ETF because it may probably open the doorways for broader institutional participation and funding within the digital asset.

In Might, one other extremely anticipated occasion is the Bitcoin halving. This recurring occasion, which happens roughly each 4 years, reduces the speed at which new Bitcoins are generated.

In June, the main target shifted to the Federal Reserve (FED) and its potential determination to chop rates of interest. Whereas market pricing at the moment suggests the probability of a fee reduce, such a transfer may have implications for the broader monetary panorama, together with the cryptocurrency market.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link