[ad_1]

Information from Santiment reveals the current native prime in Bitcoin got here after bullish calls from social media customers spiked to excessive ranges.

Bitcoin Strikes Towards Crowd: Decline Comes After Merchants Get Hyped

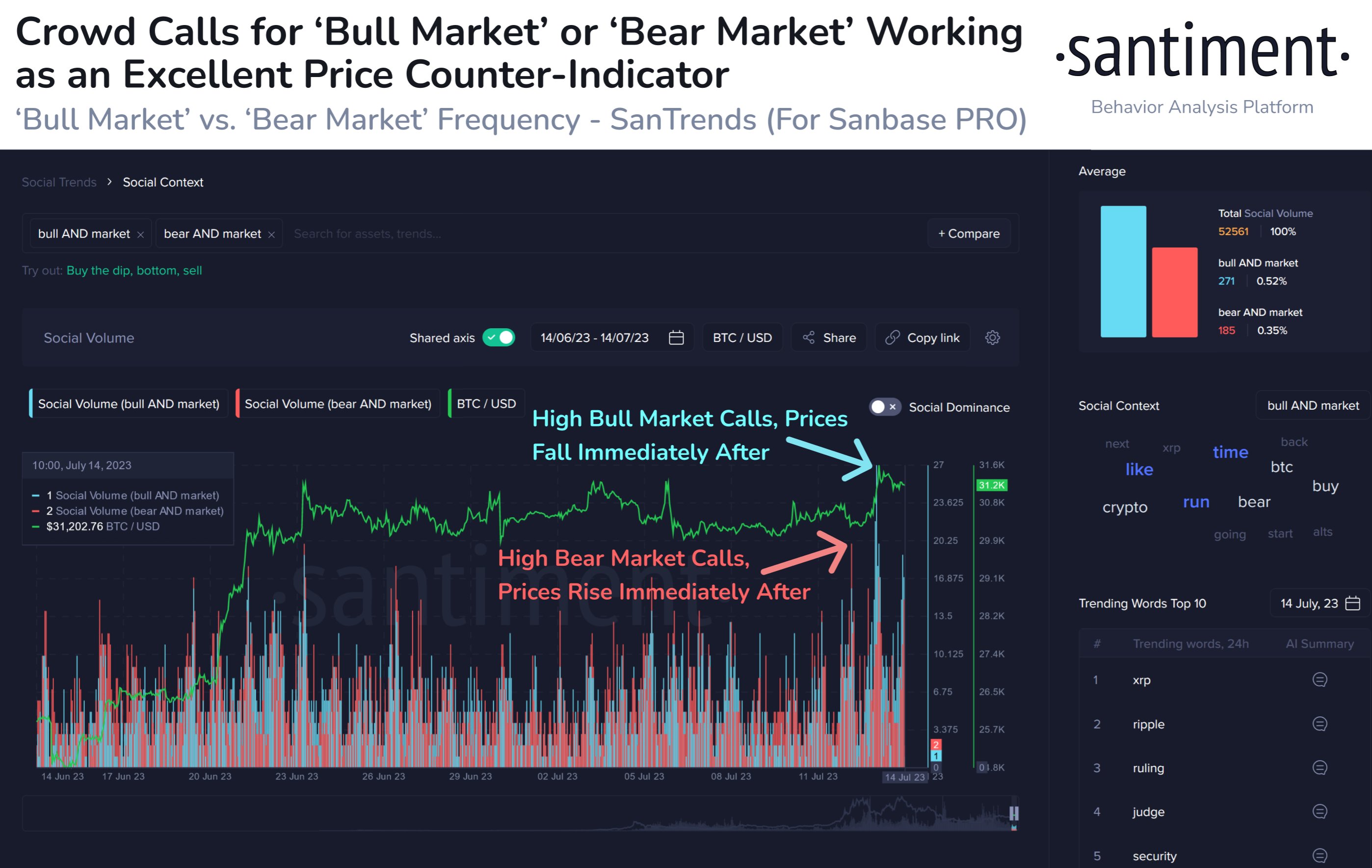

Based on the on-chain analytics agency Santiment, crowd requires a “bear market” and “bull market” can work as indicators for the place the BTC value could also be headed subsequent.

The related metric right here is the “social quantity,” which measures the whole variety of textual content paperwork (that’s, posts, threads, and different types of textual content messages) on the foremost social media platforms which might be making mentions of a given time period or subject.

This indicator solely counts the distinctive variety of textual content paperwork, which means that it doesn’t care about what number of mentions a particular publish could include the time period in query, solely that it mentions the subject at the least as soon as.

If the social quantity is utilized to the time period “Bitcoin,” for instance, the indicator will present us with hints concerning the diploma of dialogue that the cryptocurrency is receiving on social media platforms proper now.

The metric can be used to pinpoint sentiment out there if acceptable phrases are used. Within the context of the present dialogue, Santiment has filtered the social quantity of “cryptocurrency” to search out the mentions of the phrases “bull market” and “bear market.”

Here’s a chart that reveals how a lot discuss the subjects of a bull market and bear market are receiving from cryptocurrency merchants on social media:

Seems like each the metrics have noticed spikes in current days | Supply: Santiment on Twitter

As displayed within the above graph, the whole variety of cryptocurrency-related social media posts containing each “bear” and “market” noticed a spike final week as Bitcoin plunged to $30,200.

Curiously, whereas buyers had been making a excessive variety of these bear market calls, the BTC value really bottomed out and constructed up in direction of an upwards transfer.

Traditionally, the Bitcoin market has tended to maneuver in a course reverse to what nearly all of buyers predict. So the extra the group leans in direction of a particular course, the extra probably such an reverse transfer turns into to happen. As such, the current excessive bear market calls appear to have had an analogous impact on the value.

A couple of days again, when BTC had surged in direction of the excessive $31,000 stage, the social quantity for the “bull market” had additionally noticed a big spike. This is able to counsel that merchants had began getting hyped about the opportunity of the bull market being again on.

Although, because it had occurred when buyers had turn into too bearish, their turning too bullish additionally result in the value transferring within the reverse manner. This time, in fact, the value registered a decline.

This established market development provides credence to the favored investing saying that “Purchase when there’s blood on the streets.” Within the context of cryptocurrency, this recommendation interprets to purchasing when there are calls of a “bear market.”

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,200, down 1% within the final week.

BTC has been trending sideways for the reason that plunge | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link