[ad_1]

On-chain knowledge exhibits the buying and selling volumes of huge property like Bitcoin and Ethereum have noticed a surge towards one-month-highs.

Bitcoin, Ethereum, & Different Belongings Have Registered An Improve In Volumes

In response to knowledge from the on-chain analytics agency Santiment, the buying and selling quantity has been up throughout the market because the value plunge. The “buying and selling quantity” right here refers to an indicator that measures the day by day whole quantity of a given cryptocurrency that’s being transacted on the blockchain proper now.

When the worth of this metric is excessive, it means a lot of tokens of the asset in query are being moved round on the community presently. Such a development typically suggests {that a} excessive quantity of merchants are lively available in the market proper now.

Alternatively, low values of the indicator is usually a signal that the asset isn’t observing a lot exercise in the mean time. This sort of development can suggest that there isn’t a lot curiosity within the coin amongst buyers presently.

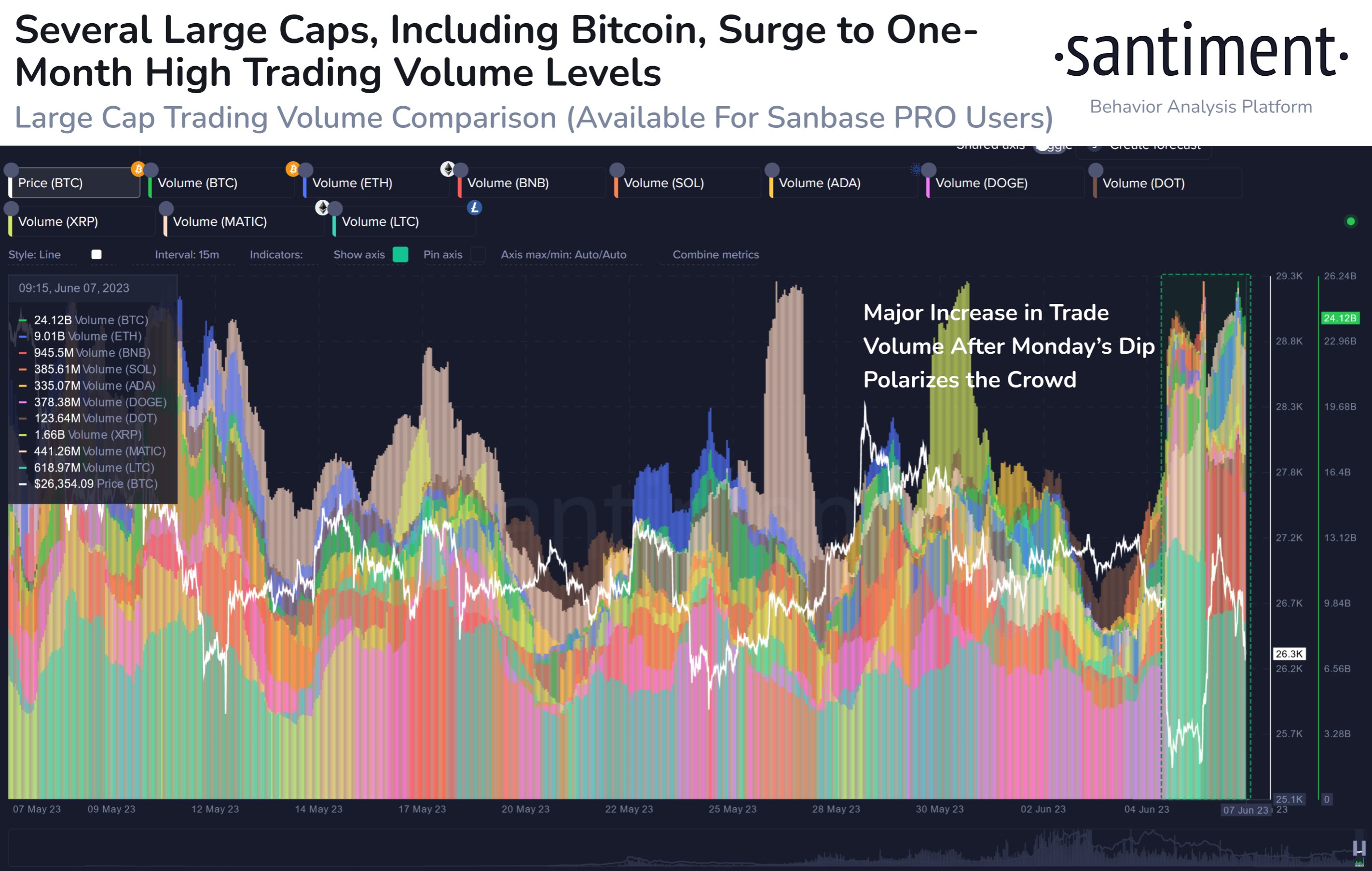

Now, here’s a chart that exhibits the development within the buying and selling quantity for the most important property within the cryptocurrency sector over the previous month or so:

The worth of the metric appears to have been elevated over the last couple of days or so | Supply: Santiment on Twitter

As displayed within the above graph, the buying and selling quantity of the biggest property by market cap, together with Bitcoin and Ethereum, has noticed a big uplift previously few days.

This surge first began when information got here out that the US Securities and Change Fee (SEC) has sued Binance and its CEO over alleged fraud, resulting in the value of BTC and different property crashing down.

Usually, the buying and selling quantity spikes throughout extremely unstable occasions like this newest plummet available in the market as such strikes collect a considerable amount of consideration from buyers.

Because of this cause, it’s not shocking that the volumes throughout the market have gone up just lately. Santiment notes that the most recent renewed curiosity within the cryptocurrency market has come by way of each dip buys and panic sells.

Within the days because the surge within the buying and selling quantity first began, the indicator’s worth has solely elevated additional for property like Bitcoin because the market has noticed extra volatility.

Whereas it’s true that volatility attracts the buyers’ eyes and results in a rise within the quantity, it’s additionally a proven fact that high-volume environments solely lead to a extra unstable value, since a lot of merchants being concurrently current offers the right gas for sharp strikes to happen.

Because the buying and selling quantity continues to be at a one-month excessive for Bitcoin and Ethereum proper now (suggesting that the investor curiosity has remained lit) it’s attainable that the market is barely going to see extra volatility within the close to future.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,400, down 2% within the final week.

Seems to be like the worth of the asset has moved sideways previously day | Supply: BTCUSD on TradingView

Featured picture from Pierre Borthiry – Peiobty on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link