[ad_1]

A bullish divergence could also be forming for each Bitcoin and Ethereum if the info of this on-chain indicator is something to go by.

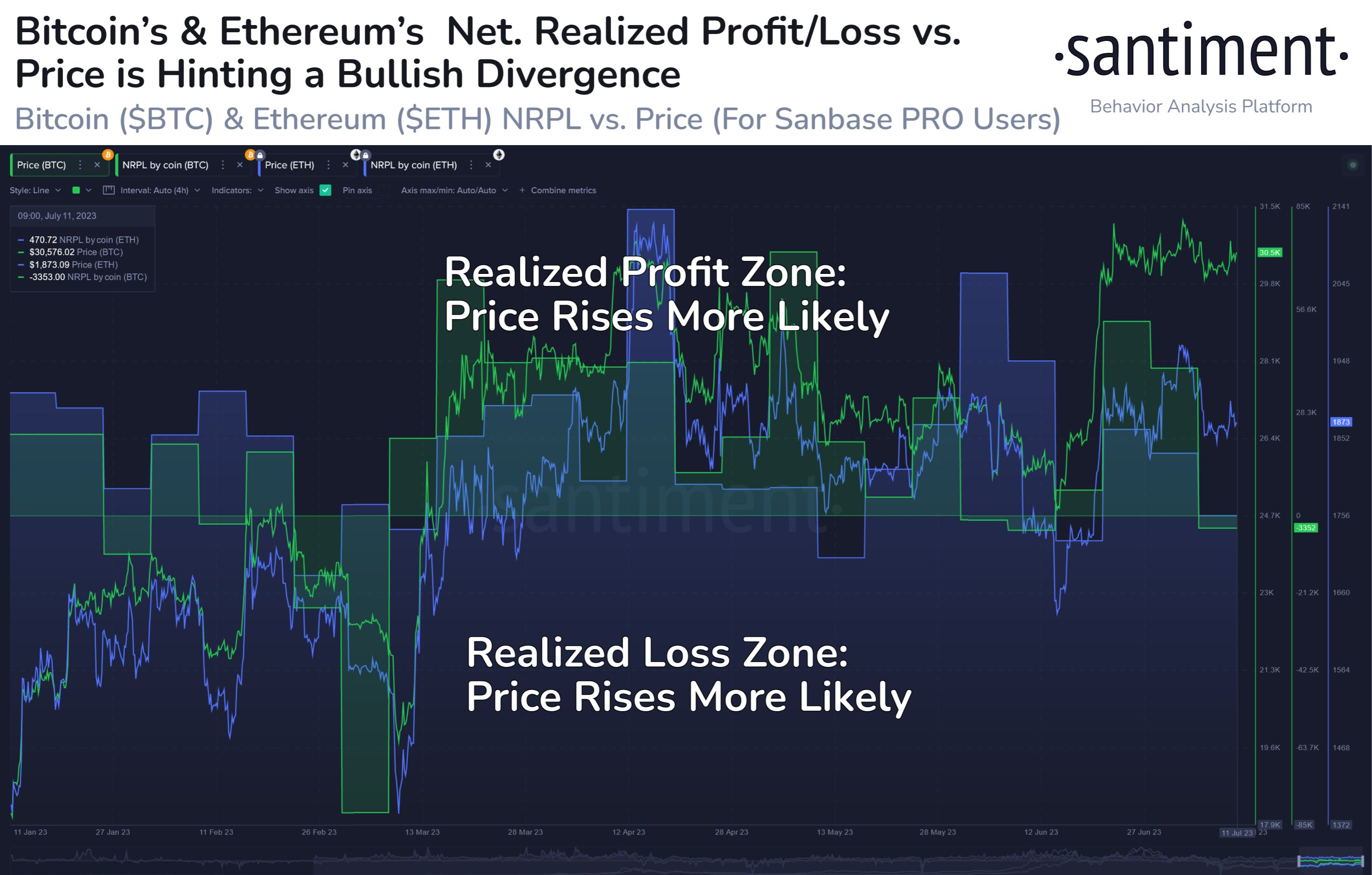

Bitcoin & Ethereum Web Realized Revenue/Loss Has Turned Adverse Lately

In response to knowledge from the on-chain analytics agency Santiment, the typical dealer is shifting their BTC and ETH at a slight loss proper now. The related indicator right here is the “Web Realized Revenue/Loss” (NRPL), which retains monitor of the web quantity of revenue or loss that the buyers are realizing by their promoting at present.

This indicator works by going by the blockchain historical past of every coin being offered to see what value it was final moved at. If this earlier promoting value for any coin was lower than the present spot value (that it’s now being offered at), then that specific coin’s sale is realizing a revenue.

Equally, within the reverse case, the investor can be harvesting losses with the coin’s motion. As such, the NRPL provides up all such income and losses and takes their distinction.

When the metric’s worth is constructive, it signifies that the market as a complete is realizing a web quantity of revenue at present. Alternatively, unfavorable values recommend the typical dealer is promoting at some loss.

Now, here’s a chart that reveals the pattern within the NRPL for each Bitcoin and Ethereum over the previous couple of months:

The worth of the metric appears to have been change into unfavorable for each the cryptocurrencies | Supply: Santiment on Twitter

As displayed within the above graph, the NRPL has turned unfavorable for each Bitcoin and Ethereum just lately. Which means the buyers of the 2 largest cryptocurrencies within the sector have been promoting their cash at a loss on common on this interval.

These losses have solely been slight, although, as each of those property haven’t moved too considerably on this interval. Typically, deep capitulation occasions the place holders exit the market at giant losses solely happen when the worth observes an prolonged drawdown.

Traditionally, at any time when the indicator has entered into the loss territory, the likelihood of a value bounce has gone up. It’s because loss promoting is usually a signal of weak arms leaving the market and buyers with a stronger conviction could also be selecting up the cash they’re promoting.

Santiment notes that the present pattern of the NRPL for these property is forming a bullish divergence when in comparison with the costs. And naturally, this might result in an increase within the costs of those cash.

Nonetheless, as talked about earlier than, for the reason that loss-taking is just at a slight stage at present, the probability of a value enhance can be clearly not too excessive, though it’s nonetheless a constructive signal for Bitcoin and Ethereum nonetheless.

An instance of this sample probably influencing the worth could also be seen proper earlier than the BTC rally above the $30,000 mark, the place buyers had been promoting at loss ranges much like now.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,700, up 1% within the final week.

BTC continues to consolidate sideways | Supply: BTCUSD on TradingView

Featured picture from Pierre Borthiry – Peiobty on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link