[ad_1]

Information reveals the Bitcoin Coinbase Premium Index has not too long ago seen a surge, an indication that purchasing from US traders might contribute to the restoration.

Bitcoin Coinbase Premium Index (7-Day SMA) Has Been Going Up Just lately

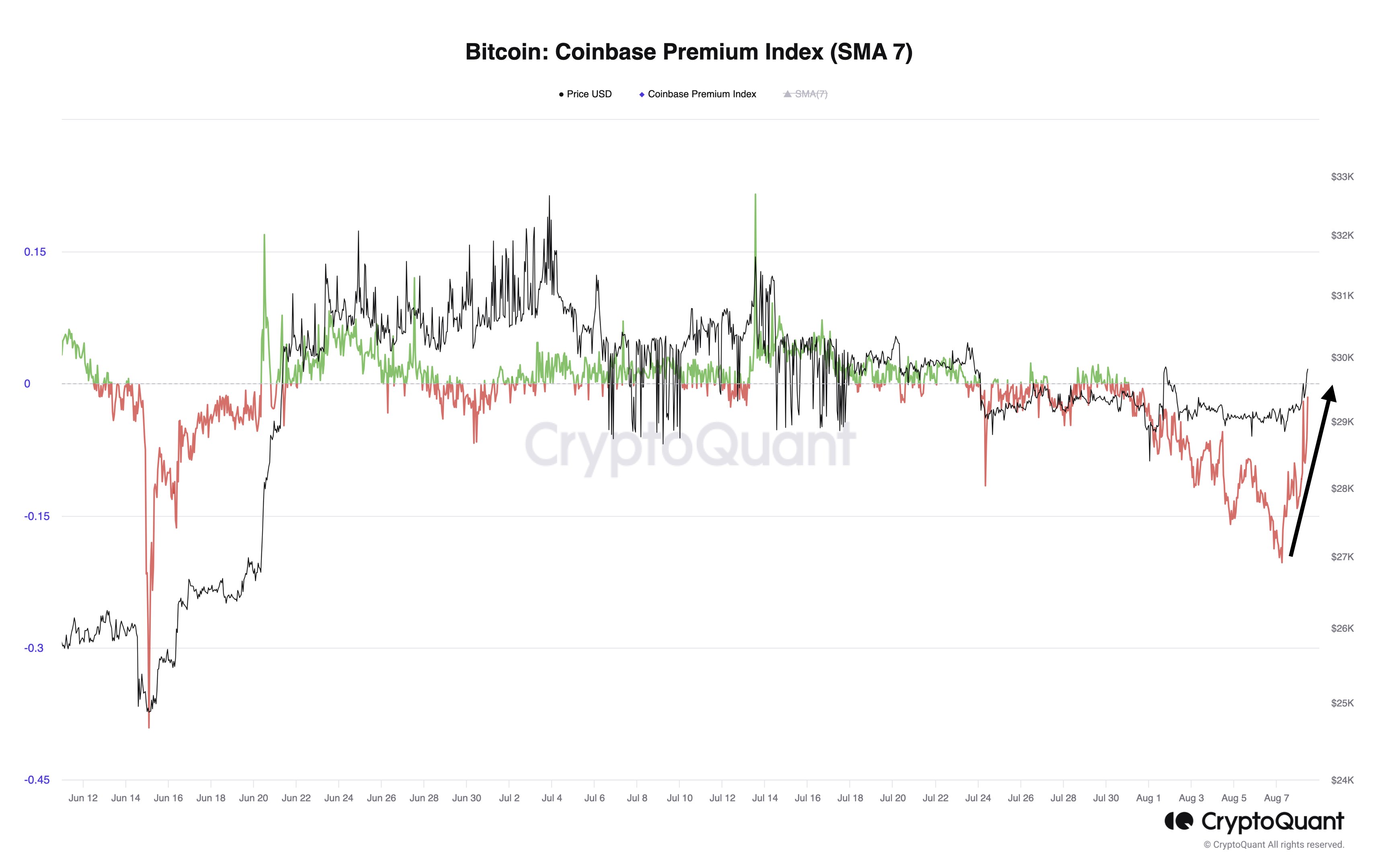

In line with information shared by Julio Moreno, the Head of Analysis at CryptoQuant, the Coinbase Premium Index has been sharply trending up not too long ago. The “Coinbase Premium Index” right here refers to a metric that retains monitor of the proportion distinction between the Bitcoin worth listed on Coinbase (USD pair) and that listed on Binance (USDT pair).

This metric can assist us know which platform’s consumer base is shopping for or promoting extra of the asset. For instance, when the index’s worth is larger than zero, it implies that an additional quantity of shopping for stress has been current on Coinbase, which has pushed the asset’s worth up on the platform (or only a decrease quantity of promoting stress than on Binance is there on Coinbase).

Coinbase is thought for use extra closely by US-based traders (particularly giant institutional merchants), whereas Binance’s visitors is unfold across the globe.

Thus, if extra shopping for is going on on Coinbase, it may be an indication that the US-based traders are taking part in additional shopping for than the worldwide merchants.

Now, here’s a chart that reveals the pattern within the 7-day Easy Transferring Common (SMA) Bitcoin Coinbase Premium Index over the previous couple of months:

The 7-day worth of the metric appears to have been rising in latest days | Supply: Julio Moreno on X

As displayed within the above graph, the 7-day SMA Bitcoin Coinbase Premium Index has solely been damaging this month, implying that the worldwide traders have both outpaced the US merchants in accumulation or the Individuals have been promoting to the next diploma.

Just lately, nonetheless, as information has began to return out that the chance of the BTC spot ETFs being authorized within the US is rising, the indicator has circled and is now heading up.

The metric has sharply elevated up to now day, suggesting that the US-based institutional merchants might now be taking part in some heavy shopping for.

Throughout this identical interval, Bitcoin has noticed a restoration rally during which the cryptocurrency’s worth briefly managed to the touch the $30,000 mark earlier than falling again to the present ranges.

Naturally, the timing of the rally and the 7-day Coinbase Premium Index sharply going up might suggest that the shopping for from the American holders are offering the gasoline for the transfer.

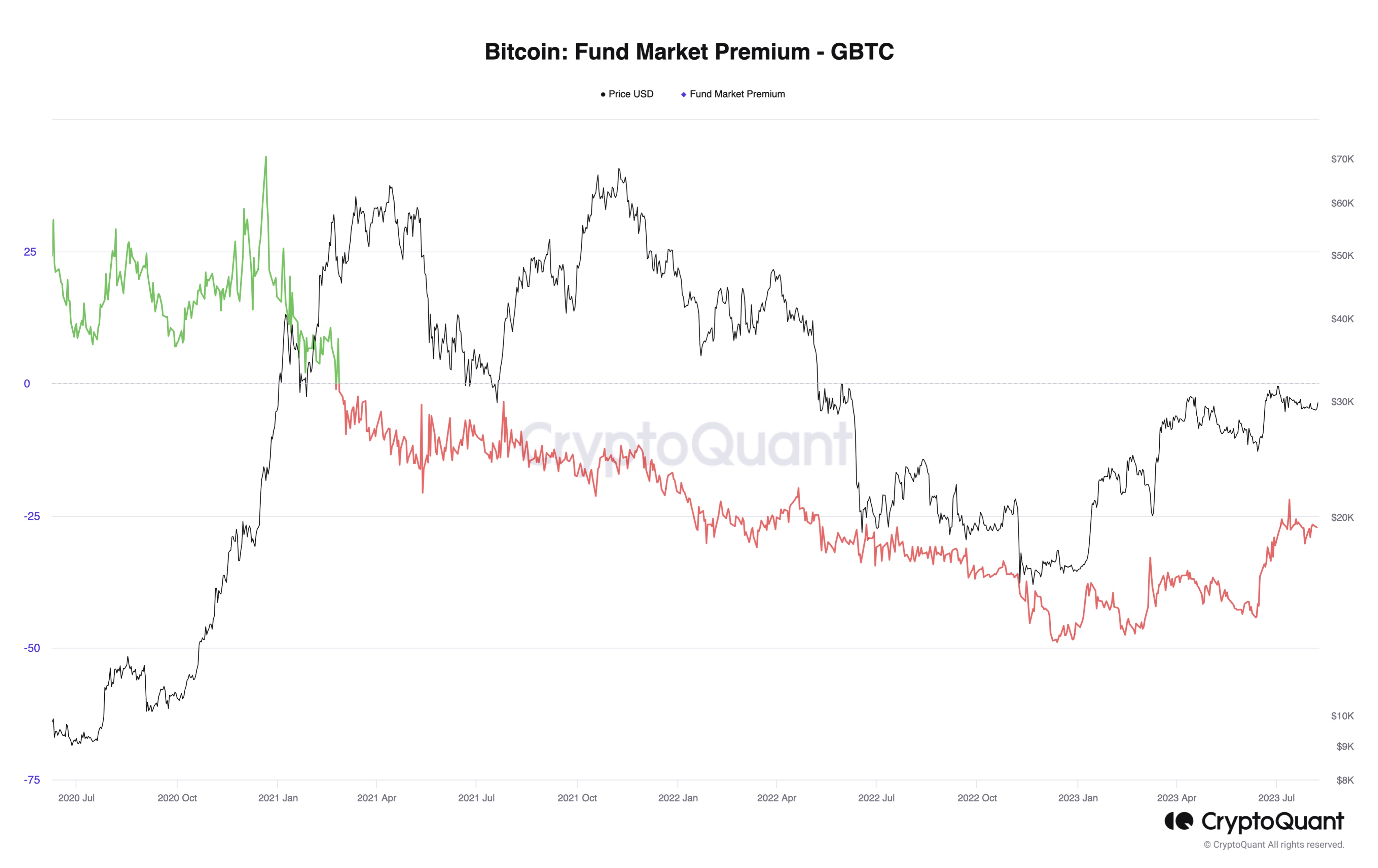

The Grayscale Bitcoin Belief (GBTC) Premium, a metric that checks for whether or not GBTC is buying and selling at a premium or a reduction, has additionally been trending up not too long ago, implying that the low cost on the fund is reducing (though it’s not close to the constructive territory but not like the Coinbase Premium Index).

Appears just like the metric’s worth is turning into much less damaging | Supply: CryptoQuant

GBTC is a fund that permits customers to get oblique publicity to Bitcoin in a approach that conventional traders could be extra conversant in. Thus, this metric holds hints concerning the shopping for or promoting exercise during which the extra typical US institutional merchants are at present taking part.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,800, up 1% within the final week.

BTC has noticed some uplift in the course of the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link