[ad_1]

Bitcoin Money (BCH) and a number of other distinguished altcoins are experiencing an upward trajectory of their buying and selling costs, attributed to a current report indicating a positive ruling by the US federal appeals courtroom.

The courtroom’s resolution means that the US Securities and Trade Fee (SEC) erred in its rejection of Grayscale’s utility for a spot bitcoin exchange-traded fund (ETF).

This improvement has as soon as once more underscored the influence of optimistic regulatory information on the sentiment and valuation of the cryptocurrency market.

Regulatory Reassurance Boosts BCH, General Market Confidence

The crypto market has lengthy been vulnerable to fluctuations pushed by regulatory uncertainty. Nonetheless, situations of regulatory readability, such because the newest ruling concerning Grayscale’s ETF utility, have repeatedly proven their potential to impress optimistic sentiment amongst traders.

The maturation and legitimacy that regulatory approvals signify are sometimes interpreted as promising indicators for the business’s future progress. This enhanced sentiment invariably piques curiosity not solely in Bitcoin but in addition in numerous different cryptocurrencies, together with Bitcoin Money.

Bitcoin Money Seizes The Momentum

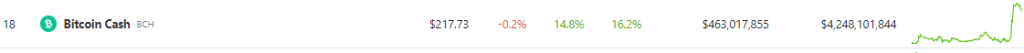

With Bitcoin Money exhibiting a strong worth rally, the digital asset’s worth soared to $217, as reported by CoinGecko. Over the span of 24 hours, the coin witnessed a powerful surge of 14.8%, which additional expanded to 16% over the course of the previous week.

BCH worth motion immediately. Supply: Coingecko

The outstanding features could be largely attributed to the optimistic ripple impact generated by the Grayscale-SEC ruling, which has reverberated throughout all the cryptocurrency panorama.

BCH market cap at $4.2 billion immediately. Chart: TradingView.com

The Bitcoin Impact On Altcoins

Bitcoin, because the vanguard of cryptocurrencies, continues to wield substantial affect over the market. The surge in its worth to $27,456—a rise of greater than 5% inside a single day—epitomizes the profound influence of Grayscale’s overcome the SEC.

What makes this rally much more intriguing is its domino impact on altcoins like Bitcoin Money. As traders search to diversify their portfolios, they inevitably discover different cryptocurrencies to maximise their potential features. This pattern has triggered a surge in curiosity and funding in altcoins, propelling them to new heights.

The collective impact of those developments is clear within the substantial progress of the complete crypto market capitalization. A surge of practically $50 billion underscores the instant influence of regulatory developments in the marketplace’s valuation.

The truth that among the most vital features have been recorded by cryptocurrencies intently linked to Bitcoin reinforces the notion that regulatory wins and main cryptocurrency efficiency are intertwined in a symbiotic relationship.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from Getty Photos

[ad_2]

Source link