[ad_1]

Bitcoin worth is at present buying and selling at barely above $26,000 per coin, however remains to be reeling after final week’s 10% single day selloff. The scenario seems dire for crypto bulls who have been hoping for a extra vital restoration to start after such extended sideways.

Nevertheless, the bullish market construction stays unbroken. Let’s take a better take a look at what precisely this implies and why the 2023 uptrend remains to be intact.

Recapping Latest BTCUSD Volatility

After a strong begin to 2023 – actually a yr that’s been kinder to the king of cryptocurrency than 2022 – BTCUSD has bears celebrating and bulls kicking their wounds. A number of months of sideways worth motion and dwindling volatility ended with a bang as anticipated, however the transfer was down and never what bulls had been hoping for.

A pointy, 10% intraday selloff induced extra lengthy liquidations than the FTX collapse, and despatched the Relative Power Index instantly into probably the most oversold territory in all of 2023. However even with all of the carnage, Bitcoin stays in a near-term uptrend with a bullish market construction.

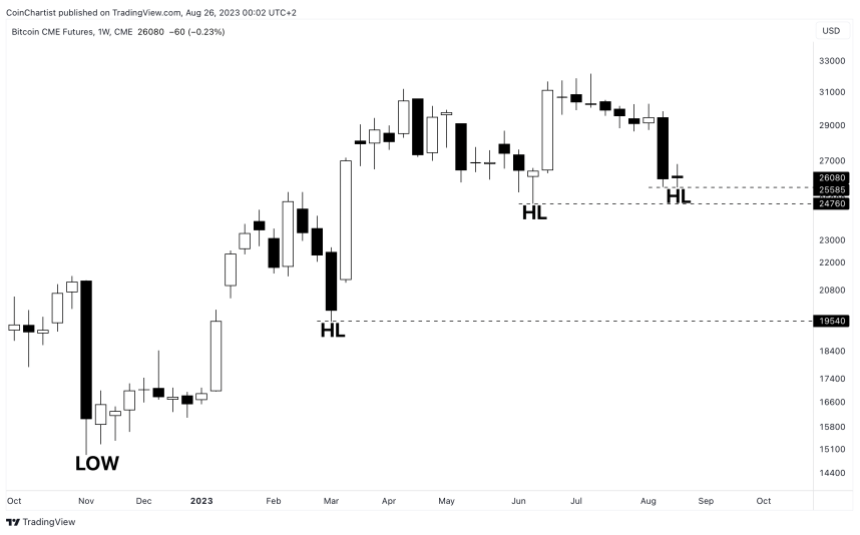

Bitcoin’s uptrend remains to be intact | BTCUSD on TradingView.com

Why Bitcoin Worth Stays In A Structural Uptrend

By pure definition, an uptrend is a sequence of upper highs and better lows. Which is exactly what remains to be taking place in BTCUSD worth motion all through 2023. Presently, the FTX collapse in November 2022 was the native “low” of the downtrend. In distinction, a downtrend is a sequence of decrease lows and decrease highs. As soon as a brand new excessive was made in early 2023 after which the next low was put in, the downtrend was thought-about over.

The current 2023 uptrend in Bitcoin hasn’t but made a decrease low after a decrease excessive. Even a attainable decrease low past right here remains to be and not using a correct decrease excessive. Which means that the highest cryptocurrency by market cap may doubtlessly bounce right here, and even decrease, and nonetheless keep an general bullish market construction.

A decrease low would nonetheless be vital, doubtlessly warning that the market construction is popping again bearish. If a decrease low occurs beneath the $25,000 low from June 2023, then it will likely be all eyes on if a decrease excessive is to comply with.

The 2023 uptrend in Bitcoin has been muted in comparison with what the cryptocurrency is able to. BTCUSD is up roughly 50% through the first roughly 9 months of the yr. The ultimate 9 months of 2020, for instance, had over 900% ROI by comparability. May this sort of returns quickly be on the way in which? Or will the cryptocurrency market fall again into the clutches of bears?

This chart initially appeared in Situation #18 of CoinChartist VIP. Subscribe at no cost.

[ad_2]

Source link