[ad_1]

The Bitcoin bull run might not begin correctly till this on-chain ratio reverses the trajectory it’s at present stepping into.

Bitcoin RHODL Ratio Is At the moment Displaying A “Lifeless Cat Bounce”

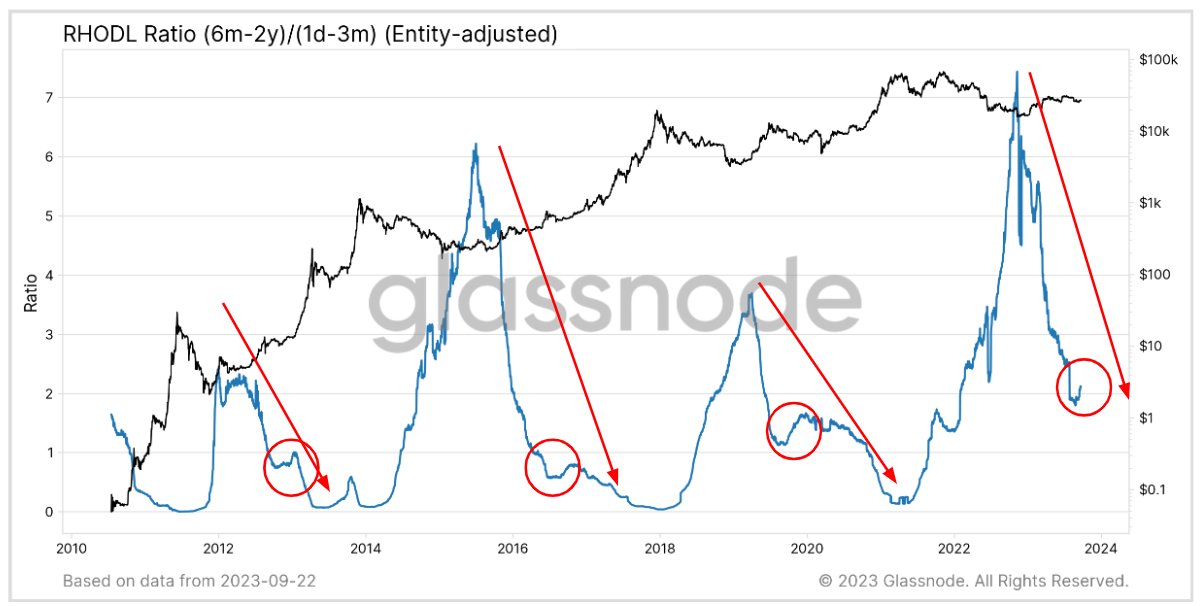

As analyst James V. Straten defined in a put up on X, the BTC RHODL ratio might include hints about when the cryptocurrency’s subsequent bull run might be coming.

The “Realized HODL ratio” (RHODL) right here refers to an indicator that retains monitor of the ratio between the worth held by the buyers holding since 6 months and three years in the past and that held by the 1 day to three months previous holders.

These former buyers make up a phase of the bigger “long-term holder” (LTH) group. Extra particularly, this a part of the group could also be termed the “single cycle LTHs” since their holding vary is contained in the span of a BTC cycle (sometimes 4 years).

The opposite buyers, these holding since 1 day and three months in the past, signify the youngest members of the “short-term holder” (STH) cohort. Your entire STH group has its cutoff on the six-month mark, the place the LTH group naturally begins.

Because the RHODL ratio compares the worth held by these two cohorts, its pattern can present hints about how the rotation of capital happens out there.

Now, here’s a chart that exhibits the pattern within the Bitcoin RHODL ratio over the historical past of the cryptocurrency:

The worth of the metric appears to have sharply gone down in latest months | Supply: @jimmyvs24 on X

The above graph exhibits that the Bitcoin RHODL ratio has adopted an identical sample in every Bitcoin cycle. The metric all the time hits a backside throughout bull run tops and begins heading up.

This improve represents a rotation of capital in direction of the LTHs, because the bear market setting in results in the STHs giving up on the asset and exiting, whereas the persistent holders left behind accumulate extra on the decrease costs.

This accumulation from the LTHs continues till the bear market backside. The graph exhibits that the RHODL ratio has all the time seen its high coincide with the cyclical bottoms within the worth.

Because of the reduction rally following the worst bear market stage, STHs return to the market and develop their holdings, whereas some LTHs promote their cash to take their earnings.

Within the graph, Straten has highlighted that the indicator has been sharply happening throughout the previous few months, identical to it did within the buildup to previous bull markets.

As famous by the circles, although, the indicator usually experiences a form of lifeless cat bounce on the way in which down. The indicator has not too long ago turned in direction of the upside, probably implying that this similar lifeless cat bounce sample is once more forming.

Traditionally, true bull markets have adopted when the Bitcoin RHODL ratio has once more reversed its path following this sample and has resumed its downtrend. The same reversal can also be the one to observe for this time, because it may lead in direction of the following bull run.

BTC Value

Bitcoin has continued to maneuver sideways for the reason that drop yesterday as its worth continues to commerce across the $26,600 mark.

Appears to be like like BTC has gone down not too long ago | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link