[ad_1]

Regardless of at this time’s macroeconomic developments, the value of Bitcoin continues to maneuver sideways and appears more likely to keep on this path. The primary crypto by market cap has seen its volatility drop to recent lows as its value is trapped at present ranges.

On the time of writing, Bitcoin trades at $26,600 with sideways motion within the final 24 hours. Over the previous seven days, the cryptocurrency has recorded some income however has been unable to interrupt above or beneath the $28,000 to $30,500 vary.

A New Regular For Bitcoin? Volatility Doubtless To Decline Till This Modifications

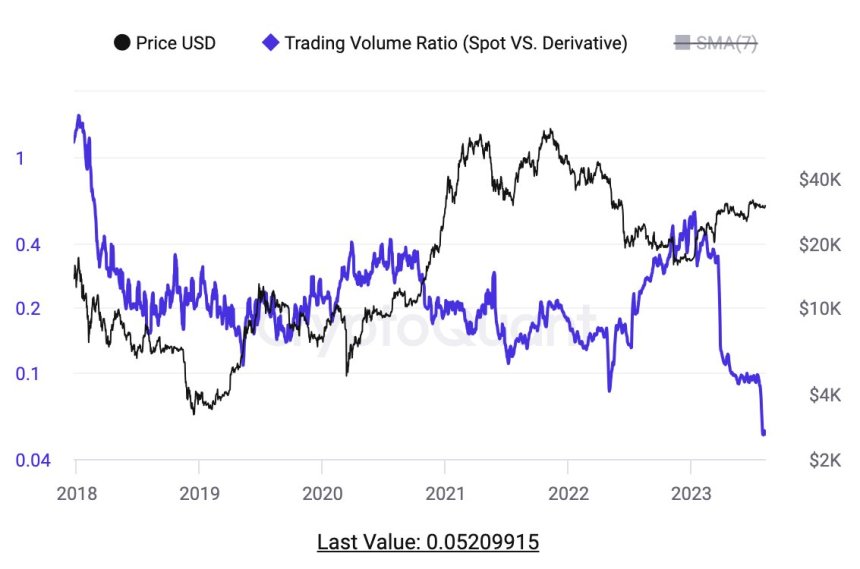

Analyst Dylan LeClair identified that operators within the derivatives sector have dominated the present Bitcoin value motion. In that sense, the BTC spot-to-derivative buying and selling quantity ratio adopted volatility and declined to all-time lows.

As seen within the chart beneath, this ratio reveals that the spot market has been suppressed by the derivatives sector, with merchants “chopping one another to oblivion.” LeClair acknowledged the next:

(…) spot bears have largely run out of cash & spot bulls are both totally deployed or are sidelined TradFi ready for ETF approval.

With the U.S. Federal Reserve (Fed) out of session till September and low uncertainty within the brief time period, the value of Bitcoin appears poised to maintain chopping round its present ranges.

On this atmosphere, derivatives merchants will possible revenue from promoting volatility by way of totally different monetary devices. Knowledge from the derivatives platform Deribit reveals an uptick in name (purchase) contracts on the choices sectors for October to December expiry.

A report posted by this platform from Rogue Dealer Academy highlights the necessity for a catalyst to push BTC out of its present vary. The market is positioning itself for a Bitcoin spot Trade Traded Fund (ETF) approval in This autumn, 2023, thus why gamers on the choices markets are accumulating calls.

Promoting volatility has been a worthwhile technique in July. Nonetheless, because the metric hovers round historic lows, merchants change into extra resilient to dump their contracts on the derivatives sector, additional suppressing BTC’s value. Rogue Dealer Academy acknowledged:

(…) these promoting volatility (gamma sellers) are rising hesitant to dump at such traditionally low implied vol ranges, particularly with important financial information just like the US Shopper Value Index (CPI) on the horizon for this week.

On this low volatility, low liquidity atmosphere, solely a catalyst will push BTC past $30,000 and past $40,000 by the tip of the yr. One thing appears obvious on this context: Bitcoin appears forward of any bullish narrative and more likely to outperform within the sector for the rest of 2023.

Cowl picture from Unsplash, chart from Tradingview

[ad_2]

Source link