[ad_1]

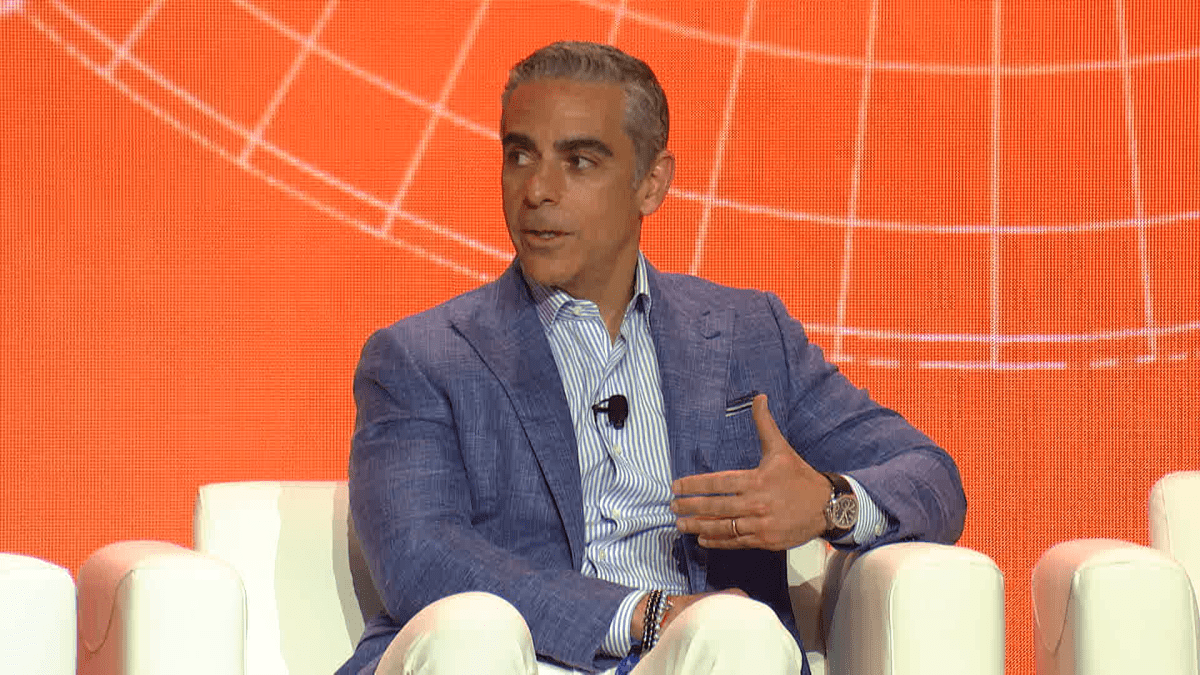

For practically 25 years, nearly so long as on-line funds have been doable, David Marcus has been attempting to determine excellent them.

Within the mid-’90s he based a telecom firm that provided web entry together with phone service. In 2000, he launched Echovox, which he spun out into Zong in 2008 — a cellular platform that permit customers pay for issues on-line instantly via their cell phone payments. When this enterprise was acquired by PayPal in 2011, Marcus joined the digital funds large, changing into its president the following 12 months.

He’d learn the Bitcoin white paper shortly after it was revealed, however “didn’t fall into the rabbit gap” at first, he recalled in an interview with Bitcoin Journal. Then, in 2012, Argentina ordered PayPal to cease all transactions that may ship cash in a foreign country because it grappled with forex inflation and a fiscal austerity effort, and the true worth of this peer-to-peer digital money system began to resonate with him.

“We needed to (comply), we have been a regulated entity,” Marcus defined. “The day that occurred, bitcoin costs went up considerably and I used to be like, ‘Whoa.’ Like, that is one thing the place shoppers in a spot like Argentina are literally speeding into bitcoin as a technique to transfer cash that they’ve earned — it’s their cash — in a method that they noticed match. So, I felt that was a really eye-opening second for me when it comes to Bitcoin being an escape valve to sure behaviors that weren’t aligned with my views of self sovereignty, of cash … in order that was form of a turning level for me in 2013, the place it actually solidified my conviction.”

Shortly afterward, in Could 2013, he attended the Bitcoin 2013 convention in San Jose and, regardless of its comparatively small group, he was intrigued by the breakthrough Bitcoin had made in how digital funds may very well be facilitated.

“It was actually a handful, like two handfuls of individuals principally, it was so extremely early,” he mentioned. “I used to be fascinated by this normal thought that you just transfer worth in a totally self-sovereign method with none intermediaries in anyway. And through that very same time interval, I keep in mind sending and receiving bitcoins, and I used to be organising wallets for buddies to indicate them what was doable: ‘Look, that is me sending you cash and there’s nobody in between, proper?’ And I used to be actually fascinated by it.”

To The Greatest Of Our Talents

However Marcus was not but prepared to surrender on the opportunity of institutionalized but open funds for the web. In June 2014, he joined Meta (then Fb) as its vp of messaging merchandise, growing the Fb Messenger cellular app. Marcus launched Messenger P2P Funds in 2015, which allowed customers to ship one another cash from their synced checking accounts by way of the app.

By mid-2019, Marcus had begun main Fb’s cryptocurrency venture, Libra, which was later renamed Diem earlier than being deserted altogether. Libra was virtually immediately dismissed by Bitcoiners as providing nothing significantly helpful in comparison with different centralized digital forex initiatives. And Marcus discovered himself defending the venture earlier than the Home Monetary Providers Committee in addition to the U.S. Senate’s banking committee, compelled to reply questions that have been usually extra broadly centered on Meta’s historical past of invading consumer privateness.

However earlier than Libra settled on the permissioned, oligarchical node mannequin outlined in its white paper, Marcus had truly thought of leveraging the Lightning Community for his venture.

“I keep in mind assembly with Elizabeth Stark (CEO of Lightning Community growth agency Lightning Labs) in early 2018 and attempting to determine whether or not Lightning was truly the best way to go, as a result of if there was a technique to truly use Bitcoin, I actually needed to try this,” Marcus mentioned. “On the time, we thought, OK, possibly we are able to use Lightning after which construct a world-class pockets that we are able to embed throughout the entire Meta merchandise, WhatsApp and Messenger and others, after which allow folks to maneuver worth round.”

In the end, he determined the protocol wasn’t strong sufficient to meet Meta’s imaginative and prescient attributable to a few of the insufficiencies that it has but to beat, together with restricted nodes and liquidity.

“Even at this time, it could be difficult, and will probably be difficult, to really get to billions of shoppers on the Lightning Community,” Marcus identified. “Even Layer 1 gained’t have sufficient HTLCs (hash time locked contracts) to really do this. So, we’ll have to search out options as we get there. However our view was that it gained’t scale… And as such, we got here to the conclusion that we have to go construct this proprietary know-how that we’ll then do no matter we are able to to decentralize to the perfect of our skills.”

Ultimately, Marcus’ capability to decentralize a funds venture below Meta proved inadequate and he has since come to the conclusion that trying to take action on every other community other than Bitcoin is an train in futility.

“We’ve constructed the unshakeable conviction at this level that the one blockchain and the one underlying property that may assist a very open protocol for funds on the web is Bitcoin and nothing else,” he mentioned.

In 2021, Marcus left Meta and the following 12 months he launched Lightspark to pursue that conviction.

The Motive Bitcoin And Lightning Are Higher

Lightspark builds software program and growth instruments meant to make accessing the Lightning Community simpler, resembling its software program growth equipment to assist companies supply Lightning wallets to their prospects and Lightspark Predict, which identifies the best-performing Lightning nodes and might route transactions to them.

Fairly than constructing a centralized platform to allow digital funds, Lightspark is targeted on constructing instruments to assist prospects entry this current, decentralized one. And whereas Lightning Community adoption continues to be removed from rivaling the consumer base of one thing like PayPal, Marcus is optimistic about its potential to scale if firms like his are profitable.

“Lightning nonetheless has points, however I really feel very assured that we’re ready to handle these points,” he mentioned. “You’ll see that for firms to combine on Lightning utilizing Lightspark companies, you don’t even want to fret about channels. You don’t want to fret about liquidity. You don’t want to fret about channel rebalancing and distributing liquidity. You don’t want to fret about what routes you’re going to make use of and which minimal price or most price you’re going to set. All of that complexity is being utterly taken away from the equation of an organization deciding whether or not they’re going to implement Lightning for his or her shoppers or not.”

When requested if abstracting customers so far-off from managing their very own liquidity, channel balances and routing may in a way recreate the problems with centralized, trusted monetary middlemen, Marcus responded with an analogy.

“Within the early days of the online, in the event you needed a web site and also you needed to be on the web, you needed to go construct your personal server, discover a rack, put it in a rack, purchase a router, configure your router, get an E1 or a T1 line, plug that router into your E1 or T1 line after which preserve that complete factor on a regular basis, and it was like, OK, nobody does that,” he defined. “However the motive Lightning and Bitcoin are higher is as a result of there are firms like Lightspark that may make issues simpler for mass market adoption, however if you’re in a random nation anyplace, and also you simply have web connectivity, you may run a node in your telephone your self and be a participant on this community. And I believe that’s what makes it wonderful.”

And he went additional to underscore that his intention now’s to allow a sure form of Lightning adoption, quite than roll out an answer that minimizes the necessity for impartial contributors.

“We don’t count on everybody to make use of our software program,” he continued. “That may truly be a nasty factor, proper? We predict that everybody ought to run their very own factor and we’re going to cater to a sure section of the market that’s going to are usually bigger, enterprise-types of shoppers.”

Of all of the executives actively engaged on Bitcoin initiatives, Marcus most likely has probably the most legacy expertise to tell him on what Bitcoin must succeed in addition to what it should keep away from so as to not fail. And, declaring that constructing on Lightning is the end result of his life’s work, he’s decided to succeed.

[ad_2]

Source link