[ad_1]

Binance.US, the US subsidiary of in style cryptocurrency change Binance, has skilled a big drop in liquidity, with market makers and merchants reportedly fleeing the change in massive numbers. In accordance to information from crypto market information supplier Kaiko, liquidity, as measured by aggregated market depth for 17 tokens on the change, has fallen practically 80% over the previous week.

On June 4, the day earlier than the Securities and Trade Fee (SEC) lawsuit, market depth was $34 million, however at present, market depth is simply $7 million.

Market Makers Exodus

Market makers are monetary corporations that facilitate buying and selling in monetary markets by offering liquidity. They purchase and promote belongings, similar to cryptocurrencies, at quoted costs to revenue from the distinction between the purchase and promote costs, generally known as the bid-ask unfold.

In cryptocurrency exchanges, market makers are essential in offering liquidity by putting purchase and promote orders at totally different value ranges. This permits traders to purchase and promote belongings at a desired value and helps to stabilize the market.

Nevertheless, the decreased market depth has resulted in a greater than 6% value distinction between mainstream cryptocurrencies on Binance.US and different exchanges, which has since been flattened.

The drop in liquidity means that market makers are nervous and need to keep away from volatility-induced losses and the opportunity of their belongings getting caught on an change, like throughout the FTX collapse.

Binance.US has suffered essentially the most out of the exchanges focused within the lawsuits, with its market share dropping from 20% in April to only 4.8% at present, in response to Kaiko.

The drop in market depth for Binance.US signifies that market makers are dashing to exit the market, probably as a consequence of regulatory considerations or different components. This will have a number of implications for Binance.US, together with decreased liquidity, elevated volatility, and potential problem for traders to purchase or promote belongings at a desired value.

Coinbase, alternatively, has seen its market share soar over the previous week, from 46% to 64%, for unclear causes. No explicit asset noticed an uncommon surge in commerce quantity.

Nevertheless, Coinbase could have essentially the most to lose within the lawsuits, contemplating 80% of its enterprise is in america. In distinction, the Binance.US entity accounts for a small fraction of world Binance exercise.

Binance Sees $500 Million Drop In Open Curiosity

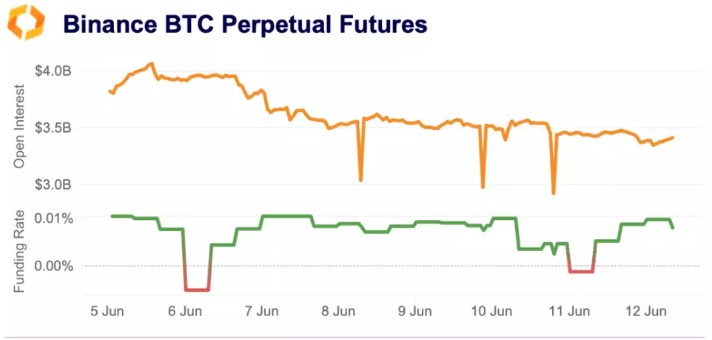

In keeping with Kaiko analysis, during the last week, the cryptocurrency market has skilled a big decline in open curiosity, with Bitcoin (BTC) open curiosity falling over 25% on Binance from peak to trough. From a excessive of $4.1 billion of open positions, BTC’s open curiosity on Binance dropped to a low of $2.9 billion as lengthy positions have been liquidated and costs fell.

Regardless of the decline in open curiosity, funding charges on Binance remained principally constructive all through the week, solely dipping destructive for 2 funding fee intervals on the sixth and the eleventh.

That is attention-grabbing as funding charges usually change into destructive throughout a market downturn when there’s a excessive demand for brief positions. The truth that funding charges remained principally constructive throughout the market decline means that traders should still be bullish on cryptocurrency.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Source link