[ad_1]

Knowledge reveals Bitcoin shorts have been piling up on cryptocurrency exchanges Binance and Deribit through the previous few days.

Bitcoin Funding Charges On Binance & Deribit Are Deep Pink Proper Now

In line with knowledge from the analytics agency Santiment, merchants on the by-product market have continued to wager towards the cryptocurrency just lately. The related indicator right here is the “funding fee,” which retains monitor of the periodic charge that by-product contract holders on an change are paying one another proper now.

When this metric has a constructive worth, it implies that the lengthy merchants are paying a premium to the quick merchants as a way to maintain onto their positions. Such a pattern suggests that almost all sentiment on the given change is bullish at the moment.

Then again, the metric being below the zero mark implies the merchants on the platform maintain a bearish mentality in the mean time, because the shorts are the dominant power.

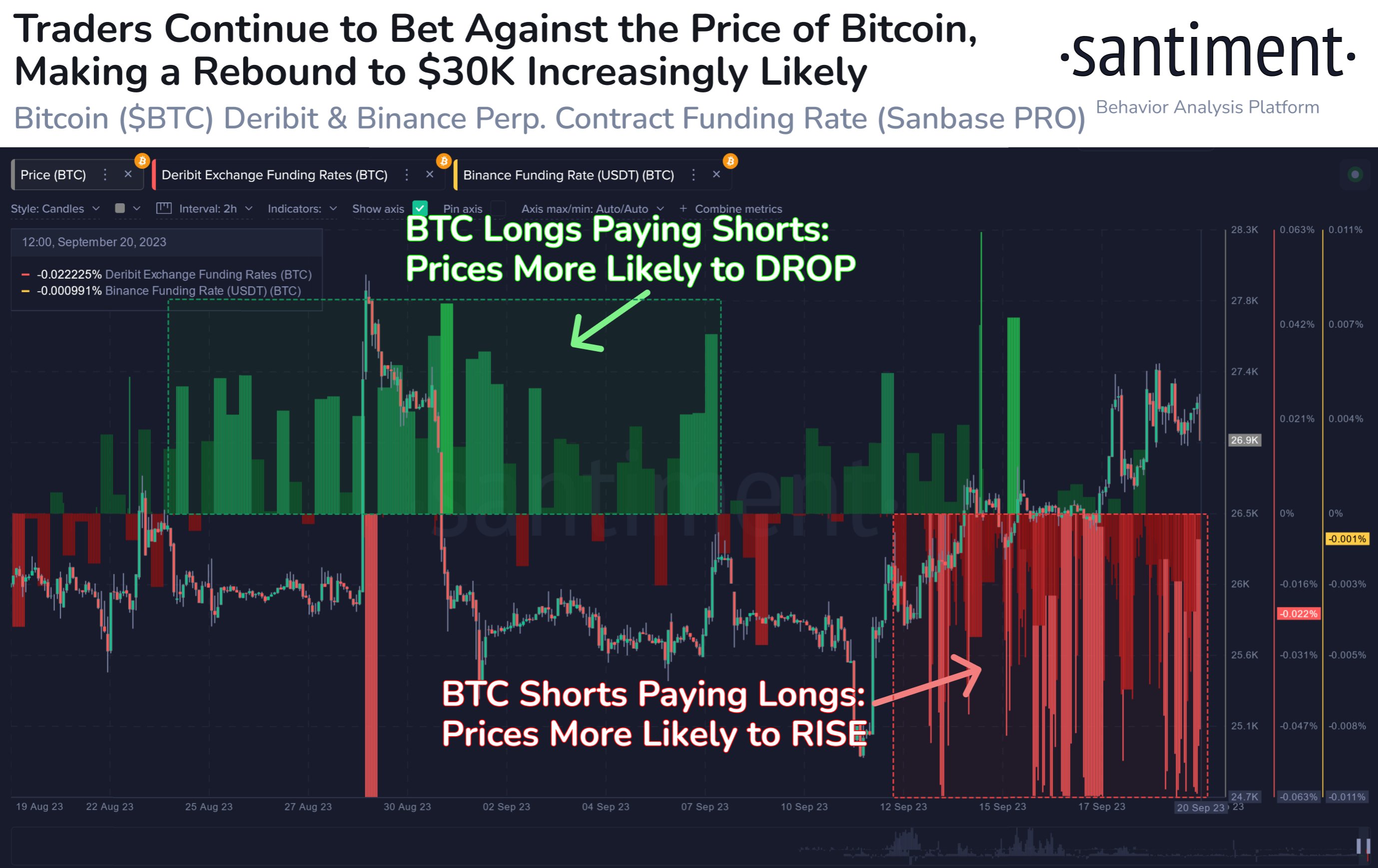

Now, here’s a chart that reveals the pattern within the Bitcoin funding charges for Binance and Deribit over the previous month:

Appears like the worth of the metric has been fairly crimson in current days | Supply: Santiment on X

As displayed within the above graph, the Bitcoin funding fee for each of those exchanges had been largely constructive over the last third of August and the beginning third of this month, implying that almost all of the merchants had been longs.

The bets of those holders had failed, nonetheless, as the value had seen an total downtrend on this interval. For the reason that rebound earlier this month, although, the sentiment has flipped available in the market as shorts have piled up on each of those platforms.

These quick merchants haven’t been profitable to date, both, as the worth of the cryptocurrency has seen internet progress since they’ve appeared. Traditionally, the market has really been extra more likely to go towards the expectation of the bulk, so this sample could also be according to that.

The rationale why the asset would transfer towards the bets of those contract holders is that mass liquidation occasions, referred to as squeezes, develop into extra more likely to occur the extra lopsided the sector is.

A considerable amount of lengthy liquidations can amplify crashes, whereas quick liquidations can present the gasoline for upward surges. Since Bitcoin remains to be seeing aggressive shorting, it could be a constructive signal for the cryptocurrency’s present value rise, as a possible quick squeeze may assist it prolong additional.

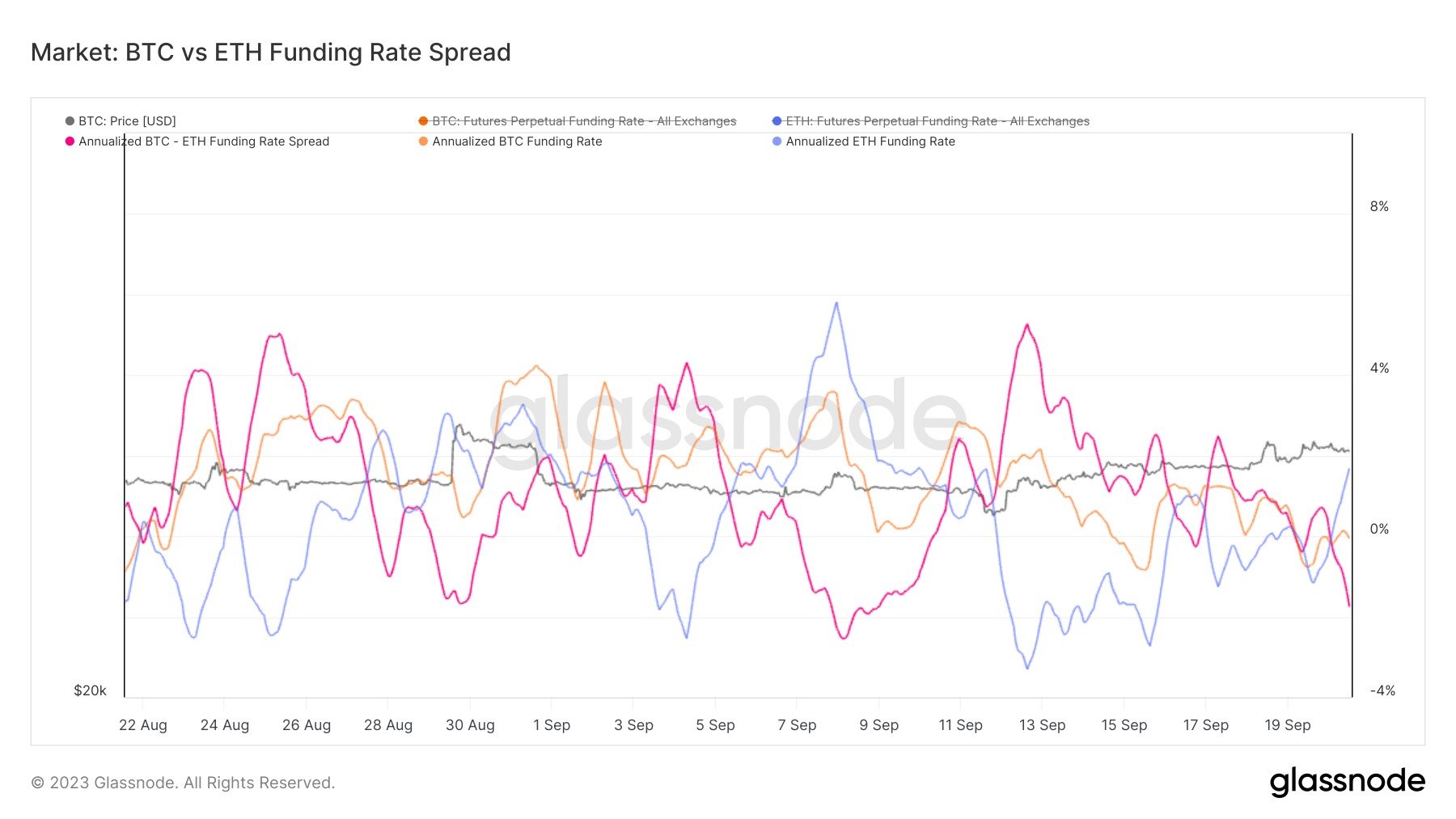

Curiously, whereas Bitcoin is being wager towards proper now, Ethereum’s funding charges are constructive, as identified by analyst James V. Straten in a publish on X.

The 2 metrics have diverged just lately | Supply: @jimmyvs24 on X

From the graph, it’s seen that the funding charges of the highest two belongings within the sector have gone reverse methods just lately. Which means whereas BTC could possibly construct an uptrend off the shorts, ETH may face the other impact if the longs find yourself being liquidated.

BTC Worth

Bitcoin has seen a drawdown of about 1.5% in the present day because the asset’s value has now dropped in direction of the $26,700 stage.

BTC remains to be total up up to now week | Supply: BTCUSD on TradingView

Featured picture from Yiğit Ali Atasoy on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link