[ad_1]

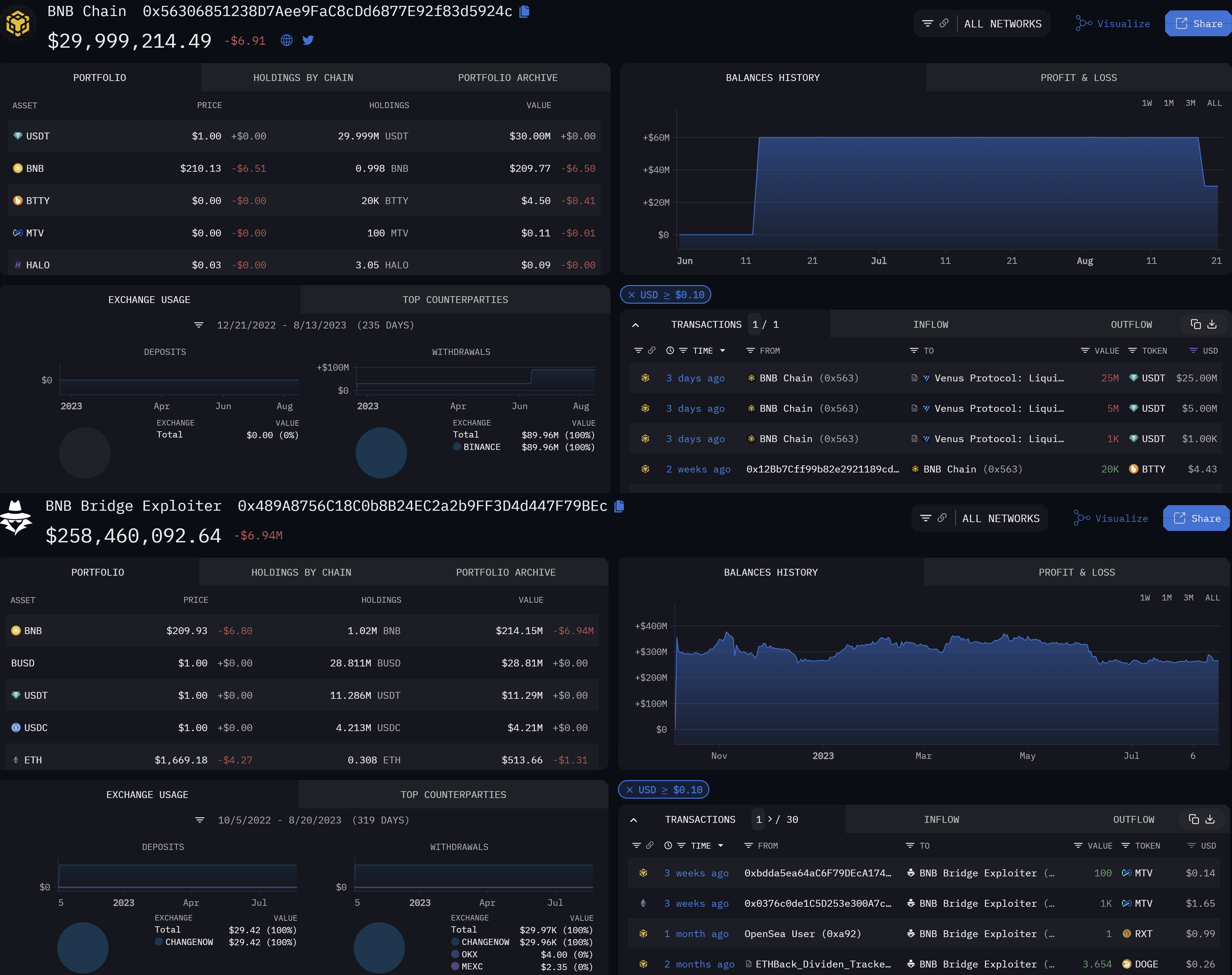

In a fancy tangle of good contracts, governance proposals, and fluctuating crypto costs, the monetary well being price of the notorious Binance BNB Bridge exploiter tackle (0x48…9bec) has fallen under the crucial worth of 1, hovering at 0.99. This improvement is of explicit curiosity, provided that the tackle holds a major collateral of 784,616.10 BNB and a debt place within the type of USDT and USDC totaling $124 million.

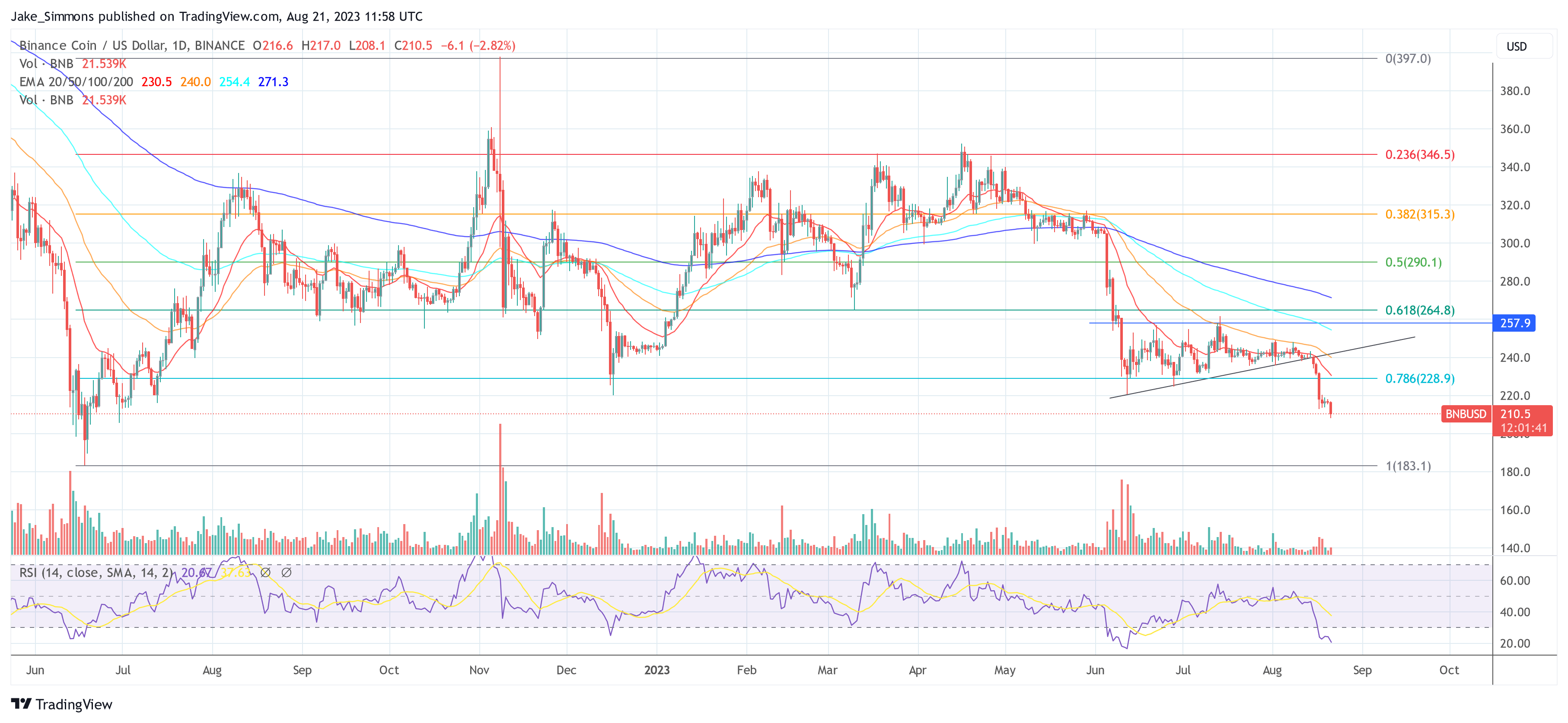

The plummeting well being price comes amidst the autumn of Binance Coin (BNB) to $207.9, nicely under the pre-determined liquidation value of $210.80, resulting in elevated hypothesis about potential liquidation eventualities.

As per a tweet from blockchain safety agency PeckShield: “The well being price of the BNB Bridge Exploiter on Venus is 0.99. BNB has dropped to $207.9. The Venus group has handed a governance proposal to whitelist liquidation of the BNB Bridge exploiter’s place earlier than.”

Liquidation Contingency: The Binance Plan

He Yi, the co-founder of Binance, alleviated some issues stating, “The BNB collateral of Venus is roofed by Binance. When the worth of BNB falls, Binance will liquidate it in time. These BNB is not going to have an effect on the secondary market value, and Binance will likely be accountable for burning these extra BNB.”

However, the crypto group and analysts alike are intently following the state of affairs, speculating on whether or not Binance CEO Changpeng Zhao, generally generally known as CZ, intends to execute the liquidation to take away the illegitimate BNB from the ecosystem.

Famend analyst Skew remarked concerning the at the moment ongoing value actions: “”BNB Shorts going at it once more + -24% APR (24hr). BNB Combination CVDs present takers are web sellers on the day thus far. BNB Binance Spot: Various spot bids under all the way down to $200, so there’ll have to be a frenzy of spot promoting with the intention to trigger value dislocation or a crash. Massive restrict purchaser has been attempting to soak up the promote strain.”

Crypto influencer MartyParty introduced this speculation into the limelight, stating, “Is CZ attempting to liquidate the Venus mortgage to burn the 900k unlawful BNB? Primarily based on the Venus protocol documentation, the mortgage must be liquidated to burn the unlawful BNB. That’s the solely approach to take away it from the ecosystem.”

This liquidity and governance problem comes after an “exploiter” illegally minted 2 million $BNB by means of a vulnerability in BNB Bridge, which has since been repaired. Of this illegally minted BNB, 900,000 BNB was used as collateral on Venus Protocol to acquire a mortgage exceeding $150 million in stablecoins, which was then dispersed throughout a number of blockchains.

On June 12, 2023, a possible liquidation was averted when Binance stepped in so as to add $30 million in USDT margin, bringing the liquidation value all the way down to $212. Once more on August 17, one other liquidation was sidestepped, pulling the liquidation threshold all the way down to $210.80 and consequently the well being price to 1.02.

In an earlier response to MartyParty’s question, CZ appeared unfazed: “Took me some time to know (IF I even vaguely perceive now). So, Marty is frightened a couple of $30-120m price re-buy of #BNB? Possibly he ought to examine the final BNB burn? or the #SAFU insurance coverage fund measurement?”

He additionally commented on the volatility of BNB, including, “And the place did the $212 magic quantity come from? #BNB value is decided by the market. A $30m re-buy is lower than 4% of a single day’s quantity.”

As of this writing, the market continues to be unsure, ready for additional indicators from CZ, who hasn’t commented on the most recent developments. In the meantime, Arkham Intelligence’s dashboard stays a focus for real-time updates on the mortgage standing and the well being price of the exploiter’s account. At press time, no liquidation befell but.

At press time, the BNB value was at $210.5.

Featured picture from Steel Pay, chart from TradingView.com

[ad_2]

Source link