[ad_1]

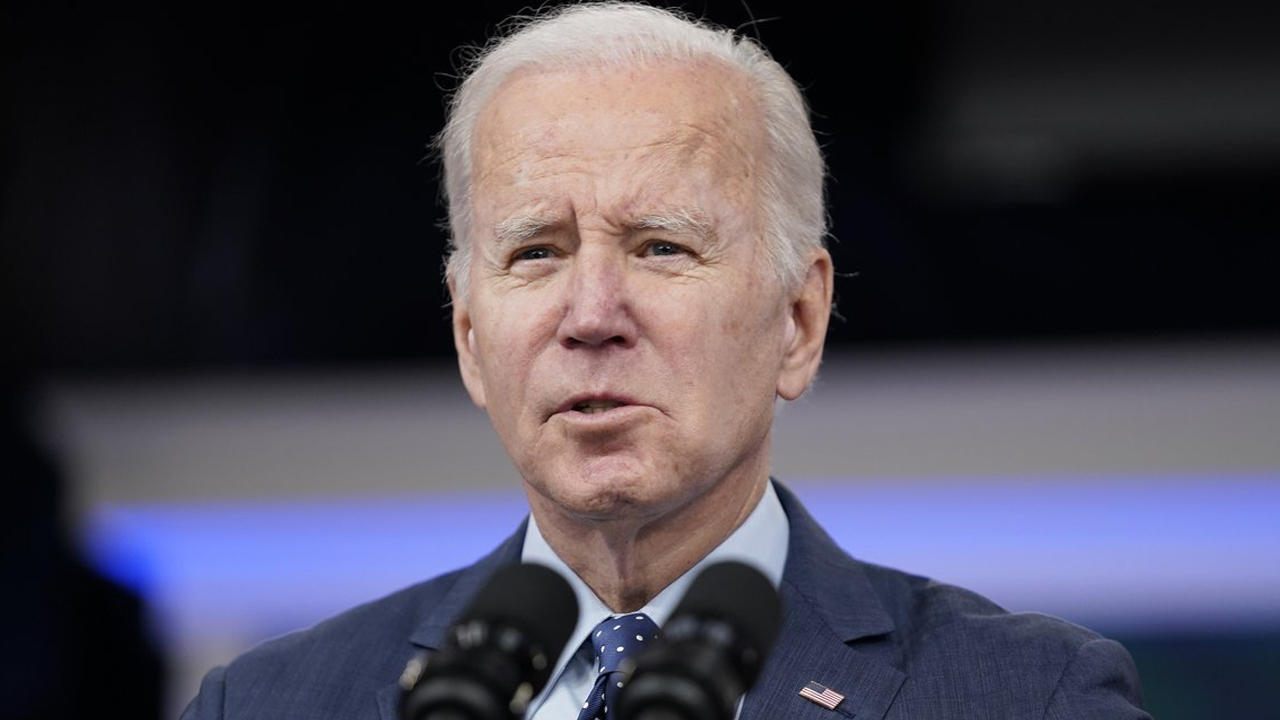

Amid the collapse of the second, third, and fourth largest banks in American historical past, U.S. president Joe Biden reassured the general public that the nation’s banking system stays sturdy. Nevertheless, the president additionally acknowledged the “risk by the speaker of the Home to default on the nationwide debt.”

Biden Expresses Confidence in American Banking System Regardless of First Republic Financial institution Collapse

Biden’s current statements had been made following California’s monetary regulators seizing First Republic Financial institution and inserting it below the management of the U.S. Federal Deposit Insurance coverage Company (FDIC). After the financial institution’s seizure, it was then bought to JPMorgan Chase, the most important financial institution in america, which pledged to cowl all deposits, together with the uninsured.

Biden expressed his approval of the federal government’s dealing with of the disaster, saying, regulators have taken motion to facilitate the sale of First Republic Financial institution, ensuring that every one depositors are protected, and “taxpayers will not be on the hook.”

“These actions are going to be sure that the banking system is secure and sound,” Biden said. “And that features defending small companies throughout the nation who have to make payroll for employees and their small companies.”

The president’s feedback echo these made after the autumn of Silicon Valley Financial institution and Signature Financial institution. U.S. Treasury secretary Janet Yellen additionally gave related reassurances when the 2 banks collapsed, emphasizing the security and soundness of the banking business.

Nevertheless, some have criticized Yellen’s dealing with of the disaster, with one contributor to the New York Put up, Charles Gasparino, labeling her “clueless” for her failure to stop the collapse of First Republic Financial institution.

Yellen was “drooling joyful speak in regards to the banking system, and asking different banks to bail out the zombie. She’s additionally doubling down on her errors that precipitated this banking disaster within the first place, making it tougher to flee,” Gasparino mentioned.

Yellen has sounded an alarm in regards to the U.S. defaulting on its money owed, a priority that Biden echoed throughout his press convention on First Republic’s downfall. On Monday, the president emphasised the necessity to make sure the continued reliance on the economic system and monetary system, calling for the “risk by the speaker of the Home to default on the nationwide debt” to be taken off the desk.

Republican lawmakers, nonetheless, have stood agency on the nation’s debt restrict, demanding repeals of the Inflation Discount Act earlier than they comply with any improve. The potential default on the nation’s debt by the top of the summer time has heightened fears of monetary instability and a chronic recession in america.

In a word shared with Bitcoin.com Information, Ruslan Lienkha, the chief of markets at Youhodler, a global fintech platform primarily based in Switzerland, expounded on the impression of First Republic’s failure on the steadiness of the U.S. banking sector. Lienkha voiced apprehension that the Fed’s fee hikes which have taken place up to now 12 months have been notably “painful for small and mid-sized banks in america.”

“Which implies the collapse of First Republic Financial institution is probably going not the final one,” Lienkha opined. “A possible chapter of the financial institution might set off a broader monetary disaster within the nation, affecting the true property market and lots of different associated industries—which might have large implications for the world economic system.”

What do you suppose the federal government will do to attempt to forestall one other banking disaster and a possible default on the nationwide debt sooner or later? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link