[ad_1]

Test these 7 AI monetary advisors which can be anticipated to guide the market in 2023. These platforms make the most of superior algorithms and machine studying methods to supply customized funding recommendation and portfolio administration providers.

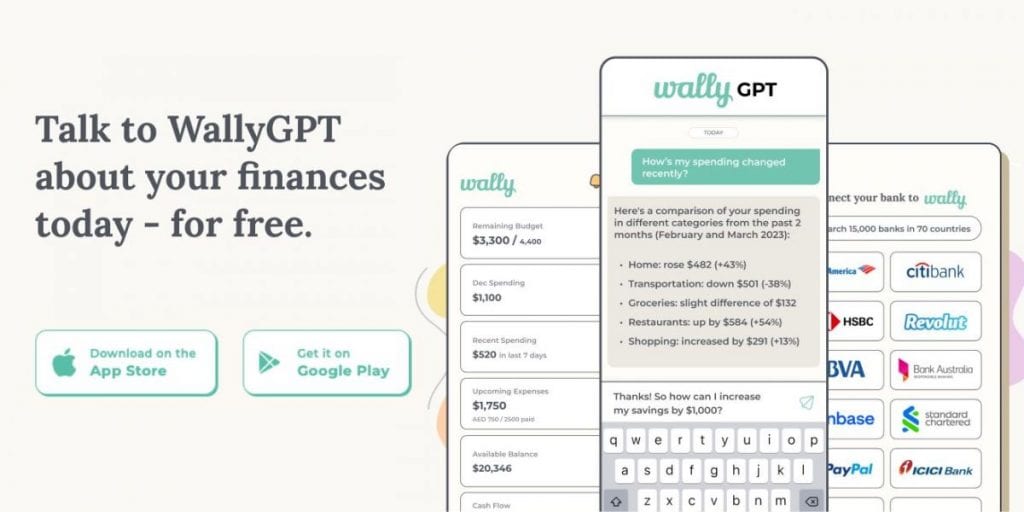

WallyGPT: AI-Powered Private Finance Assistant

WallyGPT is the world’s first generative AI-powered private finance app! Wally combines the ability of AI with the intricacies of non-public finance, providing a tailor-made expertise that goes past conventional charts and graphs. It supplies contextual insights, customized steering, and promotes monetary literacy.

Over time, we’ve got come to grasp that private finance is extra than simply monitoring bills or setting budgets. It’s about comprehensively understanding your monetary life. Wally affords a complete view of your monetary scenario, robotically monitoring all the things from spending, budgets, and balances to web value and money circulate, multi functional place.

Enter WallyGPT, your private finance assistant. WallyGPT elevates your monetary literacy by offering professional context and tailor-made recommendations. Ask WallyGPT questions like “How have my grocery bills modified within the final 4 months?” or “How a lot do I want to avoid wasting every month for a marriage in Greece?” and obtain an prompt motion plan. It’s like having a monetary professional in your pocket, prepared to help you at any second.

It additionally serves as your funding coach, answering your questions and serving to you improve your monetary literacy. Whether or not you’re researching the precise ETFs or want steering on investing throughout a recession, WallyGPT is there to help you. Wally simplifies your funds, automates mundane duties, and supplies contextual insights and customized steering that empower you to make higher monetary selections.

At Wally, we prioritize security, safety, and privateness. We have now constructed Wally from the bottom up with these ideas in thoughts. Your conversations with WallyGPT are non-public and confidential. We use your knowledge to supply related responses, and inside 30 days, it’s fully deleted. We don’t use your knowledge for coaching functions, nor can we gather any delicate banking or account info.

With the power to hook up with over 15,000 banks in 70 international locations, WallyGPT is now obtainable free of charge on the Apple App Retailer and Google Play Retailer. Obtain the app at present and begin your journey in direction of mastering your funds with the assistance of WallyGPT.

Michael AI: GPT-Powered Funding Analyst

Michael is your very personal AI-powered Funding Analyst. With Michael, you achieve entry to 1000’s of firm paperwork and present monetary metrics, reworking your funding evaluation expertise and boosting your productiveness.

Michael is a sophisticated Synthetic Intelligence search instrument designed particularly for the funding group. Utilizing cutting-edge AI expertise, Michael means that you can discover and uncover info on publicly-traded corporations just by utilizing pure language. With Michael, you possibly can merely ask your questions and get the solutions you want.

Michael supplies entry to Earnings Name and Convention Transcripts, in addition to Quarterly (Qs) and Annual (Ks) Experiences for a variety of corporations, together with AAPL, ABNB, AMZN, BX, CAT, CMG, COST, CRM, CRWD, DDOG, DIS, DKNG, GOOGL, HD, JPM, MAR, MSFT, NFLX, NVDA, PANW, PLTR, RIVN, SNOW, SQ, TGT, TSLA, UBER, UNH, V, and WMT.

To maximise the advantages of utilizing Michael, strive asking questions in a conversational method, as in case you have been chatting with an individual. Whereas Michael can deal with key phrase searches, it excels whenever you use pure language statements or questions.

Within the Chat function, Michael makes use of a system just like Auto-GPT, an open-sourced AI Assistant based mostly on ChatGPT. It evaluates your query and obtainable actions to find out the very best method. After a couple of iterations, Michael supplies you with a solution together with the set of paperwork it used to reach at that reply.

Within the Search function, Michael takes your search assertion or query, performs a semantic search towards the obtainable info, and returns essentially the most related outcomes.

FinChat.io: AI Inventory Investing Analyst

FinChat.io is your AI-powered inventory investing analyst designed particularly for the finance world. Think about accessing a digital assistant that may give you useful insights and knowledge on over 750 corporations, 100+ super-investors, and an unlimited array of monetary metrics and investing supplies.

As fellow buyers, the creators of FinChat.io acknowledged the challenges confronted by the trade. Hours have been spent sifting by way of filings, transcripts, and conventional monetary knowledge terminals, making it tough to mixture complete knowledge on particular person corporations.

With FinChat, they’ve mixed up-to-date monetary knowledge with highly effective giant language fashions to create a easy and user-friendly instrument. And right here’s the very best half: the fundamental model of the product is at the moment obtainable free of charge, permitting customers to get pleasure from as much as 10 prompts per day. Because the platform scales and improves, customers can count on much more insightful solutions and options.

However that’s not all. The group behind FinChat.io can also be devoted to fostering innovation within the AI trade. They’re within the means of creating an trade affiliation referred to as The AI Innovators Collective. This affiliation goals to convey collectively AI, ML, and GPT specialists to collaborate on on-line programs and contribute useful content material.

Jarvis Make investments: Let AI Maximize Your Inventory Market Returns

Jarvis Make investments analyzes 12 million monetary parameters, together with basic, technical, and mawkish elements, together with 120 international parameters, to create a personalized fairness portfolio for you. This customized method ensures that your investments align together with your threat profile, funding horizon, and desired quantity. With over Rs. 100+ crores in trusted funds, Jarvis Make investments makes use of AI to assist your cash develop within the inventory market.

One of many greatest challenges in inventory investing is managing threat. Jarvis Make investments addresses this with its inbuilt 24X7 threat administration system. With steady monitoring, Jarvis retains a vigilant eye in your portfolio, mitigating potential dangers and striving to ship benchmark-beating returns in the long term.

Figuring out well timed funding alternatives within the inventory market requires experience and fixed market evaluation. Jarvis Make investments leverages AI to research market tendencies and your portfolio, figuring out potential money-making alternatives. This proactive method ensures that you simply keep forward out there and make knowledgeable funding selections.

Jarvis Make investments’s partnership with 25+ main broking homes ensures seamless execution of your commerce orders. With only a click on of a button, you possibly can onboard digitally and begin executing your trades effortlessly.

One of many key benefits of utilizing AI in inventory advisory providers is the elimination of human biases and errors. Jarvis Make investments depends on AI algorithms that learn and analyze huge quantities of information inside minutes, making it sooner and extra correct than conventional approaches. The 24X7 threat administration system ensures fixed vigilance even when human cash managers should not actively monitoring the market.

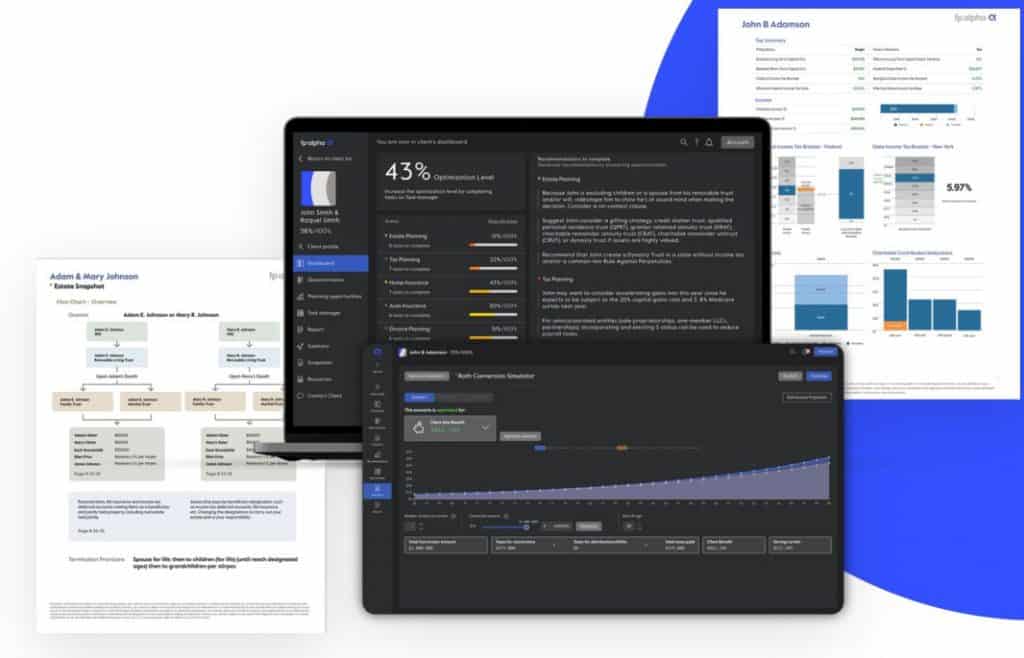

FP Alpha: Reworking Monetary Planning with AI Expertise

FP Alpha is the AI-driven platform for monetary advisors supplies complete planning providers to their purchasers. By leveraging superior expertise, FP Alpha empowers advisors to scale their planning capabilities and supply actionable recommendation based mostly on purchasers’ tax, authorized, and insurance coverage paperwork.

With FP Alpha, the time-consuming process of reviewing and analyzing purchasers’ tax returns, wills, trusts, and insurance coverage insurance policies is now streamlined. The AI-driven expertise “reads” these paperwork and immediately summarizes key knowledge, figuring out useful planning insights and quantifying the worth of recommendation. What used to take hours can now be carried out in minutes, saving each advisors and purchasers useful time.

FP Alpha goes past conventional retirement planning software program by offering a complete resolution that demonstrates the worth of advisors’ experience past investments. By analyzing purchasers’ full monetary image, advisors can supply actionable plans for implementation, serving to purchasers obtain their monetary targets with confidence.

The FP Alpha platform equips advisors with visible reviews that assist illustrate suggestions to purchasers. These reviews make it simpler for purchasers to grasp the worth and advantages of the proposed methods, enhancing their general monetary planning expertise.

Importantly, FP Alpha is designed as an extension to conventional retirement planning software program, not a alternative. The platform seamlessly integrates with the trade’s most generally used expertise, enhancing the capabilities of current planning processes. Advisors can leverage FP Alpha’s AI-driven insights whereas sustaining their most well-liked planning instruments and workflows.

Zumma: Private Finance Assistant with AI

Zumma is the private finance platform that makes use of the ability of AI that will help you make higher monetary selections. Designed to cater to customers in Mexico and Latin America, Zumma affords a complete private finance and funding platform that gives useful suggestions, recommendation, and rewards.

With Zumma, you possibly can take management of your funds and make knowledgeable selections. The platform harnesses the capabilities of AI to research huge quantities of information and supply tailor-made suggestions based mostly in your monetary targets and preferences. Whether or not you’re saving for a giant buy, planning for retirement, or seeking to develop your investments, Zumma is right here to information you each step of the best way.

One of many standout options of Zumma is its customized method. The platform takes into consideration your distinctive monetary scenario, threat tolerance, and funding horizon to ship personalized suggestions that align together with your targets. This stage of personalization ensures that you simply obtain recommendation that’s related and significant to your particular circumstances.

Zumma’s AI-powered algorithms constantly analyze market tendencies, financial indicators, and funding alternatives to give you up-to-date insights. With this info at your fingertips, you can also make extra knowledgeable selections about the place to allocate your funds and optimize your funding technique.

However Zumma goes past simply providing suggestions. The platform additionally rewards you for taking optimistic monetary actions. By reaching monetary milestones, saving constantly, or assembly your funding targets, you possibly can earn rewards that additional increase your monetary well-being. This distinctive rewards system serves as a further motivator that will help you keep on observe together with your monetary targets.

Pefin: AI-Powered Monetary Planning Companion

Pefin is the world’s first AI monetary recommendation platform that show you how to handle your funds. Pefin serves as your digital companion, providing complete monetary planning and recommendation that’s accessible anytime, wherever. With Pefin, you possibly can entry reasonably priced fiduciary monetary planning, recommendation, and investing proper at your fingertips, 24/7. This progressive platform empowers people to take management of their monetary future by offering customized suggestions tailor-made to their particular wants and targets.

One of many key advantages of Pefin is its means to drive monetary inclusion. By leveraging AI expertise, this platform allows monetary establishments and digital advisors to supply monetary planning, recommendation, and robo-investment providers on a bigger scale. Which means that extra people, no matter their demographic or wealth stage, can entry high-quality monetary steering and providers. Pefin’s AI platform is designed with people in thoughts. It helps each digital-only and digital-advisor hybrid fashions, providing you with the pliability to decide on the extent of human interplay you like. Whether or not you like a completely digital expertise or wish to join with a human advisor, Pefin has you lined.

The platform’s superior AI algorithms analyze huge quantities of information to supply correct and dependable monetary recommendation. By leveraging machine studying and knowledge analytics, Pefin constantly learns and improves its suggestions, making certain that you simply obtain essentially the most up-to-date and related steering. Pefin’s user-friendly interface makes it straightforward to navigate and perceive your monetary scenario. By way of interactive instruments and visualizations, you possibly can observe your progress, set monetary targets, and make knowledgeable selections about your cash.

FAQs

What’s an AI monetary advisor?

An AI monetary advisor is a computer-based system that makes use of synthetic intelligence algorithms to supply monetary recommendation and steering.

How do AI monetary advisors work?

AI monetary advisors analyze giant quantities of information, together with market tendencies, historic efficiency, and person enter, to generate customized monetary suggestions and methods.

What are the advantages of utilizing AI monetary advisors?

Some advantages of utilizing AI monetary advisors embrace 24/7 availability, data-driven insights, automated portfolio administration, and the power to cater to particular person monetary targets.

Can AI monetary advisors exchange human monetary advisors?

Whereas AI monetary advisors supply many benefits, they aren’t designed to fully exchange human monetary advisors. They will complement human experience and supply extra instruments for decision-making.

Are AI monetary advisors appropriate for all sorts of buyers?

AI monetary advisors can cater to a variety of buyers, from inexperienced persons to skilled buyers. They will present tailor-made recommendation based mostly on the investor’s threat tolerance, monetary targets, and funding preferences.

How safe is the private and monetary knowledge utilized by AI monetary advisors?

AI monetary advisors prioritize knowledge safety and make use of strong encryption protocols to guard private and monetary info. It’s important to decide on respected suppliers who prioritize person privateness.

What are some examples of standard AI monetary advisor platforms?

Some standard AI monetary advisor platforms embrace:

WallyGPTMichael AIFinChat.ioJarvis InvestFP AlphaZummaPefin

Can AI monetary advisors assist with tax planning and optimization?

Sure, some AI monetary advisors have options that help with tax planning and optimization, serving to buyers decrease tax liabilities and maximize tax-efficient investing methods.

Are there any limitations or dangers related to AI monetary advisors?

Some limitations of AI monetary advisors embrace the potential for algorithmic bias, the lack to account for unexpected market occasions, and the shortage of a human contact in complicated monetary conditions. It’s vital to grasp these limitations and think about them when utilizing AI monetary advisors.

How do the charges for AI monetary advisors examine to conventional monetary advisors?

Charges for AI monetary advisors range relying on the platform and the providers offered. Typically, AI monetary advisors are inclined to have decrease charges in comparison with conventional human monetary advisors, making them cheaper for sure buyers.

Learn extra about AI:

[ad_2]

Source link