[ad_1]

BNB is at present displaying bearish indicators that recommend a potential continuation of the continued downtrend, surpassing the expectations of many buyers.

Regardless of preliminary hopes for a swift restoration, the persistence of those bearish indicators compels buyers to discover the implications and brace for the potential of a extra extended downturn, upsetting additional scrutiny of the way forward for BNB and its affect on the broader cryptocurrency ecosystem.

However what precisely are these indicators telling us about the way forward for BNB?

BNB Current Downturn Coincides With Surge In Buying and selling Quantity

Based on a current tweet by Santiment, BNB has skilled a notable downturn of -15% since June 4. The decline in BNB’s value coincided with a surge in its buying and selling quantity, reaching a degree not seen up to now 5 weeks.

📉 #BinanceCoin has been hammered in comparison with the remainder of the markets these previous couple days. Now -15% since Sunday, social dominance has surged because the asset has turn out to be fairly polarizing. $BNB buying and selling quantity is at 5-week excessive ranges as effectively. https://t.co/E7sU59lkRe pic.twitter.com/FL0Er5vmQa

— Santiment (@santimentfeed) June 7, 2023

This enhance in buying and selling exercise means that market contributors are actively partaking with BNB throughout its value decline, probably searching for shopping for alternatives or adjusting their positions in response to the market motion.

The upper buying and selling quantity signifies heightened market curiosity and the potential for elevated value volatility as buyers carefully monitor BNB’s efficiency.

BNB market cap at present at $40.5 billion. Chart: TradingView.com

This confluence of things, with BNB experiencing a major lower in worth alongside a surge in buying and selling quantity, presents a dynamic and evolving scenario for merchants and buyers, warranting cautious consideration and evaluation of the underlying market dynamics.

Amidst the volatility of the cryptocurrency market, BNB’s value on CoinGecko stands at $260.59, reflecting a mere 0.8% drop up to now 24 hours. Nevertheless, a extra regarding pattern emerges after we contemplate its seven-day decline, which quantities to a major 15.1%.

Supply: Coingecko

Open Curiosity Up, Whale Transactions Down

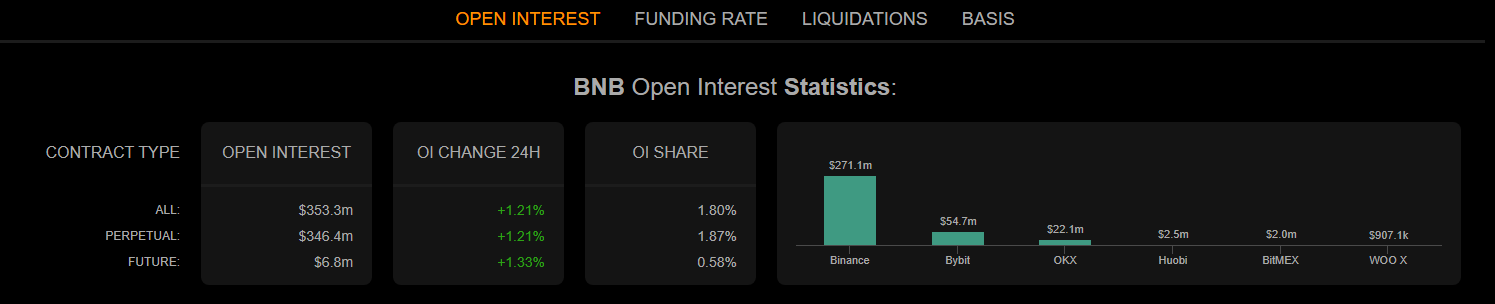

Including to the prevailing bearish sentiment surrounding BNB, its chart evaluation reveals extra causes for concern. Notably, BNB’s open curiosity has gained upward momentum, indicating an inflow of latest or extra capital coming into the market.

This enhance in open curiosity means that the present market pattern could persist for an extended interval, with none imminent reversal.

Supply: Coinalyze

Nevertheless, a bearish indication got here from the Market Worth Realized Worth (MVRV) Ratio, which confirmed a substantial lower. This decline means that the typical revenue or lack of BNB holders is at present decrease, reflecting the downward stress on the coin’s worth.

Consistent with the bearish pattern, whale curiosity in BNB has additionally waned, evident from the lower within the variety of whale transactions. This decline in whale exercise signifies a lowered involvement of large-scale buyers or entities, doubtlessly including to the market’s cautious outlook.

Moreover, BNB’s velocity, representing the frequency at which the coin is utilized in transactions inside a given timeframe, registered a decline. This lower in velocity means that BNB is being utilized much less steadily for transactions, probably indicating a lower in total market exercise.

Featured picture from Tradedog

[ad_2]

Source link