[ad_1]

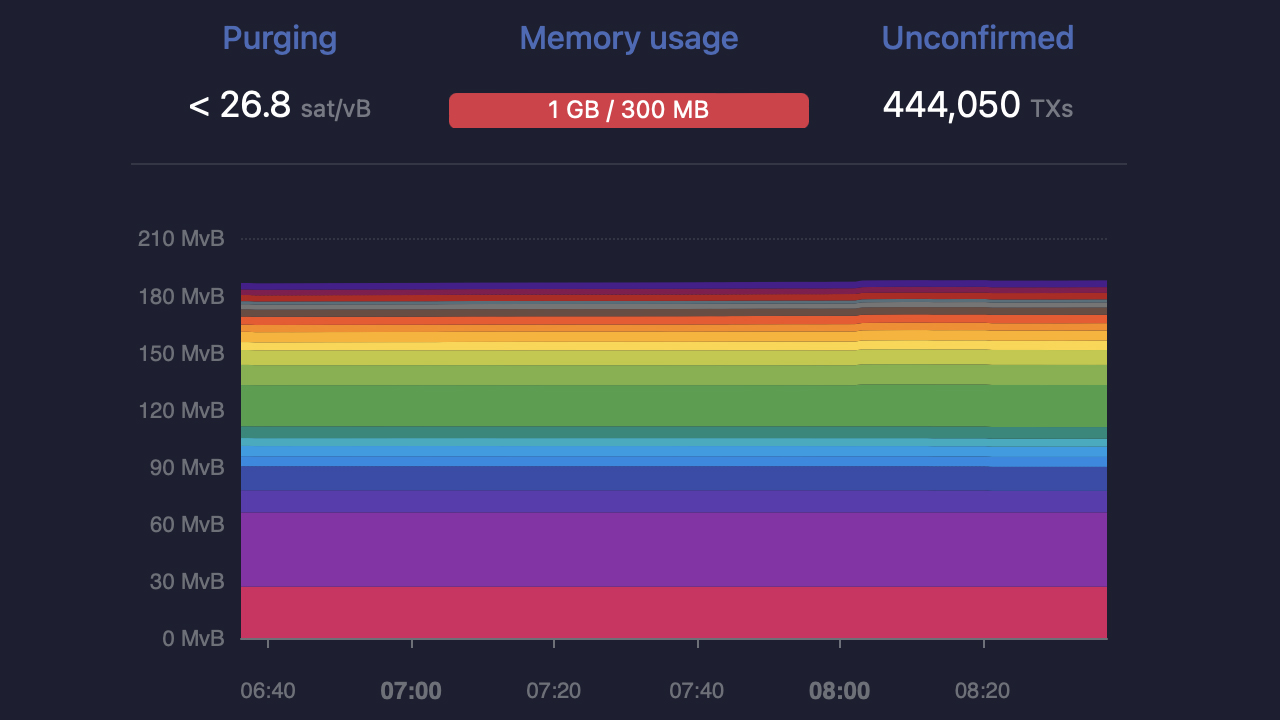

Bitcoin transaction charges have surged considerably up to now 24 hours, with the common price reaching $19.20 per switch. The rise in charges could be linked to a backlog of transactions trapped within the mempool, as over 440,000 unconfirmed transactions are at present awaiting affirmation.

Block Reward Dethroned: Bitcoin Transaction Charges Surpass Mining Subsidy for the First Time Since 2017

On Sunday, Might 7, 2023, bitcoin transaction charges exceeded the block reward for the primary time since December 2017 at block peak 788,695. Subsequent block heights 788,700 and 788,702 additionally witnessed charges surpassing the subsidy.

At current, over 440,000 bitcoin transactions are pending affirmation with 193 blocks left to mine for clearing all of them. Charges soared previous the $25 mark per transaction on Sunday, and present knowledge shows a mean price of 0.00069 BTC or $19.20 per transaction.

In response to bitinfocharts.com knowledge, the median-sized price is 0.0004 BTC or $11.05 per switch. Excessive-priority transactions are paying upwards of $22.90 per transaction and people are paying $19.95 for medium-priority transactions.

Block intervals or mining instances have been exceeding the ten-minute common recently. The newest block time was roughly ten minutes and 34 seconds. Slower block instances could end in one other decline in issue — an estimated drop of round 5.3% is anticipated to happen on Might 18, 2023.

The typical hashrate over the previous 2,016 blocks is roughly 338 exahash per second (EH/s). The community’s hashrate has dipped under the 300 EH/s vary on some cases and is presently operating at 385 EH/s on the time of writing.

What influence do you suppose the surge in bitcoin transaction charges and the backlog of unconfirmed transactions may have on the way forward for cryptocurrency adoption and scalability? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, mempool.area

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link