[ad_1]

AVAX has been increasing its attain in numerous areas over the previous few months, however one facet that has seen super development is its good contract deployment.

With this important milestone, many buyers and merchants alike are speculating whether or not this growth could possibly be the catalyst that propels the Avalanche Community native token’s value to new heights.

Will this newfound development in good contracts result in a surge in AVAX’s worth?

Contract Deployment Spike Might Increase AVAX Adoption

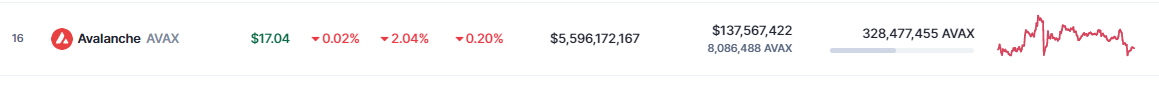

In line with the newest CoinMarketCap knowledge, Avalanche (AVAX) has skilled a minor 2.04% dip in its value over the past 24 hours, however nonetheless stays comparatively regular at $17.04.

Regardless of this slight setback, knowledge from Artemis reveals that the community has witnessed a major spike in contract deployment, which could be a constructive indicator for the protocol’s utilization and adoption.

The contract deployment of $AVAX has just lately hit its highest ranges in over six months.

After analyzing the on-chain exercise, we discovered that contract deployment hasn’t seen such development since Might 2022. pic.twitter.com/ehkVk7ZrrK

— Artemis 🏹 (@Artemis__xyz) April 28, 2023

The rise within the variety of good contracts deployed on the Avalanche community means that extra builders are constructing dApps and exploring the potential of the platform.

Because the variety of dApps on the community grows, it may well result in a wider vary of use instances for the protocol, attracting extra customers and initiatives. This elevated adoption and utilization can finally drive up demand for AVAX.

If the pattern of contract deployment continues to rise, it could possibly be an indication of a wholesome and rising ecosystem on Avalanche. This, in flip, can additional enhance the token’s worth.

Avalanche Community TVL. Picture: Defillama

Avalanche’s DeFi Efficiency Disappoints

Regardless of a major enhance in good contract deployment on the Avalanche community, the platform’s efficiency within the decentralized finance (DeFi) sector has been lower than stellar.

Latest knowledge exhibits a pointy decline within the platform’s decentralized trade (DEX) quantity, falling from 311 million to 13.74 million in just some months. This has had a direct influence on Avalanche’s whole worth locked (TVL), which has additionally seen a decline.

One of many contributing components to the decline in Avalanche’s DeFi efficiency has been the reducing curiosity in BTC.b, a wrapped Bitcoin token on the community used for DeFi functions.

In line with knowledge from Dune Analytics, all DEXes on the Avalanche community have witnessed a decline in BTC.b utilization, indicating an absence of curiosity within the platform’s DeFi choices.

AVAX whole market cap at $5.5 billion on the day by day chart at TradingView.com

Outlook For AVAX

Regardless of the disappointing DeFi efficiency, the rise in good contract deployment on the Avalanche community stays a constructive indicator for the platform’s future prospects.

As extra builders construct dApps and discover the community’s potential, it may well result in a wider vary of use instances and appeal to extra customers and initiatives.

-Featured picture from Analytics Perception

[ad_2]

Source link