[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

Australia’s central financial institution stated the launch of a Central Financial institution Digital Forex (CBDC) is a few years away because of unresolved points encountered by a pilot undertaking.

That was the conclusion of a year-long examine collectively performed with the Digital Finance Cooperative Analysis Centre. The report discovered plenty of authorized, regulatory, technical, and operational points that require additional analysis.

“Given the various points which can be but to be resolved, any resolution on a CBDC in Australia is more likely to be some years away,” the report stated.

RBA Expects Years of Additional Analysis

From March to July this yr, the RBA and Digital Finance Cooperative Analysis Centre experimented with CBDCs in varied use circumstances.

The pilot undertaking entailed the RBA issuing a limited-scale trial CBDC in a ring-fenced setting to particular business companions. The collaborating companies ranged from rising fintech ventures to established banking establishments equivalent to ANZ, Commonwealth Financial institution, and Westpac.

The pilot section was performed with the goal of interacting and dealing with varied industries to research use circumstances for a CBDC which the central financial institution has been engaged on over the previous few years. Ultimately, a complete of 16 use circumstances have been submitted by the business individuals.

A year-long analysis undertaking by the Reserve Financial institution of Australia has uncovered plenty of authorized, regulatory, technical and operational points that might stymie the introduction of a central financial institution digital forex (CBDC)Working in a ring-fenced setting and involving a digital… pic.twitter.com/RkGDohPURV

— jamiemcintyre (@jamiemcintyre21) August 23, 2023

As an illustration, primarily based on the outcomes, the experiment discovered that customers have a difficulty with key administration. “For finish customers of tokenized belongings, which embody stablecoins and the pilot CBDC, key administration stays a sensible problem,” the report stated.

This has been a prevalent problem within the crypto neighborhood particularly amongst companies that use safety keys for multi-tiered approval processes for vital transactions.

“Contemplating the broader context – the place the Australian funds system is at the moment assembly many of the wants of finish customers and work on CBDC in superior economies is usually nonetheless in an exploratory stage – it’s possible that any critical coverage consideration of issuing a CBDC in Australia remains to be some years away,” it stated.

CBDC Could Be Helpful

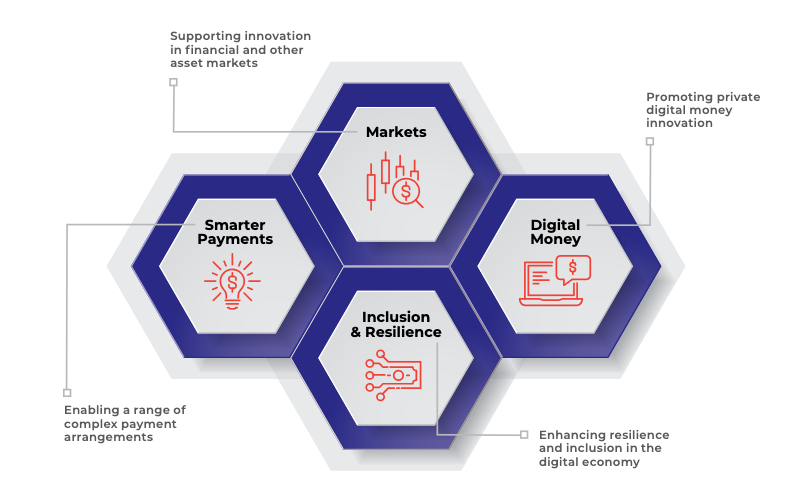

Except for discovering points with the undertaking, the RBA additionally discovered that the CBDC could possibly be utilized efficiently in 4 most important areas. These areas included facilitating “smarter” funds, the place a tokenized CBDC enabled quite a lot of advanced cost preparations that aren’t doable with present cost programs.

The central financial institution additionally found that CBDCs could possibly be used to foster innovation in creating personal digital cash sectors, help monetary innovation in domains like debt securities markets, in addition to enhance inclusion and resilience within the bigger digital financial system.

Along with these most important areas, the participant companies discovered that the tokens could possibly be employed for atomic settlements, or transaction settlements which can be each simultaneous and immediate. This was termed helpful as a result of it might cut back settlement dangers and enhance effectivity in settlement processes.

Different recognized advantages have been programmability, the place CBDCs may enhance effectivity and cut back threat in a variety of advanced enterprise processes and transparency which might allow customers to independently confirm their CBDC balances.

Whereas the CBDC proved helpful in some circumstances, the RBA additionally got here to the conclusion that the digital token was not needed in different circumstances. In response to the report, some advantages could possibly be attained utilizing different means equivalent to utilizing privately issued tokenized financial institution deposits or asset-backed stablecoins.

“It was not clear that CBDC was solely required to realize the specified financial outcomes,” the RBA stated.

This exhibits that the CBDC won’t essentially exchange crypto in Australia however will as an alternative complement it. In truth, it highlighted that submissions by some collaborating business companies spoke of the potential for privately issued stablecoins that have been absolutely backed by CBDC to extra readily compete with digital types of cash issued by regulated monetary establishments.

Associated Articles

Wall Road Memes – Subsequent Large Crypto

Early Entry Presale Dwell Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Crew Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link