[ad_1]

New York public sale homes are projecting their marquee spring gross sales may carry in additional than $2.2bn, regardless of worries that the artwork market could also be cooling, each for up to date work deemed dangerous by collectors in occasions of financial uncertainty and for the most costly works that consignors could also be holding again given the unsure macroeconomic image. Notably absent this month are any works with nine-figure estimates, and even estimates within the excessive eights. There is no such thing as a Georges Seurat masterpiece or Andy Warhol Marilyn portrait or Catastrophe canvas to check the appetites of the deep-pocketed trophy-hunters, as in current seasons.

Sellers say that components similar to warfare, failing banks, an unsure political outlook and rising rates of interest aren’t stopping rich collectors from shopping for artwork altogether, however acknowledge that the jittery economic system could hold them from repeating the record-breaking bids of the previous few rounds of main auctions.

“I wouldn’t say that that market is struggling in any way. I believe it’s nonetheless very sturdy and really secure,” says Emily Kaplan, co-head of Christie’s Twentieth-century night sale. “The fully unprecedented public sale outcomes that we noticed from the final two years could have simply tempered barely.”

Christie’s New York is devoting a number of gross sales to single-owner collections this month. They embrace works from the collections of the Chicago commodities dealer Alan Press and his spouse Dorothy, the late Boston Institute of Up to date Artwork trustee Gerald Fineberg, and Sophie Danforth, whose household based the Rhode Island College of Design. Additionally headed for the public sale block are items from the collections of the publishing billionaire SI Newhouse and the Microsoft co-founder Paul Allen. Christie’s estimates that its Might gross sales will herald between $760m and $1.1bn.

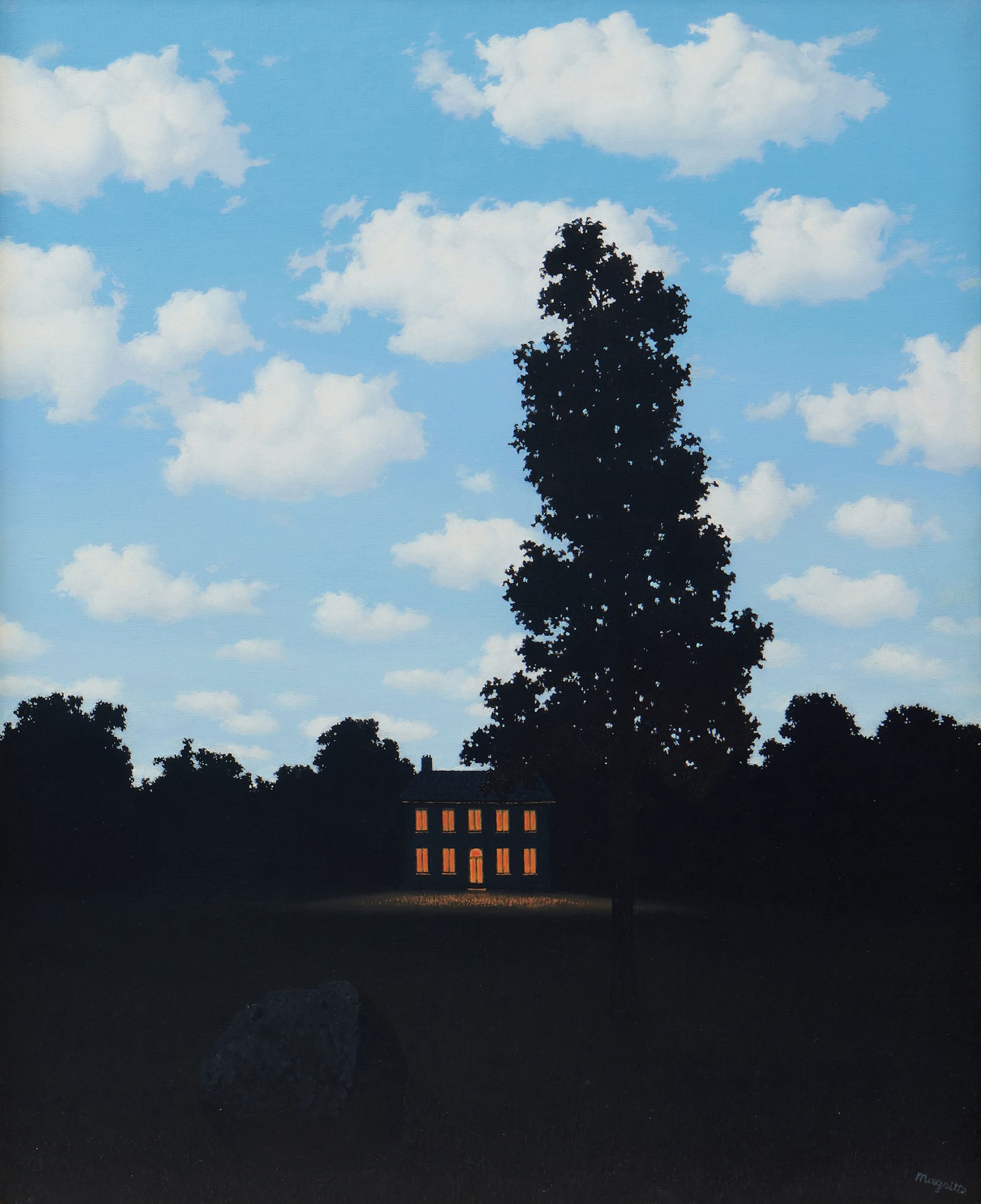

René Magritte, L’Empire des lumières, 1951 Courtesy Sotheby’s

“To weave a story in regards to the collections helps present collectors how particular these works are,” Kaplan says.“That’s why we love promoting collections, to have the ability to inform these thrilling tales our shoppers reply to so properly.” Final yr, Christie’s introduced in $1.6bn from two gross sales of Allen’s assortment.

Throughout Christie’s Twentieth-century night sale on 11 Might, Burning Fuel Station (1966-69) by Ed Ruscha from the Press assortment is estimated to promote for between $20m and $30m. It’s only the second portray from Ruscha’s Stations collection to seem at public sale, in response to Christie’s.

“For me, that’s the work that signifies the whole final industrial revolution and the entire Twentieth century,” says the artwork adviser Lisa Schiff, who based the New York-based agency SFA Artwork Advisory. “I hope any individual actually spectacular will get it, and I hope it goes excessive.”

Christie’s can be specializing in highlighting ladies artists and selling their markets, Kaplan says. Half of the heaps in its Twenty first-century public sale on 15 Might are by ladies.

Kaplan provides: “The market is mostly fairly conscious that works by feminine artists and artists of color have been undervalued. A variety of collectors are each that as a wise funding… and desirous to concentrate on a greater variety of artists and ensure their assortment is extra consultant.”

Monumental Basquiats

Christie’s Twenty first-century night sale is led by Jean-Michel Basquiat’s El Gran Espectaculo (The Nile) (1983), a large canvas that’s anticipated to fetch round $45m. It isn’t the one monumental Basquiat work up on the market this season. Three nights later, Sotheby’s New York is providing Now’s the Time (1985), Basquiat’s rendition of the jazz legend Charlie Parker’s 1945 report of the identical identify. Sotheby’s estimates the portray will promote for round $30m in its public sale debut, after spending a long time within the assortment of the journal writer Peter Brant, the one individual to have owned the portray. It’s amongst essentially the most precious works being supplied this month by Sotheby’s, which anticipates its Might gross sales figures will hit between $732.3m and $1bn.

Louise Bourgeois, Spider, 1996 Picture by Edouard Fraipont, courtesy Sotheby’s

Throughout the identical up to date artwork night sale, Sotheby’s is providing a ten-foot tall Spider (1996) by Louise Bourgeois that can doubtless break a minimum of one public sale report. Its estimate of between $30m and $40m is the very best ever for a Bourgeois work, Sotheby’s says. If it sells for the low finish of the estimate, it’s going to doubtless change into essentially the most precious Bourgeois work to promote at public sale, beating the $28m ($32.1m with charges) one other model ofSpider (1996) fetched at Christie’s in Might 2019. If the sculpture’s value rallies towards the excessive finish of its estimate, it stands to compete with the report for any work by a girl at public sale, presently held by Georgia O’Keeffe’s Jimson Weed (1936), which the Walmart heiress Alice Walton bought for $44.4m (with charges) in 2014.

Insel im Attersee (1901-02), a uncommon lake panorama by Gustav Klimt, is anticipated to fetch round $45m for Sotheby’s in the course of the public sale home’s fashionable artwork night public sale on 16 Might. One other high lot for the sale is Peter Paul Rubens’s Portrait of a Man because the God Mars (round 1620), estimated at between $20m and $30m. The portray comes from a gaggle of works caught up in an advanced divorce between the previous Metropolitan Museum of Artwork trustee Mark Fisch and the previous decide Rachel Davidson. Ten different Baroque work from their assortment—together with one other Rubens—introduced in a mixed $49.5m with charges at Sotheby’s earlier this yr.

Gustav Klimt, Insel im Attersee, 1901-02 Courtesy Sotheby’s

A devoted night public sale and a sequence throughout a up to date artwork day sale have been put aside by Sotheby’s for the gathering of the late Warner Bros music govt Mo Ostin, whose works by René Magritte, Cy Twombly, Willem de Kooning, Basquiat, Joan Mitchell, Cecily Brown, Takashi Murakami and Pablo Picasso are estimated to herald greater than $120m.

At Phillips, the public sale home’s sole night sale can be led by Banksy’s Banksquiat. Boy and Canine in Cease and Search (2018), a portray the pseudonymous British artist made in response to a 2017 Basquiat present in London. On a wall close to the Barbican Centre, the place the present was held, Banksy spray-painted a determine impressed by Basquiat’s portray Boy and Canine in a Johnnypump (1982) being frisked by two London law enforcement officials. This model on canvas, launched by Banksy the next yr, is estimated to promote for between $8m and $12m. The portray is essentially the most precious work on supply this month at Phillips, which expects to herald between $92.5m and $133m over a night and two day gross sales.

Throughout the identical night sale because the Banksy, two early Yayoi Kusama sculptures, Purple Stripes (1965) and Blue Spots (1965), are estimated to fetch between $2.5m and $3.5m every. Kusama is among the most globally beloved dwelling artists—and the topic of an ongoing collaboration with Louis Vuitton, the world’s largest luxurious model—however her early work remains to be “extraordinarily uncommon” at public sale, says Robert Manley, the deputy chairman of Phillips and its worldwide co-head of Twentieth-century and up to date artwork. It’s extraordinary for the public sale home to offer two at one time, he provides, mentioning that Kusama was proud sufficient of the 2 works to be photographed standing in entrance of the sculptures a number of occasions.

‘Her market couldn’t be stronger’

“It’s simply considered one of these great moments when artwork historical past and the artwork market are in alignment, as a result of her market couldn’t be stronger,” Manley says. Final yr, Phillips set Kusama’s public sale report when her portray Untitled (Nets) (1959) bought for $10.5m with charges.

Whereas the public sale homes are optimistic about this month’s gross sales, some collectors are exhibiting extra warning on the subject of shopping for artwork, sellers say. The newest Artwork Basel and UBS Artwork Market report, launched final month, discovered public sale gross sales fell final yr by 2% to $30.6bn (together with each private and non-private gross sales), largely due to low charges of participation in China after Covid-19 lockdowns stalled autumn gross sales. The excessive finish of the public sale market was essentially the most resilient, with works priced above $10m rising in worth by 12%—the one a part of the enterprise to extend final yr, in response to the report.

In occasions of financial uncertainty, rich collectors are inclined to concentrate on shopping for work by extra established artists whom they imagine pose much less of an funding danger than the fashionable up to date artists whose works have impressed speculative frenzies lately. Whereas public sale homes and sellers say they’ve noticed a way of slowness amongst collectors amid unsure market components, they don’t anticipate it disrupting Might auctions.

“Individuals have been fast to herald the influence of a recession and the thought of the artwork market failing,” says Lucius Elliott, who leads Sotheby’s The Now sale, devoted to artwork created within the earlier twenty years. “Based mostly on the curiosity we’ve from third-party guarantors and preliminary curiosity already, it doesn’t really feel like a bearish market.” Even so, he provides, there was a “softening” in some sectors of the market.

In comparison with the last few years, Manley says, patrons are “being somewhat extra selective”. Because of this, the market could also be “somewhat bit much less frothy”.

[ad_2]

Source link