[ad_1]

Definition

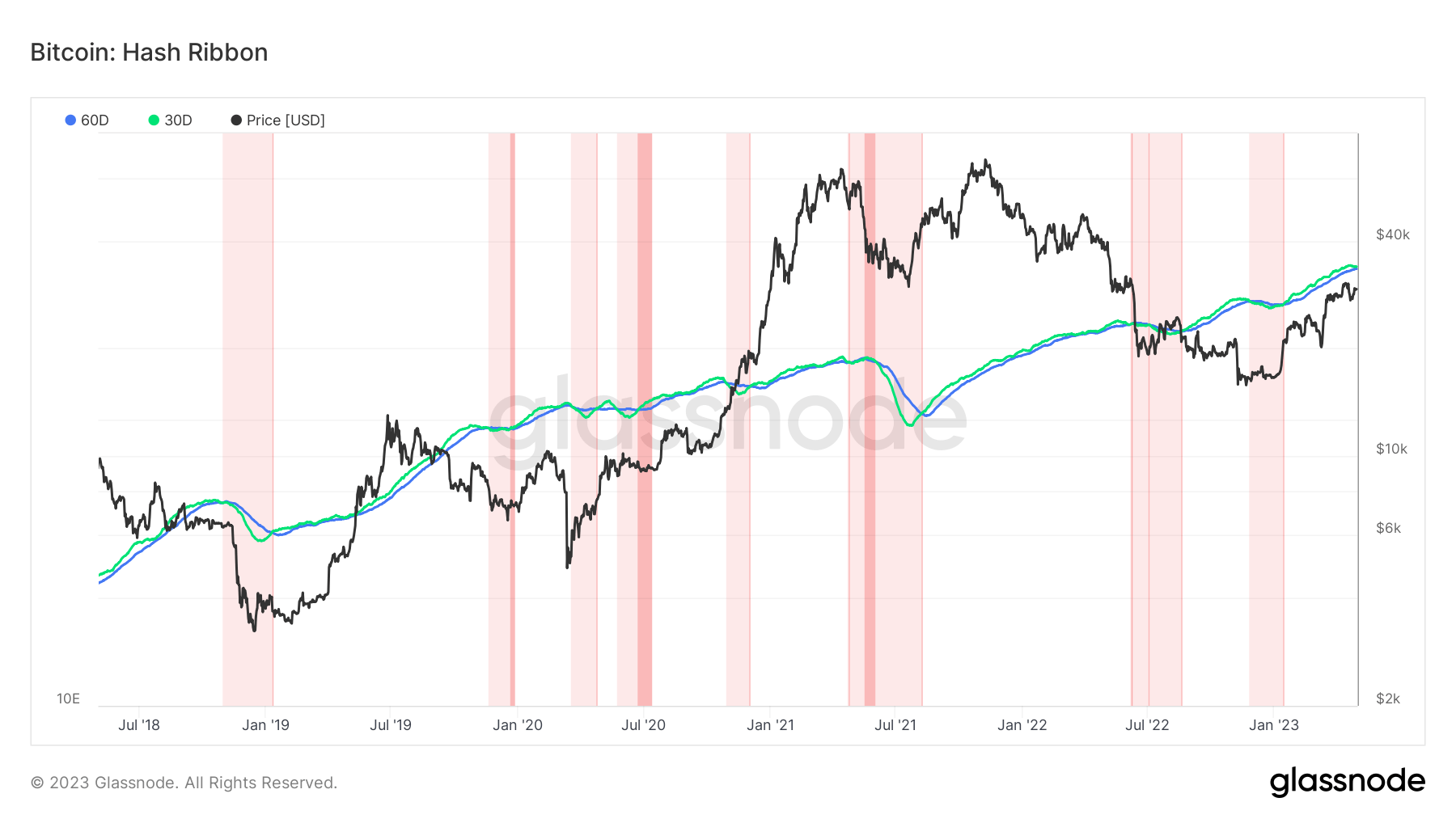

The Hash Ribbon is a market indicator that assumes that Bitcoin tends to achieve a backside when miners capitulate, i.e., when Bitcoin turns into too costly to mine relative to the price of mining.

The Hash Ribbon signifies that the worst of the miner capitulation is over when the 30d MA of the hash fee crosses above the 60d MA (swap from gentle purple to darkish purple areas).

Instances when this happens, and the worth momentum switches from detrimental to constructive, have proven to be good shopping for alternatives (swap from darkish purple to white).

Fast Take

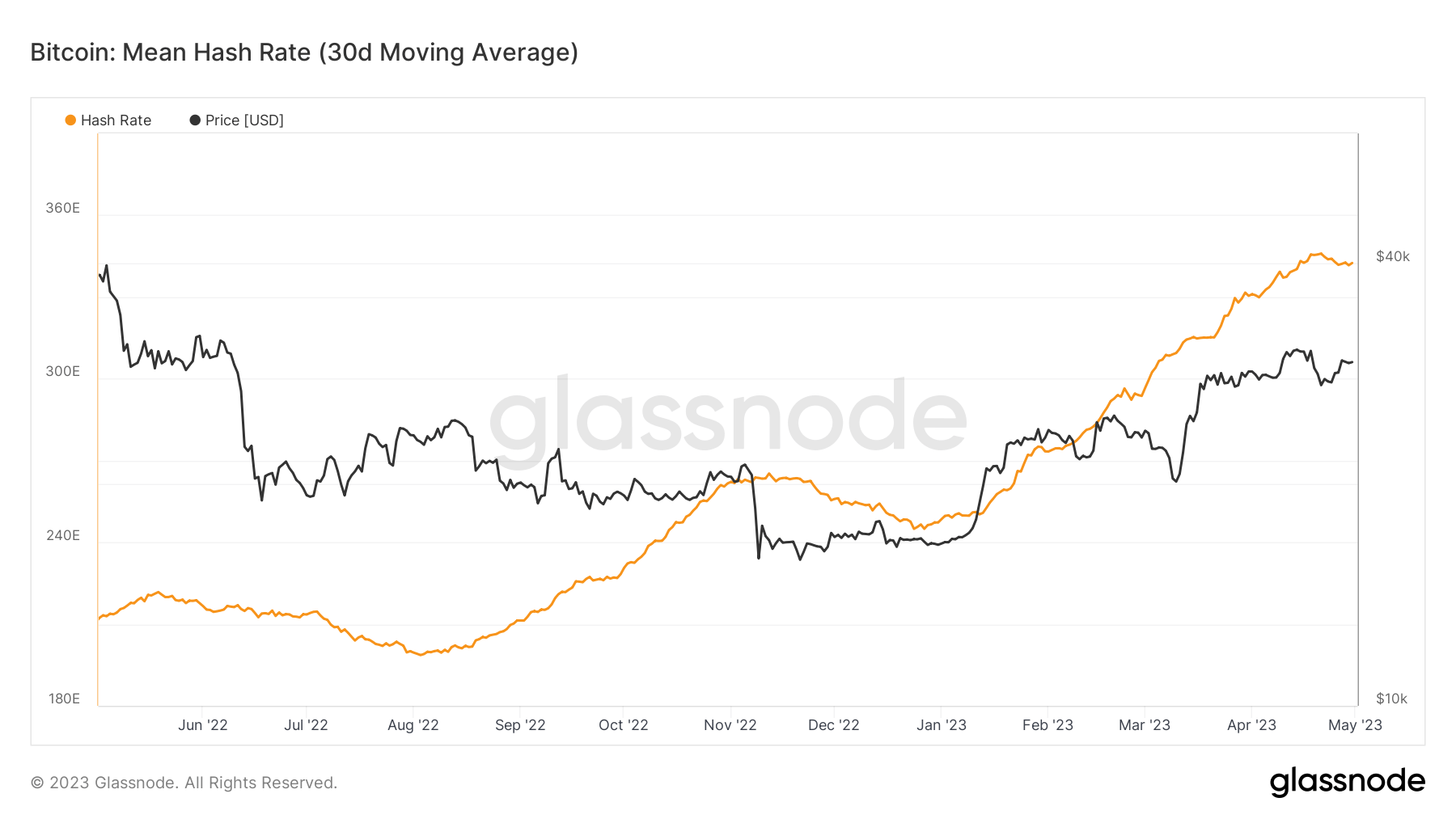

Final week, CryptoSlate analyzed the state of the mining business and believed miners have been in a a lot stronger place than final 12 months.

That’s actually the case, however in keeping with the hash ribbon metric, the 30-day and 60-day transferring averages are about to converge.

Traditionally, this has negatively impacted the worth of Bitcoin as a result of miners should promote their cash to cowl operational prices.

Whereas Bitcoin is taken into account low-cost, mining operational prices akin to power are excessive, so miners might want to offload their saved cash, which will increase liquidity and may push costs down.

For the previous two summers, now we have seen some type of mining capitulation, Could 2021 noticed the China mining ban, and final summer time with the collapse of Terra Luna.

The submit Are we on the verge of one other Bitcoin miner capitulation? appeared first on CryptoSlate.

[ad_2]

Source link