[ad_1]

Apecoin (APE) finds itself in turbulent waters because the once-promising gaming token experiences a precipitous decline, marking a 30% drop within the final 30 days, regardless of the efforts of bullish buyers to shore up its worth,

APE has plummeted nicely beneath the $1.70 assist stage, elevating considerations of a possible free-fall that might see its worth revisit the abyss of $1. At the moment buying and selling at $1.41, based on CoinGecko, APE has confronted a 6% decline previously 24 hours and a 7.2% loss during the last seven days.

APE value motion at the moment. Supply: Coingecko

This pivot could also be contingent on Bitcoin’s efficiency, significantly its means to reclaim the value vary between $28,000 and $30,000 in the long run.

Challenges Forward: Bearish Momentum Grips Apecoin

With no swift change in sentiment, Apecoin holders would possibly discover themselves trapped in a downward spiral with no seen backside. The Relative Power Index (RSI), a key indicator of market momentum, not too long ago tried a reversal however was rapidly thwarted, driving the index again into the oversold zone. This retreat underscored the persistent promoting stress that has hindered APE’s makes an attempt at a value restoration.

Since April 2023, the market has been dominated by bears, as every try by consumers to ascertain a assist stage has been met with subsequent losses. The sustained downward stress has curtailed any bullish initiatives, leaving APE’s future unsure.

APEUSD buying and selling at $1.41 at the moment. Chart: TradingView.com

Whale Exercise Raises Questions Amid Bleak Outlook

Amid the prevailing bearish sentiment, a notable improvement has emerged within the Apecoin (APE) ecosystem. A report citing information from LookOnChain reveals substantial exercise from a big APE whale, Machi Large Brother, ranging from August.

The whale, making purchases totaling 1.51 million APE tokens, equal to a staggering $3.09 million, executed these transactions on Binance.

Machi Large Brother’s substantial investments would possibly point out confidence in Apecoin’s future prospects. Nevertheless, the bigger sentiment surrounding APE tells a unique story. As of August 17, prevailing sentiment stays bearish, with analysts projecting a possible decline in APE’s worth to $1.36 by September.

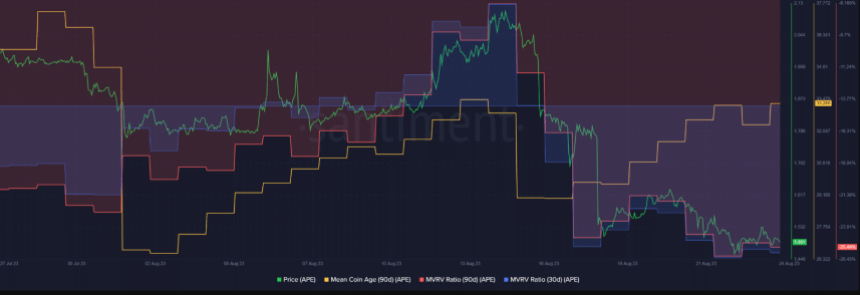

Apecoin MVRV down for the month. Supply: Santiment

In the meantime, Santiment’s information revealed an attention-grabbing statistic. Apecoin buyers have suffered important losses, with the Market Worth to Realized Worth (MVRV) ratio falling by -15.90% and -25.49% for month-to-month and quarterly holders, respectively.

Apecoin finds itself at a important juncture, grappling with intense bearish pressures which have led to a big erosion of its worth. As market sentiment stays unsure, all eyes are on each Bitcoin’s efficiency and APE’s means to shake off the shackles of bear dominance and regain its foothold within the unstable cryptocurrency panorama.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. If you make investments, your capital is topic to danger).

Featured picture from UnSplash

[ad_2]

Source link