[ad_1]

Primarily based on a latest report by Bloomberg analyst Jamie Coutts, asset managers’ curiosity in Bitcoin stretches past exchange-traded funds (ETF) into the mining sector. Particularly, Coutts speaks about BlackRock, describing the asset supervisor’s utility with the US Securities and Alternate Fee (SEC) to supply a Bitcoin spot ETF as “unsurprising.”

The analyst acknowledged that BlackRock and different outstanding international asset managers, particularly Vanguard and State Avenue, have been concerned within the Bitcoin mining business for over three years.

In hindsight, #BlackRock’s large #Bitcoin spot ETF play should not have been that stunning. Together with different behemoths (Vanguard, StateStreet) who espouse #ESG-driven investing rules, they began scooping up public mining inventory again in 2020

ESG, Institutionalization🧵 pic.twitter.com/VcKX8TrgZ2

— Jamie Coutts CMT (@Jamie1Coutts) September 26, 2023

BlackRock And Different ESG-Pushed Corporations Investing In Bitcoin Mining, Analyst Says

James Coutts acknowledged that BlackRock started its enterprise into Bitcoin mining in 2020 by investing in Marathon Digital, the second-largest publicly traded mining firm.

Notably, this growth occurred when the Bitcoin mining business confronted excessive criticism, probably because of the substantial reliance on fossil fuels.

During the last three years, Coutts reviews that BlackRock, Vanguard, and State Avenue have elevated their respective investments in Bitcoin mining corporations, whatever the market cycle.

Apparently, all three asset managers are recognized to advertise Environmental, Social, and Governance (ESG) funding rules, a part of which is limiting fossil gasoline use. Nevertheless, it seems that investing in Bitcoin mining might not injury the ESG credentials of those corporations.

Based on a report by Daniel Batten, co-founder of CH4 Capital, James Coutt notes that Bitcoin mining at present derives 50% of its power from sustainable sources. And this share is prone to enhance as Bitcoin mining has the distinctive skill to monetize stranded power and stabilize power grids.

Potential Impact Of Bitcoin Mining Institutionalization

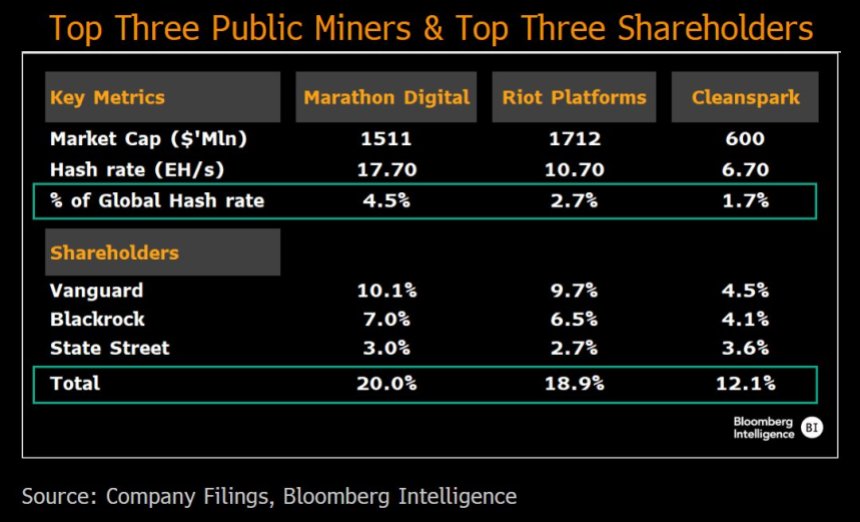

Primarily based on James Coutts’s report, BlackRock and the 2 different asset managers within the dialogue are at present the highest buyers within the three largest publicly traded mining corporations, particularly Marathon Digital, Riot Platforms, and Cleanspark.

Collectively, these mining corporations collectively personal 8.9% of the worldwide hash charge, which is critical as public miners solely account for 15% of the worldwide hash energy.

Supply: Bloomberg Intelligence

Supply: Bloomberg Intelligence

For now, James Coutts believes that the involvement of those asset managers in Bitcoin mining poses little problem to the community’s decentralization.

Nevertheless, the analyst notes that there could also be a future conflict of community and ESG values, particularly given the activist tendencies of BlackRock, Vanguard, and State Avenue.

Nevertheless, this could not forestall the Bitcoin community from working as anticipated. However it could lead different miners whose operations nonetheless depend on fossil fuels to begin processing “censored transactions.”

On the time of writing, Bitcoin trades at $26,198.48, with a 0.57% acquire within the final month, in response to information from Tradingview.

BTC buying and selling at $26,198.48 on the hourly chart | Supply: BTCUSDT chart on Tradingview.com

Featured picture from The New Yorker, chart from Tradingview

[ad_2]

Source link