[ad_1]

The crypto market has been on a rollercoaster this 12 months, with costs fluctuating wildly and regulatory pressures inflicting important drops. Nevertheless, current developments have given buyers renewed confidence available in the market, resulting in a complete crypto market cap restoration.

On June fifteenth, the overall crypto market cap hit a low level of $972 billion, following the Securities and Alternate Fee’s (SEC) regulatory strain on the business. However since then, the market has rebounded.

This restoration has been pushed partly by the doorway of main monetary gamers into the crypto area. A number of functions for a Bitcoin Spot Alternate-Traded Fund (ETF) by main monetary gamers resembling Blackrock and Constancy have been filed, indicating that they’re eager about betting on cryptocurrencies.

This has helped to rebuild investor confidence available in the market, resulting in elevated investments and an increase within the whole crypto market cap.

Crypto Market Cap’s Second Of Fact

Cryptocurrency buyers are carefully monitoring the overall crypto market cap because it makes an attempt to interrupt by way of a major resistance degree. In accordance to crypto analyst Rekt Capital, if the market can efficiently breach this degree, it may pave the best way for continued upward momentum and probably important positive aspects for the general market.

On the time of writing, the overall crypto market cap is round $1.17 trillion, with Bitcoin making up the lion’s share of this worth. Nevertheless, the market has been buying and selling in a comparatively tight vary over the previous few weeks, with many buyers in search of a catalyst to drive costs increased.

Rekt Capital believes {that a} breakout above the present resistance degree might be simply the catalyst that the market must see a sustained uptrend. Rekt Capital means that the market may see positive aspects of between 10% and 23% over time if this breakout happens.

As depicted within the chart, the instant resistance ranges for the worldwide market cap of the cryptocurrency business are presently at $1.18 and $1.25. The latter represents the best degree achieved in 2023.

Nevertheless, sure circumstances have to be met for the market to interrupt by way of these ranges. Firstly, there must be an enchancment in present market circumstances, together with a leisure of crypto rules by regulators globally, notably within the US. Moreover, there must be a decision of the continued Bitcoin Spot ETF functions by main monetary gamers with the SEC.

If these circumstances are met, it may result in an inflow of monetary gamers and buyers into cryptocurrency. Many buyers wish to cryptocurrencies as a hedge towards inflation, and higher regulatory readability and the approval of a Bitcoin ETF may make the business extra engaging to conventional buyers.

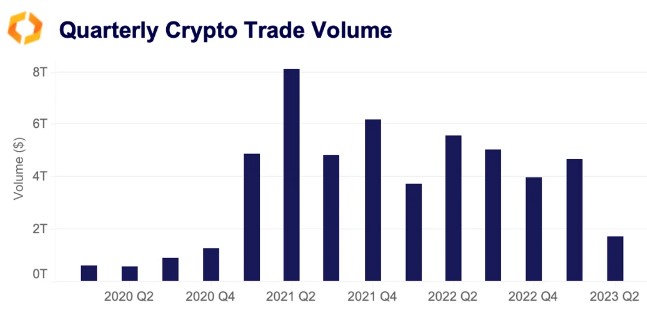

Cryptocurrency Buying and selling Quantity Drops To 2020 Ranges

Crypto buying and selling volumes have reached their lowest ranges since 2020, regardless of the continued rally in June. In accordance to a report by crypto market information supplier Kaiko, spot commerce volumes have considerably declined in Q2, with Binance registering the strongest drop in buying and selling exercise.

Binance, one of many world’s largest crypto exchanges, noticed volumes fall by practically 70% after the change reintroduced charges for its most liquid Bitcoin pairs. This transfer, geared toward lowering market manipulation, seems to have considerably impacted buying and selling exercise on the platform.

Nevertheless, Binance was not the one change to see a major decline in buying and selling volumes. Different widespread exchanges, together with Coinbase, Kraken, OKX, and Huobi, additionally noticed volumes decline by over 50% in Q2.

The decline in buying and selling volumes is stunning, given the current rally within the crypto market. Bitcoin, the most important cryptocurrency by market cap, has been bullish in June, reaching a excessive of over $31,000. Regardless of this, buying and selling volumes have remained subdued, suggesting that buyers usually are not as energetic available in the market as they’ve been.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Source link