[ad_1]

Fast Take

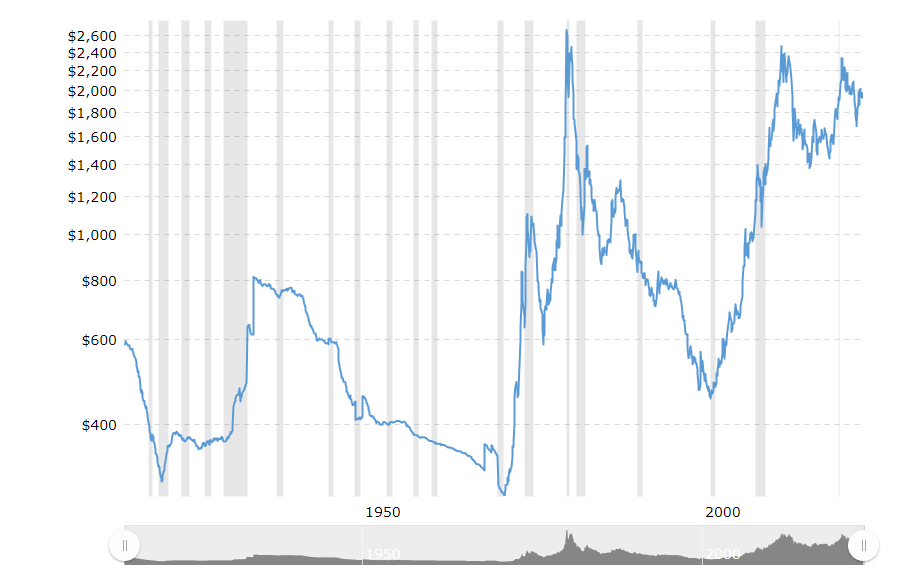

An examination of the true, inflation-adjusted gold costs since 1915, utilizing the headline Shopper Worth Index (CPI), reveals a hanging sample of peaks and troughs. Notably noteworthy is the height in January 1980, when an oz of gold reached $2,675, its highest ever in inflation-adjusted phrases.

Since then, regardless of two subsequent peaks in August 2011 and August 2020, at $2,472 and $2,327 respectively, gold has not but reclaimed its inflation-adjusted excessive from 1980. This information suggests a major resistance degree for actual gold costs, indicative of underlying financial elements and market sentiment that stop a return to the 1980 excessive.

As gold is commonly seen as a hedge in opposition to inflation, this pattern may additionally make clear totally different intervals of financial stability and inflationary pressures.

The publish Evaluation of inflation-adjusted tendencies reveals gold unable to interrupt 1980 excessive appeared first on CryptoSlate.

[ad_2]

Source link