[ad_1]

Uniswap, the main decentralized trade (DEX) primarily based on complete worth locked (TVL), continues to set itself aside in a extremely aggressive market by way of relentless innovation.

With a formidable $3.9 billion locked on the protocol, its most up-to-date development, the v4 improve, marks a decided step in the direction of offering real-time utility for its customers.

This improve builds upon the successes of its v3 improve, which launched concentrated liquidity to boost capital effectivity for liquidity suppliers.

The Uniswap v4 improve introduces new options and enhancements to the protocol which might be exactly designed to fulfill the evolving wants of customers and the broader DeFi sector.

On this article, we discover the important thing components of the Uniswap v4 improve and the way it cements Uniswap’s place as a pioneer within the DEX world.

What’s Uniswap v4?

Uniswap v4 is the most recent iteration of the Uniswap protocol. It introduces new and improved options that outperform earlier iterations and enhance the person expertise for builders, liquidity suppliers, and finish customers.

These enhancements not solely profit Uniswap customers but in addition contribute to the general development and improvement of the DeFi ecosystem by setting new effectivity and person expertise requirements.

The Uniswap workforce introduced the Uniswap v4 improve on June 13, 2023.

Improved Options in Uniswap v4

Uniswap Model 4 (v4) is a big improve from its earlier variations, particularly in the way it manages liquidity swimming pools. Not like Uniswap v3, which had a one-size-fits-all strategy, Uniswap v4 lets liquidity suppliers tailor their methods to suit their wants. This improve brings in a number of new options that make the entire system work higher and supply a smoother expertise in comparison with v3.

Let’s take a better have a look at the important thing adjustments within the Uniswap v4 improve that make it higher than v3.

Hooks

Uniswap v3 built-in an on-chain oracle mechanism to acquire real-time asset knowledge, enriching the Uniswap expertise. Nevertheless, this led to elevated prices for customers, and liquidity suppliers (LPs) had much less participatory affect.

However Uniswap v4 introduces an idea referred to as “hooks.” These hooks function specialised instruments that empower LPs to regulate commerce dynamics. With hooks, LPs can affect components corresponding to price assortment timing and commerce mechanisms.

To raised perceive hooks, consider them as a algorithm governing pre- and post-trade actions that give LPs the liberty to customise their operations. These guidelines enable for the modification of parameters corresponding to price allocation, price assortment timing, commerce velocity, and extra.

Along with enabling builders to create AMM DEXs platforms, hooks additionally enhance person interactions. Notably, Uniswap v4 permits using tokens from a selected pool to pay fuel charges, which was not attainable in earlier iterations. This twin profit diversifies transaction administration methodologies whereas optimizing prices.

The scope of prospects afforded by hooks inside Uniswap v4 is expansive and is topic to the ingenuity of builders. Nevertheless, basic hook operation ideas are ingrained inside the good contract structure.

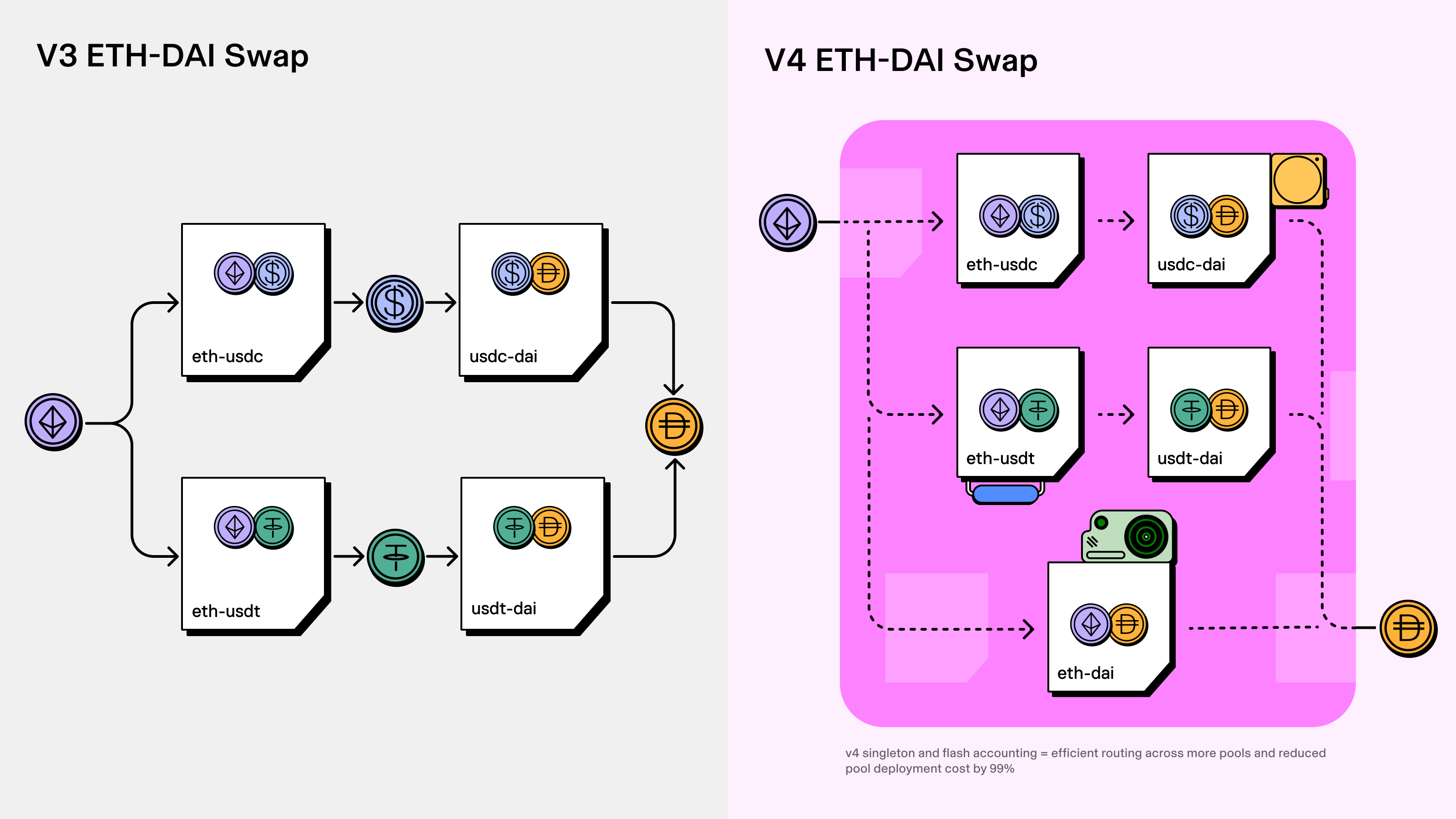

Singleton

Uniswap v4 introduces the “singleton” function the place a single good contract oversees all swimming pools within the protocol. This presents an enchancment over the v3 mannequin, the place every pool deployed on the protocol had its personal distinctive good contract.

The singleton contract in Uniswap v4 permits for cheaper multi-pool swaps in comparison with Uniswap v3, the place swimming pools function independently with separate guidelines.

By consolidating pool administration into one contract, inter-pool swaps are eradicated, lowering fuel charges for pool creation by as much as 99%.

For context, contemplate a hypothetical state of affairs the place you wish to swap two tokens: ABC and USDC, and there are two obtainable buying and selling swimming pools on Uniswap v3: ABC/ETH and ETH/USDC. You’d have to work together with each swimming pools to attain this token swap.

The method includes two steps: first, you swap ABC for ETH, and then you definately swap ETH for USDC. This dual-step strategy will increase person charges as every pool fees its particular person price. Additionally, builders face increased bills because of the necessity of deploying separate contracts for every of those swimming pools.

In distinction, Uniswap v4 streamlines this course of by having a single contract that oversees all swimming pools collectively.

Then again, in Uniswap v4, there’s a single contract that manages all swimming pools as one entity. Consequently enabling a direct and cheaper swap from ABC to USDC in comparison with the Uniswap v3 mannequin.

Flash Accounting

Flash accounting is a function of Uniswap v4 that enhances the singleton contract. It improves the effectivity of asset swaps by eliminating the necessity to transfer belongings throughout swimming pools.

In Uniswap v3, belongings have been transferred between swimming pools on the finish of every swap. This course of concerned a number of asset actions, leading to increased prices and fuel consumption.

Uniswap v4’s flash accounting system takes a better strategy – it adjusts internet balances as an alternative of shifting belongings. Solely the distinction in asset portions between swimming pools is calculated, avoiding pointless transfers. This streamlined strategy reduces prices and enhances general effectivity.

Native ETH Help

Earlier Uniswap variations lacked direct ETH assist, utilizing wrapped ETH (WETH) for ETH-related swaps. Uniswap v4 now straight helps ETH, permitting customers to commerce ETH for tokens with out WETH. This enhances liquidity, improves ETH-based buying and selling, and aligns with Ethereum’s nature, simplifying DeFi participation.

Governance

Uniswap v4 is ruled by the Uniswap neighborhood, identical to Uniswap v3. By way of the UNI DAO, UNI token holders can take part in decision-making processes concerning protocol charges and different administration features.

Uniswap v4 makes use of a protocol price mechanism modelled after v3. The UNI DAO can vote to implement a protocol price for any pool inside sure predefined limits.

Uniswap v4 has two varieties of governance charges: swap and withdrawal. The utmost share of swap charges that may be charged for a pool could be set by governance.

If withdrawal charges are enabled, governance also can set the utmost share of these charges. Nevertheless, in contrast to in v3, price tiers and tick spacings aren’t below governance management in v4.

What Does the v4 Improve Imply for the Uniswap Protocol?

Uniswap v4 considerably improves the general expertise for builders, liquidity suppliers, and protocol customers. Listed below are a few of the enhancements:

Pool customization/Flexibility

Uniswap v4’s hook function gives a customizable expertise, combining a number of features in a pool. It permits varied choices, like executing giant orders utilizing a time-weighted common market maker, dynamic charges primarily based on volatility, setting on-chain restrict orders, and customizable on-chain oracles.

Hooks additionally management price settings for swapping and withdrawing liquidity in a pool. This flexibility lets builders customise the Uniswap protocol for his or her swimming pools or integrations.

All The Causes To Love The Uniswap V4

Architectural Enhancements

Uniswap v4 revamps the protocol’s structure, particularly in pool administration. Not like Uniswap v3, which used separate contracts for every pool, Uniswap v4 employs a single-contract technique for a number of swimming pools. This, together with flash accounting, enormously enhances commerce effectivity on the platform.

Transaction Price Discount

Uniswap v4 improve prioritizes decrease transaction charges. It employs native ETH, reducing prices by half for ETH to ERC-20 transactions. Pool consolidation and flash accounting additional cut back asset transfers, making a fairer, cost-effective Uniswap protocol.

Challenges of Uniswap v4

Whereas Uniswap v4 undoubtedly introduces a plethora of progressive options, it isn’t devoid of challenges:

Controversy with the v4 Code’s Format

Uniswap v4’s code adoption introduces a level of controversy by working below a Enterprise Supply License. This licensing mannequin doubtlessly limits innovation till a transition to a Common Function License happens. This transition, scheduled for 4 years from now, may influence the tempo of progressive use instances and options. Some builders have already expressed dissatisfaction with the present code format.

Elevated Protocol Vulnerability

Uniswap v4’s strategy of consolidating all swimming pools right into a single contract raises a crucial concern because of the vulnerability of good contracts, which has led to quite a few DeFi hacks even after audits. A single exploit on this contract may jeopardize the complete protocol’s security. The Uniswap workforce should proactively deal with this problem by establishing a robust and safe resolution to make sure the protection of all swimming pools.

In Conclusion,

Uniswap v4 introduces vital potential for DEX development with its outstanding options. Its optimization and user-centric design trace at gradual developments, shifting customers towards a seamless monetary ecosystem.

This progress will cut back friction, enhancing the decentralized market. If considerations are addressed, Uniswap’s future in pushing DEX know-how boundaries appears promising.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

[ad_2]

Source link