[ad_1]

DeFi lending protocol, Abracadabra Cash, is presently debating a proposal to spice up the rate of interest in its CRV lending markets because it seems to be to mitigate its publicity to the DeFi token.

In the previous few days, CRV has seen its worth decline considerably as a result of latest Curve Finance exploit on Sunday, which resulted in a complete lack of over $60 million. In accordance with information from CoinMarketCap, CRV is presently buying and selling at $0.56, with an 8.28% loss within the final 24 hours.

Abracadabra Uncovered To Important CRV Danger Ranges

In a governance proposal submitted on Aug 1, DAO contributor and neighborhood supervisor Romy highlighted that Abracadabra was presently uncovered to a considerable degree of CRV threat.

To deal with this case, the proposal accommodates a method that introduces collateral-based curiosity to each CRV cauldrons – lending markets – on Abracadabra.

Associated Studying: Ethereum DeFi Cash Plunge As Curve Considerations Threaten Main Market Crash

Romy said that Curve Finance, the underlying platform of CRV, has seen its TVL negatively affected during the last month by a number of occasions, together with the Conic Finance Hack, the JPEG’d exploit, and the assault on Curve itself.

Particularly, Romy famous that the theft of $25 million from Curve’s CRV/ETH pool had impacted the on-chain liquidity for CRV, altering the situations that led to the adoption of the token as a collateral asset on Abracadabra.

As well as, the proposal additionally famous that Abracadabra had recorded CRV outflows towards markets with decrease Mortgage-to-Worth (LTV) ratios and better rates of interest. Collectively, all these elements have affected CRV’s worth and liquidity, prompting the necessity for Abracadabra to scale back its publicity to the token.

CRV buying and selling at $0.558 on the every day chart: Supply: CRVUSD chart on Tradingview.com

Abracadabra’s Proposed Technique To Introduce 200% Curiosity Hike

As earlier said, Romy’s governance proposal goals to cowl Abracadabra CRV’s threat by making use of collateral-based curiosity to the 2 CRV lending markets on the platform. It was said that this technique had been beforehand applied with the WBTC and WETH cauldrons.

This introduction of collateral-based pursuits would permit Abracadabra to levy curiosity immediately on every CRV cauldron’s collateral which is immediately transferred to the protocol’s treasury and transformed to Abracardra’s native stablecoin MIM, both through on-chain or off-chain transactions.

Associated Studying: Is It A Good Thought To Purchase Curve Now? Right here’s What This Founder Thinks

Based mostly on projections, Romy said that this technique would permit Abracadabra to spice up its treasury reserve and lower potential losses resulting from CRV publicity to about $5M borrowed MIM.

Underneath the brand new proposed curiosity construction, the rates of interest shall be decided primarily based on two elements: the mixed excellent principal of the CRV cauldrons and the collateral ratio of every cauldron.

The bottom rate of interest will range relying on the overall borrowed quantity, categorized into three ranges: $0M-$5M, $5M-$10M, and $10M-$18M. As an example, as the present excellent principal stands at $18M, the bottom rate of interest can be set at 200%.

Utilizing this charge, it’s estimated that the mortgage can be utterly lined in six months’ time. Moreover, the collateral ratio would affect the curiosity multiplier, with ratios starting from <= 40% to <= 70% correlating to multipliers of 1x, 5x, 10x, and 25x, respectively.

In accordance with the proposal, this rate of interest construction ensures the utmost probabilities of “full principal restoration” for Abracadabra.

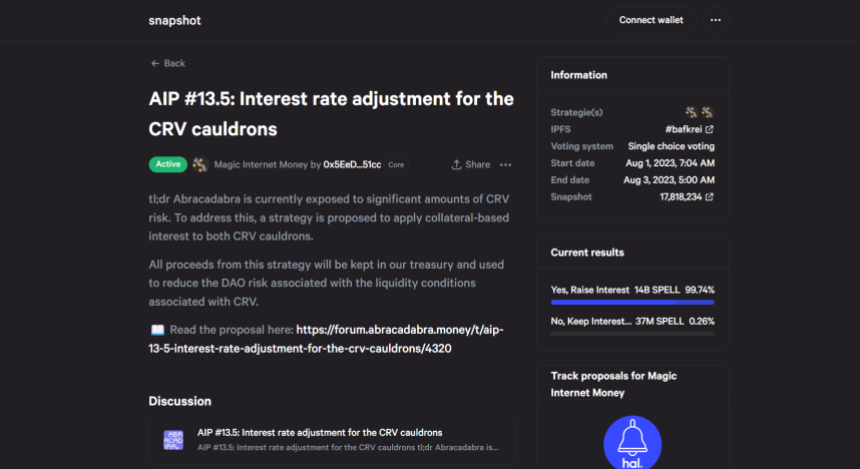

The voting session for this proposal commenced on Aug. 1. and can run for under 46 hours as a result of supposed urgency of the matter. As of the time of writing, 51 members of the Abracadabra DAO have positioned their votes, with 99.74% supporting the proposal.

Supply: Snapshot

Supply: Snapshot

Featured picture from Ceqoa, chart from Tradingview

[ad_2]

Source link

_id_b32fb481-53b2-43f3-b9be-7ec7ef356fd6_size900.jpg)