[ad_1]

Key Takeaways

Bitcoin led markets on a trip Wednesday, surging from $28K to $30K earlier than shedding 7% in an hour

Surge had come following optimism for liquidity injection from Fed, as banking points resurfaced at First Republic and shares cratered 50%

Markets are too skinny and inclined to those massive value swings, writes our Head of Analysis, Dan Ashmore

Highlights how harmful the sector could be within the brief time period, he says, warning lovers to watch out

I wrote a number of days in the past in regards to the state of crypto markets, warning that volatility was incoming following an unusually calm interval for digital property.

Final night time that volatility got here, and it got here exhausting. It doesn’t make me a genius, because the timing was nothing greater than blind luck, but it surely does reveal my level. The crypto markets are at present extremely delicate, much more so than standard, and that received’t change anytime quickly.

On Wednesday morning, Bitcoin jumped from $28,300 to shut to $30,000 within the house of a few hours. This got here as First Republic Financial institution introduced it had been topic to $100 billion of withdrawals final quarter, its share value tanking 50%.

Regardless of what lovers could argue, crypto didn’t rise as a result of the fiat world is collapsing, the banking sector going the best way of the T-Rex and the dodo chook. Some decried crypto as a retailer of worth exterior of the creaking system, scooping up panicking traders fleeing the fiat world.

Certain, in the long run, there might be dialogue available right here, however that’s for an additional day. As an alternative, it seems probably that cash surged in anticipation of extra liquidity injections from the Federal Reserve.

In different phrases, crypto did what it has been doing all 12 months: moved in response to expectations across the future path of financial coverage. A fast take a look at Bitcoin’s correlation with the Nasdaq exhibits this, now at a near-perfect 1 on a 90-day rolling foundation, ought to affirm this. Bitcoin, and crypto as a complete, continues to commerce like a extremely dangerous tech inventory.

However again to volatility. After the surge Wednesday morning, Bitcoin then plunged from $29,700 to $27,700, a 7% purple candle in a little bit over an hour. As of Thursday morning, it’s again at $29,000, because it reverberates in every single place, struggling to make up its thoughts.

Rumours swirled across the doable motion of Mt Gox cash, whereas some pointed to the obvious US authorities wallets changing into lively. I had a fast look into these and it’s in the end not possible to show the 2 developments are related. They might be, but it surely’s not clear that that is what brought on the sharp fall.

In actuality, that is precisely what I used to be pointing to earlier this week. Regardless of the purpose for the plunge, crypto markets are extremely skinny proper now and primed for violent strikes.

Capital has flooded out of the house over the past 12 months at a exceptional tempo. One good strategy to illustrate that is by trying on the stablecoin stability on exchanges (deep dive right here). Since December, over half the stablecoin stability on exchanges has evaporated, translating to $21.7 billion.

Whereas the horrors of the FTX collapse could also be banished to the again of traders’ minds, the impact on the crypto business stays actual. Alameda was a big market maker within the house, with that gap not stuffed since. Then there may be the psychological influence; crypto’s popularity has taken a ferocious blow, with establishments scaling again perceptibly from the house.

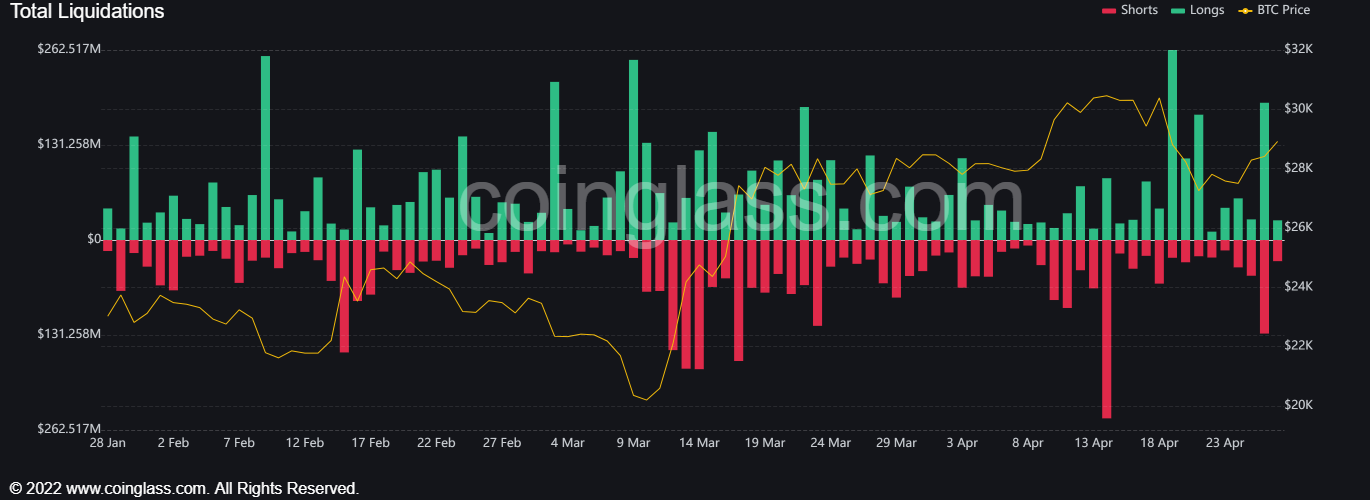

This has left liquidity low, and with low liquidity comes extra volatility. Strikes in both route are amplified, which is what we noticed yesterday. Taking a look at knowledge from Coinglass, liquidations swelled for each longs and shorts, $180 million for the previous and $130 million for the latter.

This volatility received’t go away anytime quickly. Crypto was at all times extra illiquid and liable to large strikes than most mainstream asset lessons, and this chasm has solely widened in latest months.

It’s a part of the rationale why crypto stays so harmful over a short-term time horizon. Get caught on the fallacious facet of certainly one of these strikes, and your funding can evaporate straight away.

Oftentimes, there is no such thing as a rhyme or purpose, with the markets extremely capricious. However with liquidity skinny, it solely wants a small spark after which liquations can cascade, sentiment can shift within the blink of an eye fixed and costs can go wild.

Watch out.

[ad_2]

Source link