[ad_1]

A diversified portfolio with gold and Bitcoin is smart as Bitcoin’s buying and selling quantity rises

Gold’s stability offsets Bitcoin’s volatility

This manner, traders might take part in Bitcoin’s upside potential with out compromising on danger parameters

Portfolio administration offers with managing danger. All danger can’t be averted, and a risk-averse investor wouldn’t wish to take no danger.

As a substitute, a risk-averse investor would really like larger risk-adjusted returns. Naturally, the upper the potential return, the upper the danger.

Traders construct portfolios of various belongings to search out the absolute best risk-adjusted returns. Ideally, the belongings have a damaging correlation, thus bringing diversification advantages to the investor.

Nevertheless it additionally is smart to construct a portfolio with correlated belongings. Whereas the portfolio is riskier, another asset properties might attraction to traders prepared to take a much bigger danger.

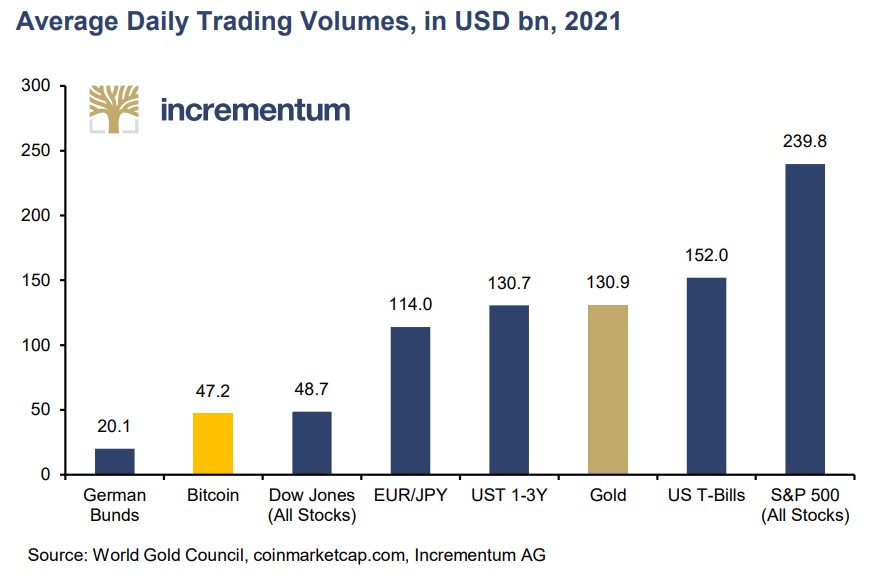

As Bitcoin’s common each day buying and selling quantity rises, such a diversified portfolio might comprise gold and Bitcoin.

Why so as to add gold and Bitcoin to a portfolio?

Diversified portfolios unfold the danger throughout uncorrelated belongings. A portfolio supervisor’s problem is discovering that diversification stage past which diversification brings no advantages anymore.

Historically, gold’s function in a portfolio is to convey stability. By including Bitcoin to a portfolio, one might take part within the cryptocurrency’s upside potential and, on the identical time, mitigate the danger related to Bitcoin’s volatility by combining it with gold.

[ad_2]

Source link