[ad_1]

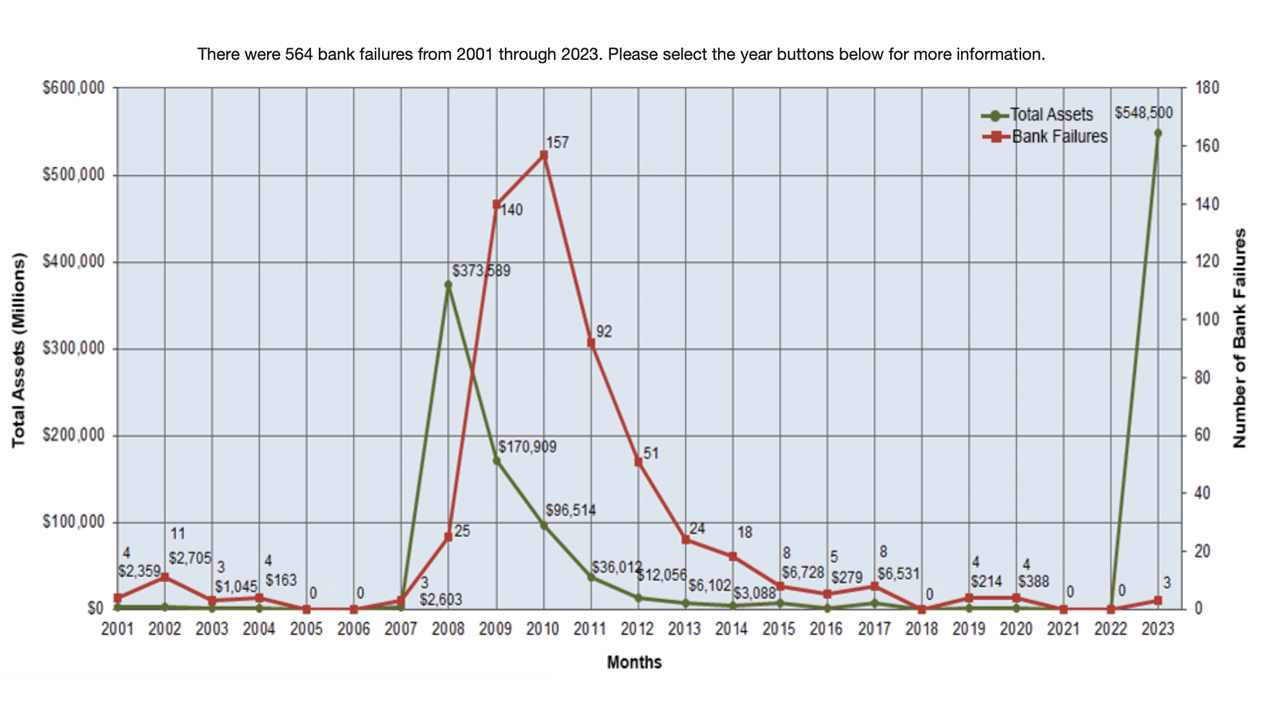

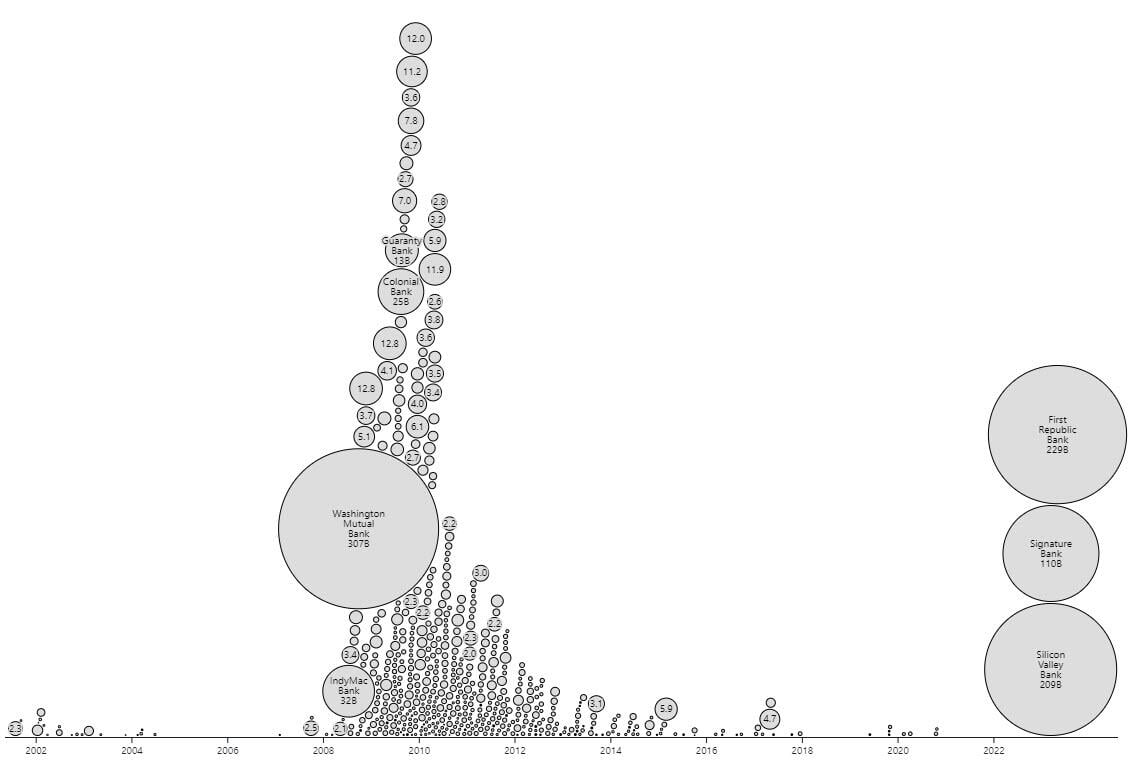

2023 has been a rollercoaster journey for the U.S. banking trade. The collapse of three main banks has despatched shockwaves by means of the monetary world, with their mixed property surpassing the highest 25 banks that crumbled in 2008. The next is a better have a look at what has triggered a ‘nice consolidation’ within the banking sector, a recurring theme within the trade’s historical past over the previous century.

A Listicle of Financial institution Consolidation, Failures, and Points Dealing with the U.S. Banking Sector

The U.S. banking trade has taken a beating in 2023, with the market capitalizations of dozens of banks throughout the nation dropping significantly in current months. The explanations for this battle are diversified, with some blaming poor selections by monetary establishments and others pointing fingers on the U.S. central financial institution. Whereas it’s essential to think about totally different opinions, a complete listicle of data can make clear the nation’s ‘nice consolidation’ within the banking sector and the most important financial institution failures in the US. So, let’s take a better have a look at these developments and what they imply for the nation’s banking trade.

Within the yr 1920, historic information reveals that the US boasted a grand complete of roughly 31,000 banks. Nevertheless, by the yr 1929, this quantity had dwindled right down to lower than 26,000. Since that point, the variety of banks has skilled a precipitous decline, plummeting by a staggering 84%. Consequently, fewer than 4,160 banks stay in operation right now.

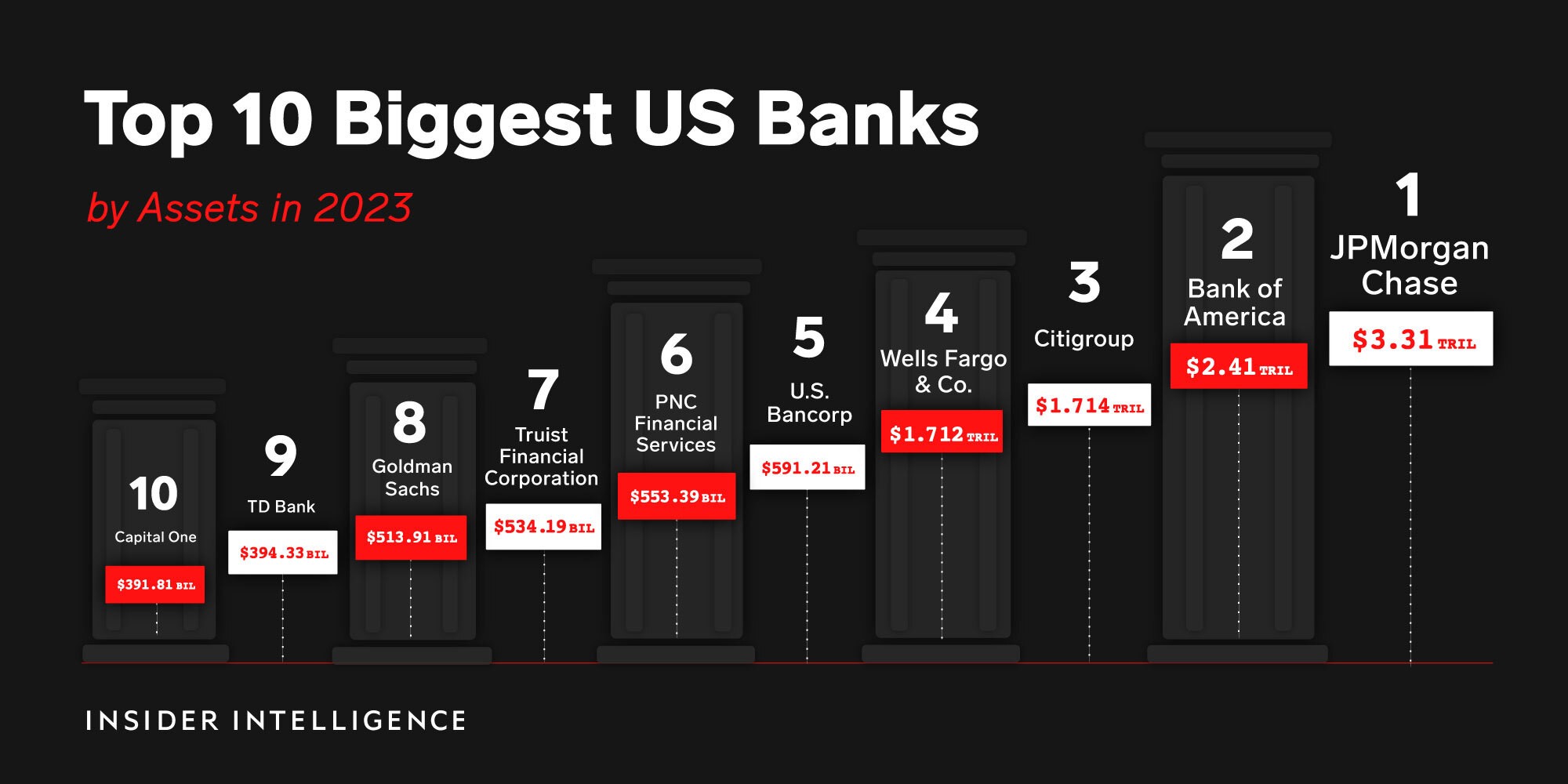

Out of the 4,150 U.S. banks, the highest ten maintain greater than 54% of FDIC-insured deposits. The 4 largest banks within the nation have amassed a whopping $211.5 billion in unrealized losses, with Financial institution of America bearing the brunt of a 3rd of that quantity.

The Federal Deposit Insurance coverage Company (FDIC) supplied JPMorgan Chase a $50 billion credit score line and famous it misplaced $13 billion from the First Republic Financial institution fallout. The FDIC estimated the price of Signature Financial institution’s failure to its Deposit Insurance coverage Fund to be round $2.5 billion and the Silicon Valley Financial institution collapse value the FDIC $20 billion, bringing the entire to $35.5 billion.

Along with the current First Republic Financial institution collapse, Pacwest Bancorp’s shares have been sinking steeply. Over the previous six months, Pacwest has misplaced 73% of its market capitalization worth. Presently, Pacwest is weighing strategic choices and a doable sale, in response to folks aware of the matter.

Western Alliance Bancorp can be scuffling with shares down 57% decrease over the last six months. Whereas a number of of the failed banks noticed vital withdrawals like First Republic’s $100 billion outflow in March, Western Alliance claims it has not seen any uncommon deposit outflows.

Sources and statistics present that U.S. banks that present mortgages misplaced a mean of $301 for each mortgage that originated in 2022, down 87.13% from the $2,339 revenue per mortgage in 2021.

Within the second quarter of 2021, banks acquired a report quantity of presidency debt by acquiring $150 billion price of 10-year Treasury notes. Nevertheless, because of the Fed’s ten consecutive charge hikes, 10-year and 2-year treasury bonds within the U.S. are presently inverted. This implies the banks with extreme reliance on long run bonds are struggling as a result of the yields on the 2-year Treasury be aware are literally increased than the 10-year Treasury.

On Could 3, 2023, the U.S. Federal Reserve raised the benchmark financial institution charge and it’s now at a 16-year excessive.

In March, the 4 largest U.S. banks by property held, JPMorgan Chase, Financial institution of America, Citigroup, and Wells Fargo collectively misplaced $52 billion of market worth.

What do you concentrate on the problems U.S. banks face in 2023? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link