[ad_1]

Understanding the intricacies of Bitcoin balances on crypto exchanges is an integral a part of analyzing the market. These balances, marked by inflows and outflows, barometer the market’s well being, sentiment, and potential future actions. As these balances shift, they paint an image of investor conduct, confidence, and technique. Equally, quantity modifications provide insights into the market’s liquidity and buying and selling exercise.

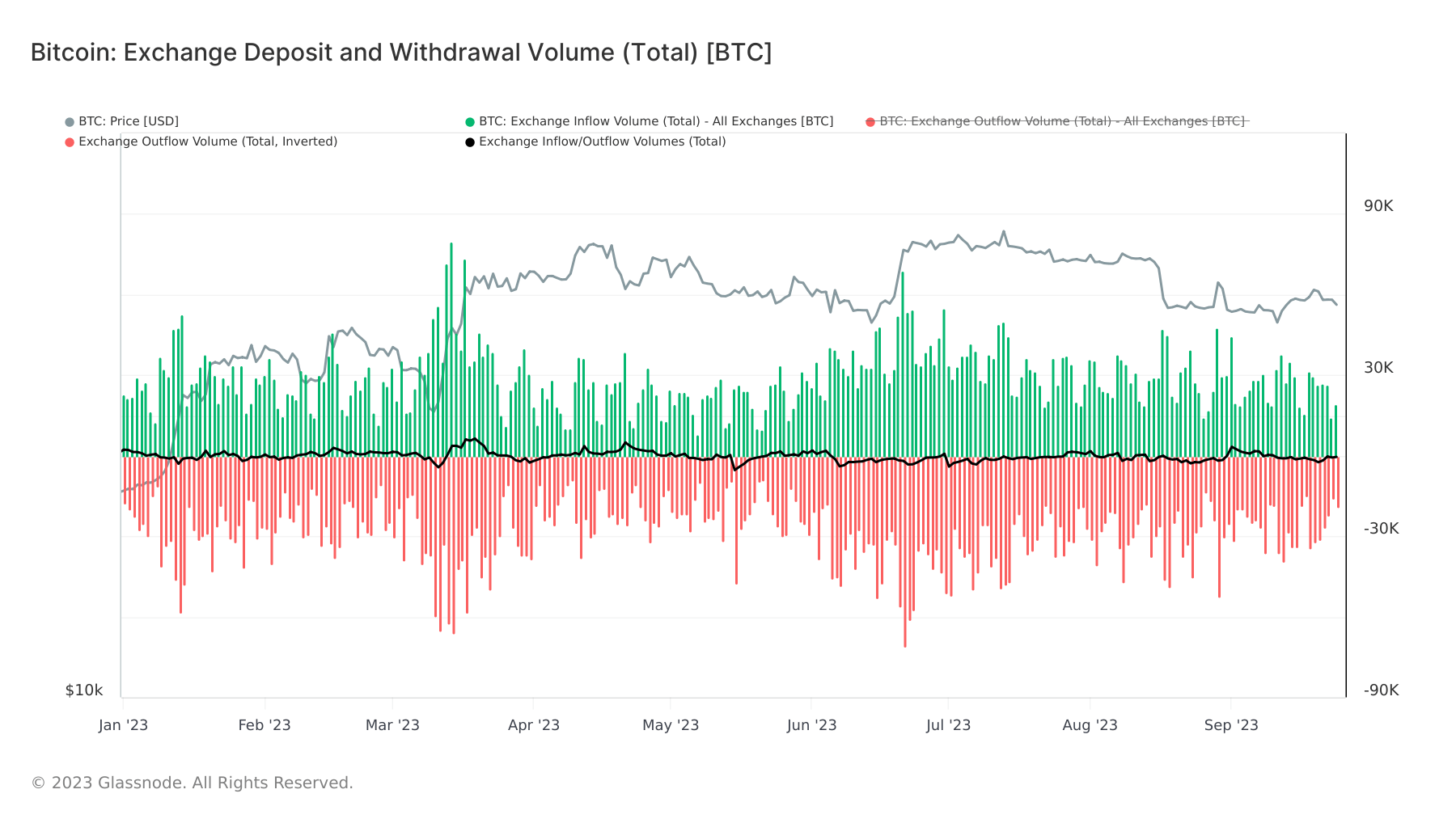

Analyzing September’s alternate deposit and withdrawal volumes reveals a constant sample of Bitcoin withdrawals surpassing deposits. This isn’t a fleeting pattern both—because the starting of 2023, withdrawals have been outpacing deposits, suggesting a broader market narrative.

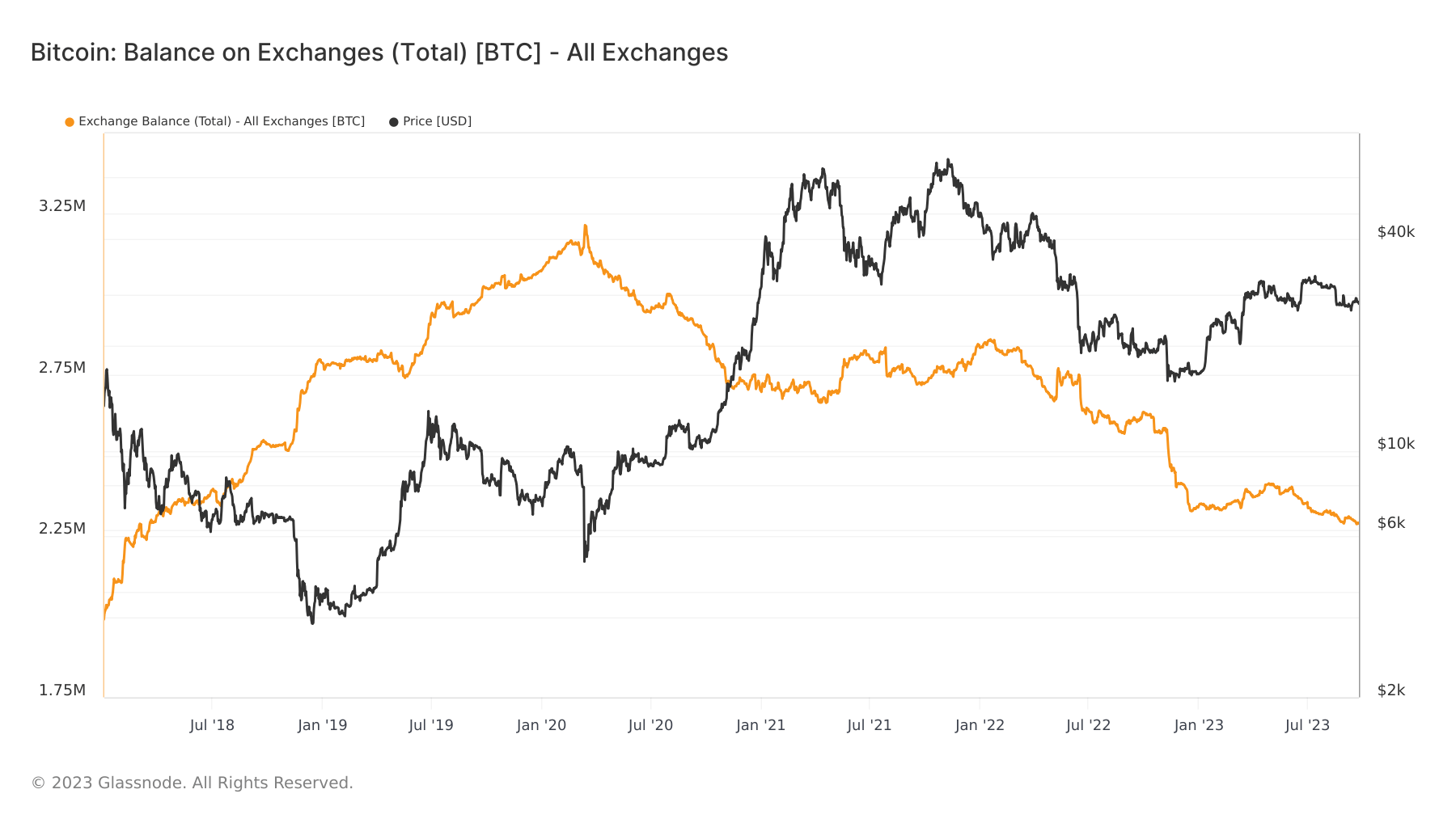

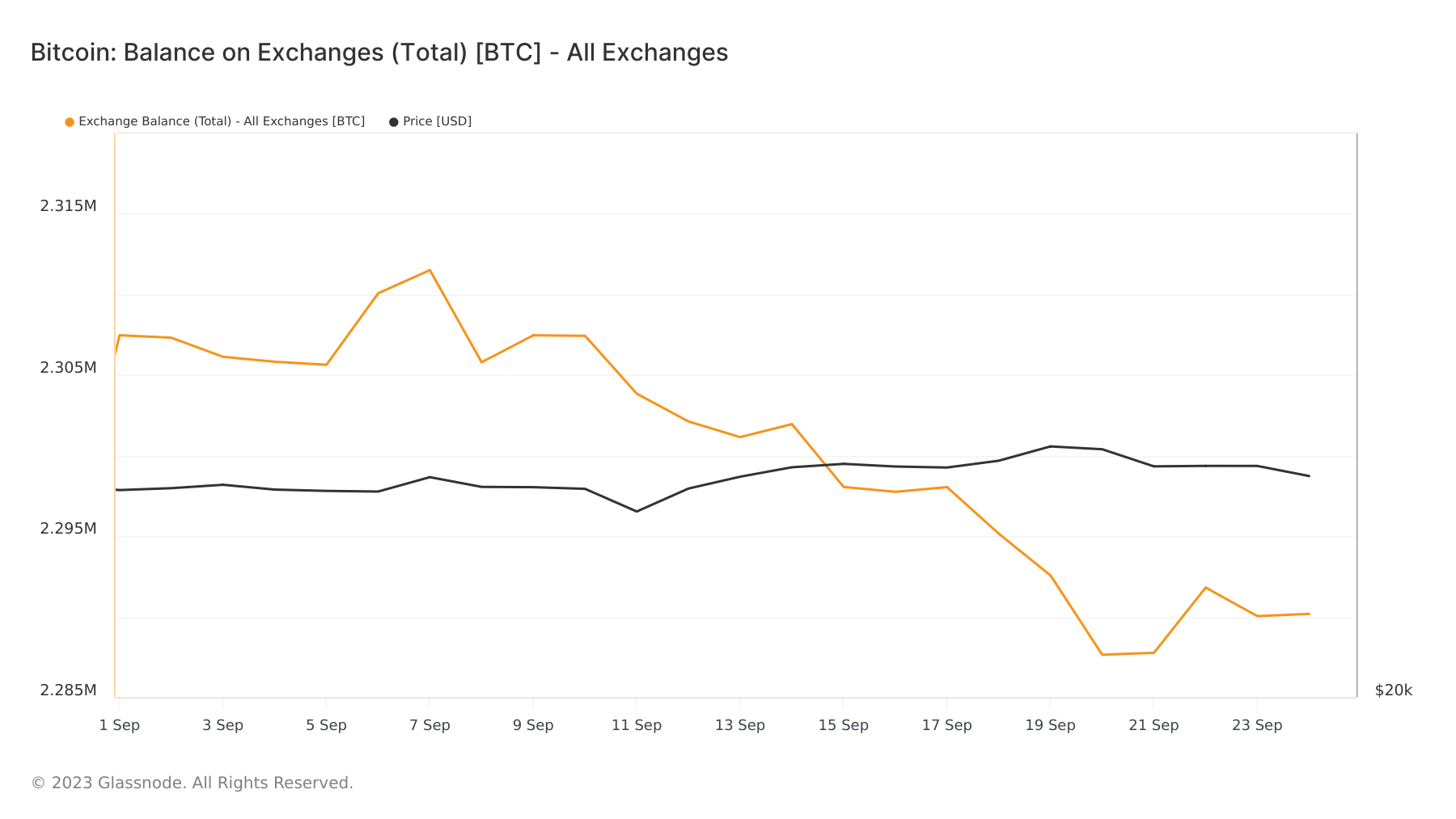

The regularly reducing Bitcoin stability on exchanges additional confirms this pattern. Change balances peaked in March 2020 at 3.21 million BTC. Nevertheless, the next months and years have seen this quantity lower drastically, standing at 2.29 million BTC on Sept. 25, 2023. Regardless of intermittent intervals of optimistic alternate inflows, the overarching pattern has been a lower.

Because the begin of September alone, exchanges have seen a discount of over 17,000 BTC of their Bitcoin balances.

The dominance of withdrawals over deposits may signify a market pivot in the direction of a long-term holding technique, occurring attributable to both an anticipatory technique for future positive aspects or as a protecting measure towards market volatility.

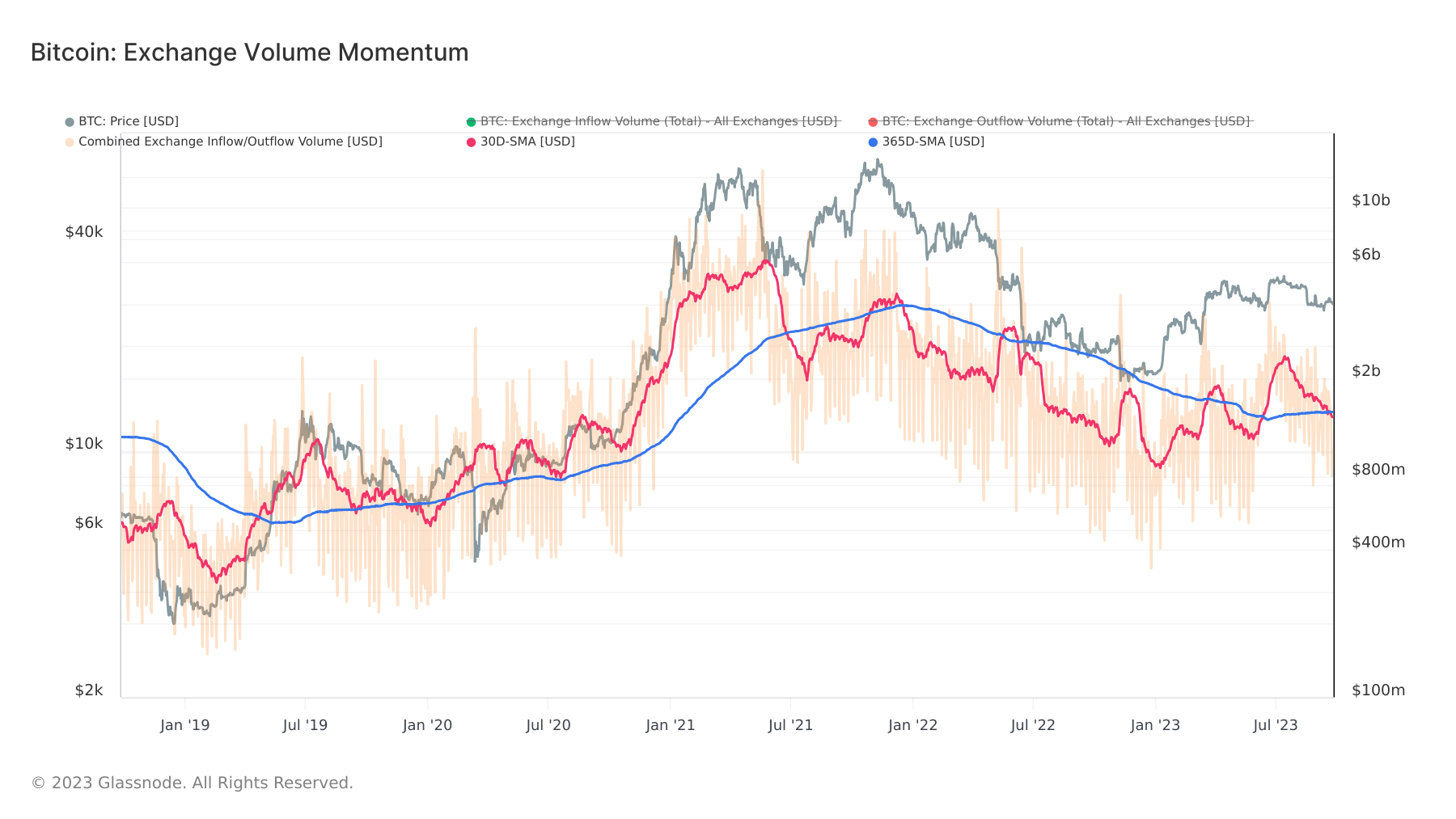

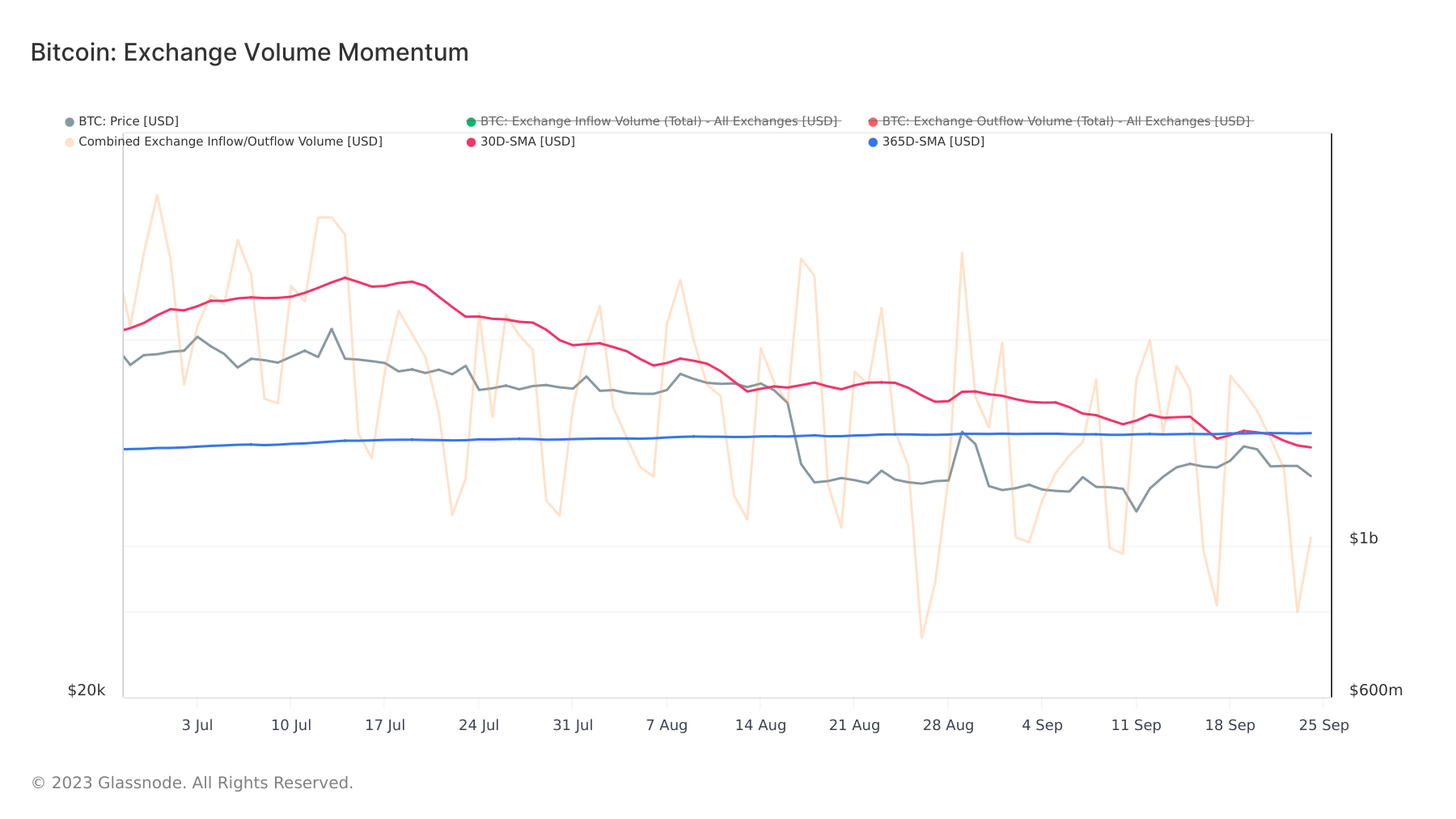

The alternate quantity momentum additional confirms this pattern. This metric, which juxtaposes the month-to-month common of mixed inflows and outflows towards the yearly common, is a dependable indicator of investor curiosity in Bitcoin. A month-to-month common surpassing the annual common sometimes indicators an uptick in exchange-related on-chain exercise, typically accompanying worth surges.

Conversely, when the month-to-month common lags behind the yearly common, it suggests a contraction in exchange-related on-chain exercise. This contraction is symptomatic of waning curiosity within the asset and a decline in buying and selling volumes. In line with Glassnode, the month-to-month common has been downward since July, culminating in falling under the yearly common on Sep. 21. This decline correlated with Bitcoin’s worth dip from $27,225 to $26,220.

The dominance of withdrawals and the declining alternate quantity momentum level to a market that’s changing into extra conservative. Traders appear to be shifting from a buying and selling mindset to a holding one, presumably anticipating future positive aspects or just hedging towards uncertainty. The current dip in Bitcoin’s worth, coupled with the drop within the month-to-month common, highlights the potential affect these metrics can have on market actions.

The publish A cautious Bitcoin market is shifting from buying and selling to holding appeared first on CryptoSlate.

[ad_2]

Source link