[ad_1]

The looming prospect of a U.S. Division of Justice (DOJ) motion towards Binance, the most important crypto change, might maintain a silver lining for Bitcoin and the broader markets. Even when this sounds loopy at first, there are good arguments for it.

Rumors have been swirling for weeks a few potential DOJ motion towards Binance, a menace that has solid a protracted shadow over the markets, resulting in elevated volatility and uncertainty amongst traders. Yesterday’s report by Semafor has rekindled the rumor, but in addition gave it a brand new perspective, hinting that these developments could also be a blessing in disguise for Bitcoin and crypto markets.

In accordance with the Semafor report, the DOJ is considering fraud fees towards Binance however can also be weighing the potential repercussions to customers and the crypto market at giant. Citing sources aware of the matter, the report means that federal prosecutors are involved that an indictment might set off a “financial institution run” just like the calamitous destiny that befell the now-bankrupt FTX platform.

This concern arises from the priority {that a} potential indictment might result in a speedy withdrawal of funds, inflicting customers to lose their cash and probably set off a wider panic within the Bitcoin and crypto markets. To avoid such a disaster, the prosecutors are exploring different choices like levying fines or establishing deferred or non-prosecution agreements.

What Does This Imply For Bitcoin And Crypto Markets?

Curiously, some crypto market analysts and commentators view this ongoing saga as a possible boon. Macro analyst Alex Kruger, in a current Twitter put up, speculated, “Too Massive to Jail? Name me loopy however this appears bullish if true.” This assertion captures the sentiment that if Binance is taken into account too necessary to be hit with crippling fees, the DOJ might discover much less dangerous alternate options.

The same view is held by famend analyst Pentoshi, who mentioned, “It doesn’t imply they received’t drop the hammer both. I believe calling it “bullish” is a bit excessive since they’re contemplating dropping the hammer. And if not billions in fines and CZ seemingly gone. However I def don’t assume it’d as bearish as headlines first mentioned in any respect. Bullish could be no DoJ involvement.”

The prospect of the DOJ performing towards Binance might additionally present a much-needed readability to the market. If Binance have been certainly susceptible to a financial institution run, it could rapidly grow to be obvious whether or not the change holds ample reserves.

Nevertheless, to this point, Binance has impressively weathered earlier “stress checks”, as highlighted by CEO “CZ” in a Twitter put up in mid-December final yr after the Mazars audit rumors, stating, “We noticed some withdrawals as we speak (web $1.14b ish). We now have seen this earlier than. Some days we have now web withdrawals; some days we have now web deposits. Enterprise as common for us.”

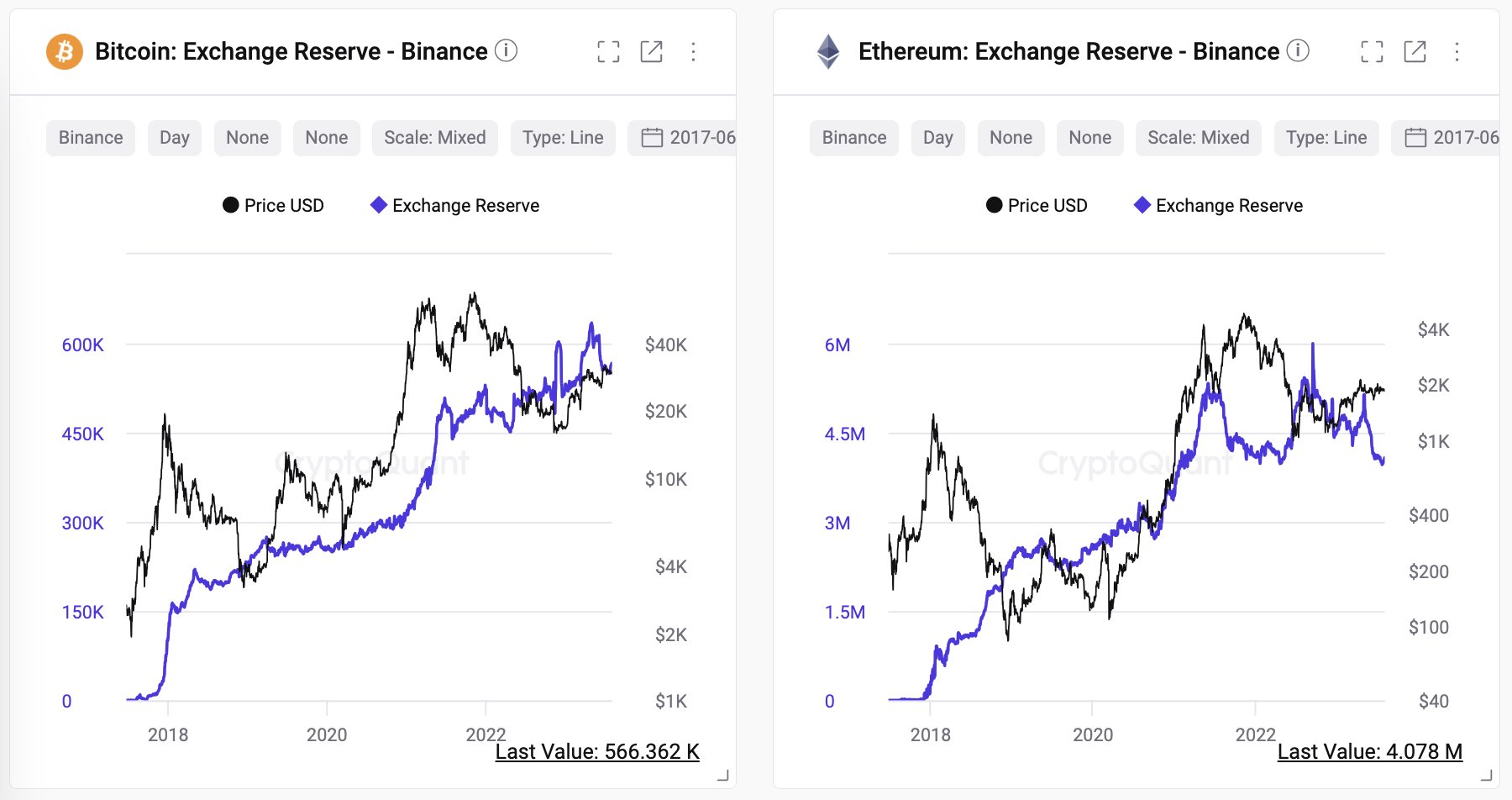

This sentiment is echoed by CryptoQuant CEO Ki Younger-Ju who shared knowledge supporting the power of Binance’s consumer balances regardless of fixed rumors of insolvency. He said:

I’ve heard in regards to the ‘financial institution run/insolvency danger on Binance’ 100 instances for years, however their consumer balances all the time inform a distinct story.

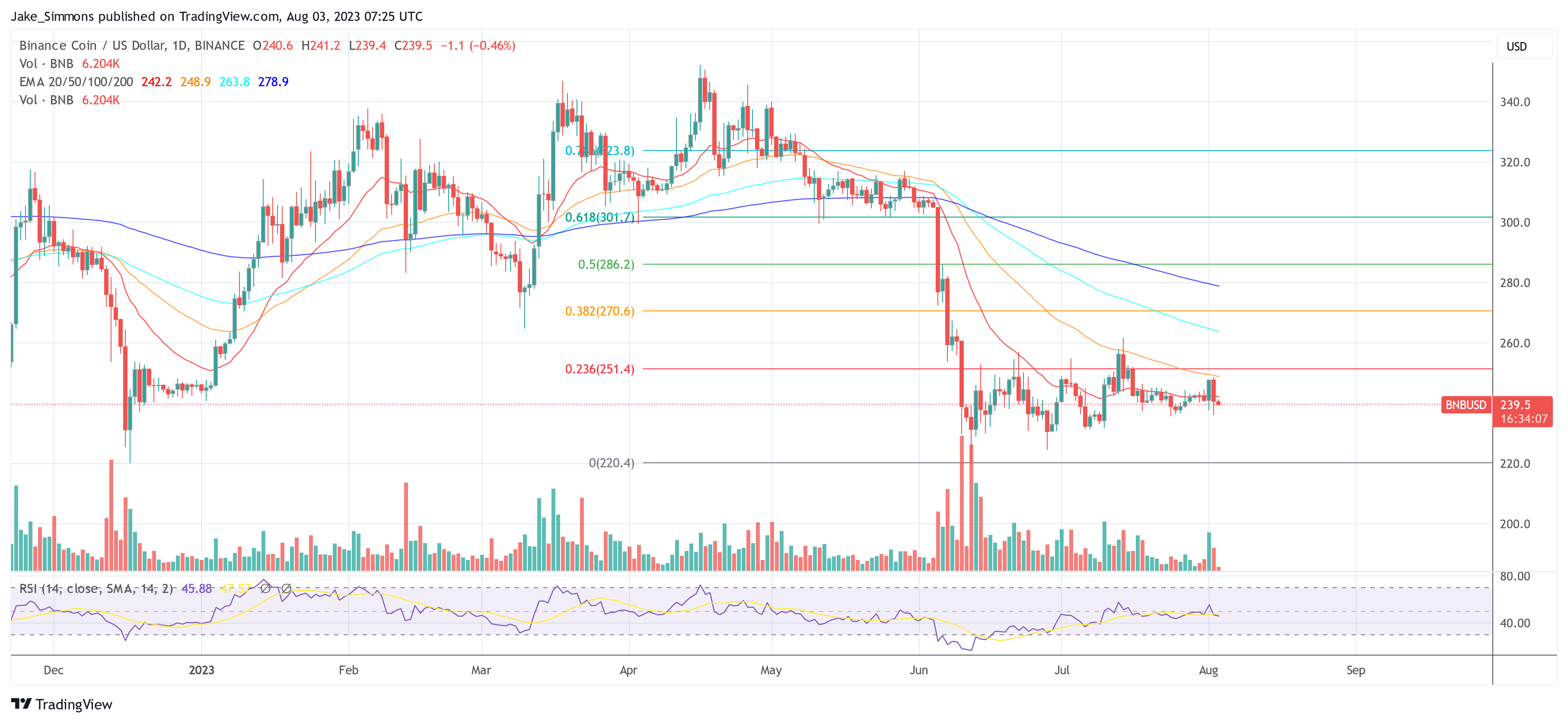

At press time, the BNB worth stood at $239.5.

Featured picture from CCN, chart from TradingView.com

[ad_2]

Source link