[ad_1]

In an atmosphere of hovering rates of interest and financial unpredictability, Bitcoin and the broader crypto market face elevated headwinds. The shift within the monetary panorama was lately underscored by the Benchmark 10-year US Treasury yield, which hit a 16-year excessive this Thursday.

Longest Yield Curve Inversion Ever

Traditionally, an inverted yield curve, the place short-term yields are increased than long-term ones, has been a harbinger of financial downturns. Notably, the 10-Yr minus the 3-Month Treasury Yield curve has been inverted for a report 217 buying and selling days. Previous knowledge signifies that the longer the delay between the inversion and the beginning of a recession, the extra extreme the recession is more likely to be.

Joe Consorti, Market Analyst at The Bitcoin Layer, underscored this concern, remarking on Twitter: “The yield curve is re-steepening at breakneck velocity. Up by 10 bps or extra as we speak throughout the curve. Are you aware what occurs when the yield curve steepens, each single time? Trace: not financial growth.”

The Fed’s latest indicators and coverage stance have taken the monetary world by storm. Charlie Bilello, Chief Market Strategist at Inventive Planning, famous, “The ten-Yr Treasury Yield moved as much as 4.49% as we speak, highest since October 2007. The Actual 10-Yr Yield (adjusted for anticipated inflation) of two.11% is now on the highest stage since March 2009.” Bilello additionally identified the numerous discount within the Fed’s stability sheet, which is at present “over 10% beneath its April 2022 peak.”

The 2 largest drawdowns over the past 20 years had been between December 2008 and February 2009 with 18.2% (stability sheet hit a brand new excessive in Jan 2010), and from January 2015 to August 2019 with -16.7% (stability sheet hit a brand new excessive in March 2020).

The rise within the 10-Yr Treasury Yield was reiterated by the analysts from “The Kobeissi Letter,” who said: “BREAKING: 10-Yr Word Yield formally hits our 4.50% goal… The ten-Yr Word Yield is up an unbelievable 20 foundation factors in lower than 24 hours… With provide facet inflation uncontrolled and oil costs again to $90+, the Fed has no selection. Greater for longer is again.”

The Federal Reserve’s Stand

Throughout Wednesday’s FOMC assembly, the US central financial institution and chairman Jerome Powell have made clear its intentions, signaling the potential for a further charge hike this yr and forecasting fewer cuts subsequent yr. It now forecasts half a proportion level of charge cuts in 2024. Prior, the dot plot confirmed lower charges by a full proportion level subsequent yr.

This “increased for longer” technique appears to diverge from the market’s prior expectations, regardless of three months of seemingly constructive inflation knowledge. Furthermore, Powell conveyed confidence within the US. economic system, emphasizing the necessity to guarantee rates of interest are adjusted appropriately to attain the central financial institution’s 2% inflation goal.

Nonetheless, the market stays unsure, with the CME Group’s FedWatch Instrument indicating solely a 32% likelihood of one other charge hike in November and a forty five% probability by December.

Implications For Bitcoin And Crypto

Danger property, together with Bitcoin and different cryptocurrencies, have traditionally been delicate to will increase within the 10-Yr Treasury Yield. Charles Edwards, founding father of Capriole Investments, highlighted the challenges for the Bitcoin and crypto sector:

The Fed needs extra unemployment. The job market continues to be too sturdy. They’ve raised the anticipated 2024 charges in consequence and the 10YR has damaged out to new decade highs. So long as the 10YR is breaking upwards like this, threat property are going to see additional headwinds.

Traditionally, rising yields are indicative of an expectation of upper rates of interest, which enhance the price of borrowing. This situation typically results in a discount in speculative investments, with buyers favoring extra secure, yield-bearing property over riskier choices similar to Bitcoin and crypto.

One other downside for the market is the “increased for longer” strategy and the large discount of the Fed’s stability sheet. Danger property like Bitcoin are historically a “sponge” for top liquidity, however when this dries up within the monetary market, they often endure probably the most.

As well as, considerations a few doable recession will proceed to rise as a result of inverted yield curve. Remarkably, Bitcoin and crypto have by no means traded in a recession, the response is unsure.

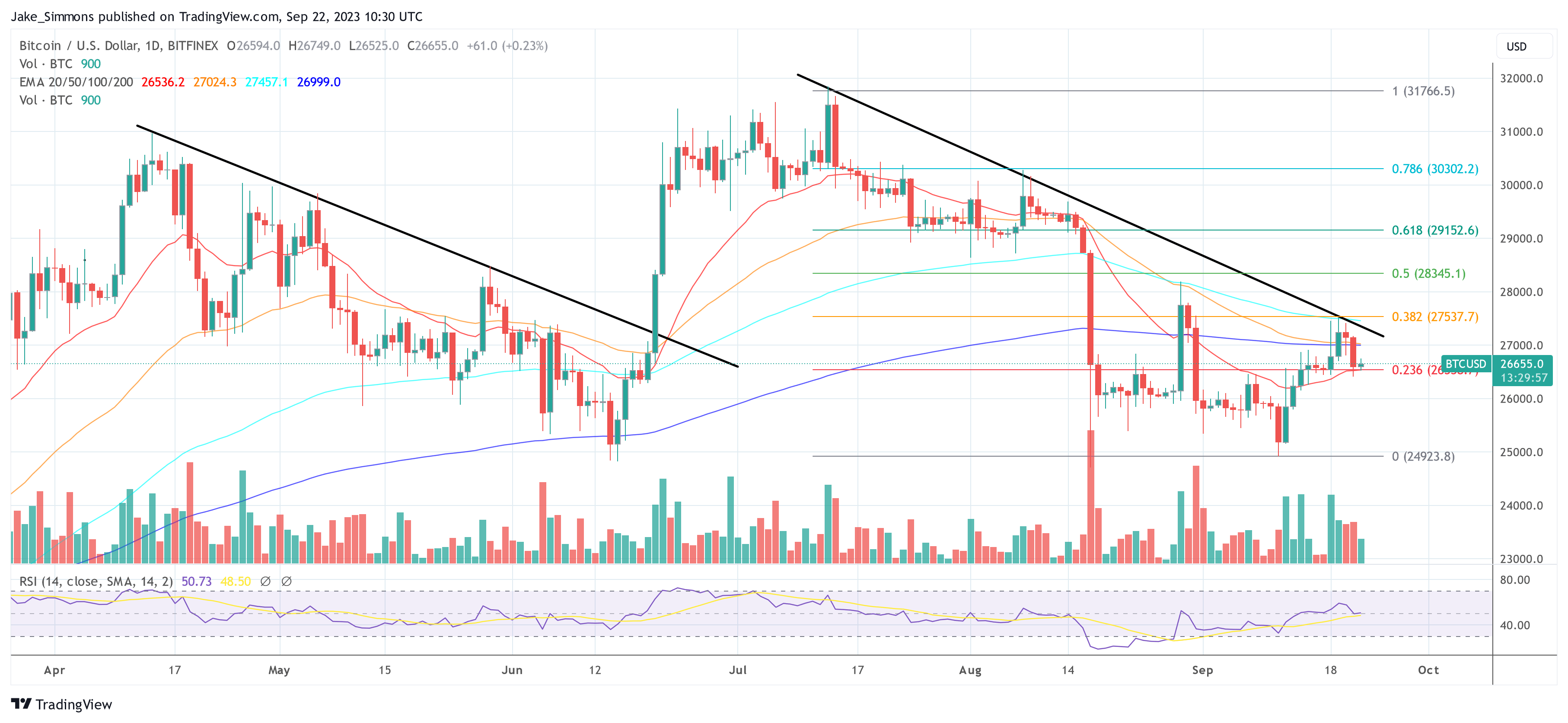

At press time, Bitcoin traded at $26,655.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link