[ad_1]

Knowledge exhibits the Bitcoin correlation with the US greenback index and inventory market indexes like S&P 500 and Nasdaq 100 have dropped low lately.

Bitcoin Is Displaying Little Correlation To Any Index Proper Now

In a brand new submit on X, the market intelligence platform IntoTheBlock famous how the correlation of BTC with conventional property has dropped to low values lately.

The related metric right here is the “correlation coefficient,” which retains monitor of the linear dependence between the costs or values of any two given commodities or property.

When the worth of this metric is above zero, it signifies that the property in query are shifting in the identical path proper now. The nearer the indicator’s worth is to 1, the stronger this correlation is, and the extra placing the resemblance between the 2 value traits.

Alternatively, the unfavourable indicator implies that there could also be a correlation between the commodities, but it surely’s a unfavourable one. Because of this if one asset goes up, the opposite will react by shifting down. As soon as once more, the nearer to -1 is the coefficient, the extra tied the property are.

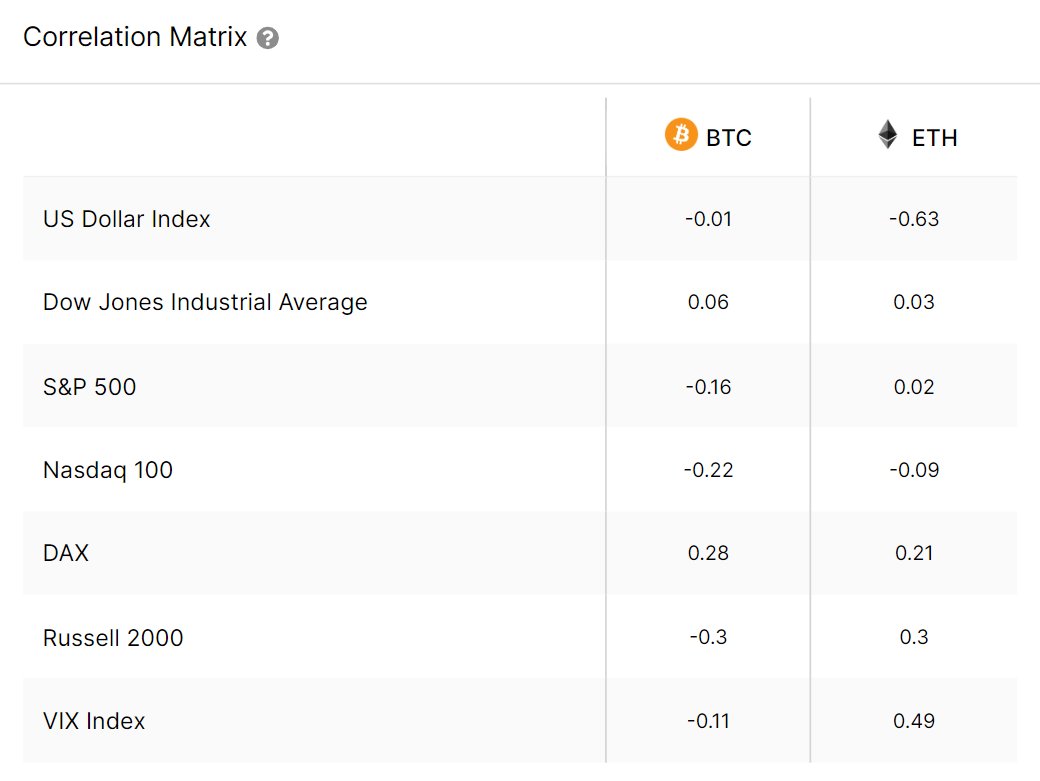

The correlation coefficient is zero or near zero, suggesting that there’s little correlation between the property. Now, here’s a desk from IntoTheBlock that exhibits what the correlation coefficient of the highest two cryptocurrencies, Bitcoin and Ethereum, appears to be like like for varied indexes proper now:

The correlation between BTC/ETH and 7 completely different main indexes | Supply: IntoTheBlock on X

As displayed above, the correlation coefficient between Bitcoin and the US Greenback Index is -0.01, that means that the cryptocurrency isn’t tied to the index.

Ethereum, then again, is exhibiting a point of correlation to the DXY, because the coefficient’s worth is -0.63 at present. The unfavourable worth naturally implies ETH has been shifting towards the index.

For the remainder of the indexes, each BTC and ETH have a correlation coefficient worth between -0.3 and 0.3, implying that the digital property don’t have any actual relationship to them.

One exception within the case of Ethereum and is the VIX index. The second largest coin within the cryptocurrency sector at present has a correlation coefficient of 0.49 with this inventory market volatility index, which is a notable worth.

The 2 digital property having little correlation to conventional property just like the S&P 500 and Nasdaq 100 could also be excellent news for his or her buyers, because the cash current a portfolio diversification avenue.

Nonetheless, Bitcoin and Ethereum don’t supply a lot diversification, as some current knowledge revealed that ETH and lots of different prime property within the sector are extremely correlated to BTC.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $26,500, down 1% in the course of the previous week.

Appears like BTC has plunged in the course of the previous day | Supply: BTCUSD on TradingView

Featured picture from Pierre Borthiry – Peiobty on Unsplash.com, chart from TradingView.com

[ad_2]

Source link