[ad_1]

On-chain knowledge exhibits the Bitcoin trade provide has resumed its downtrend just lately, after earlier deviating in direction of an increase.

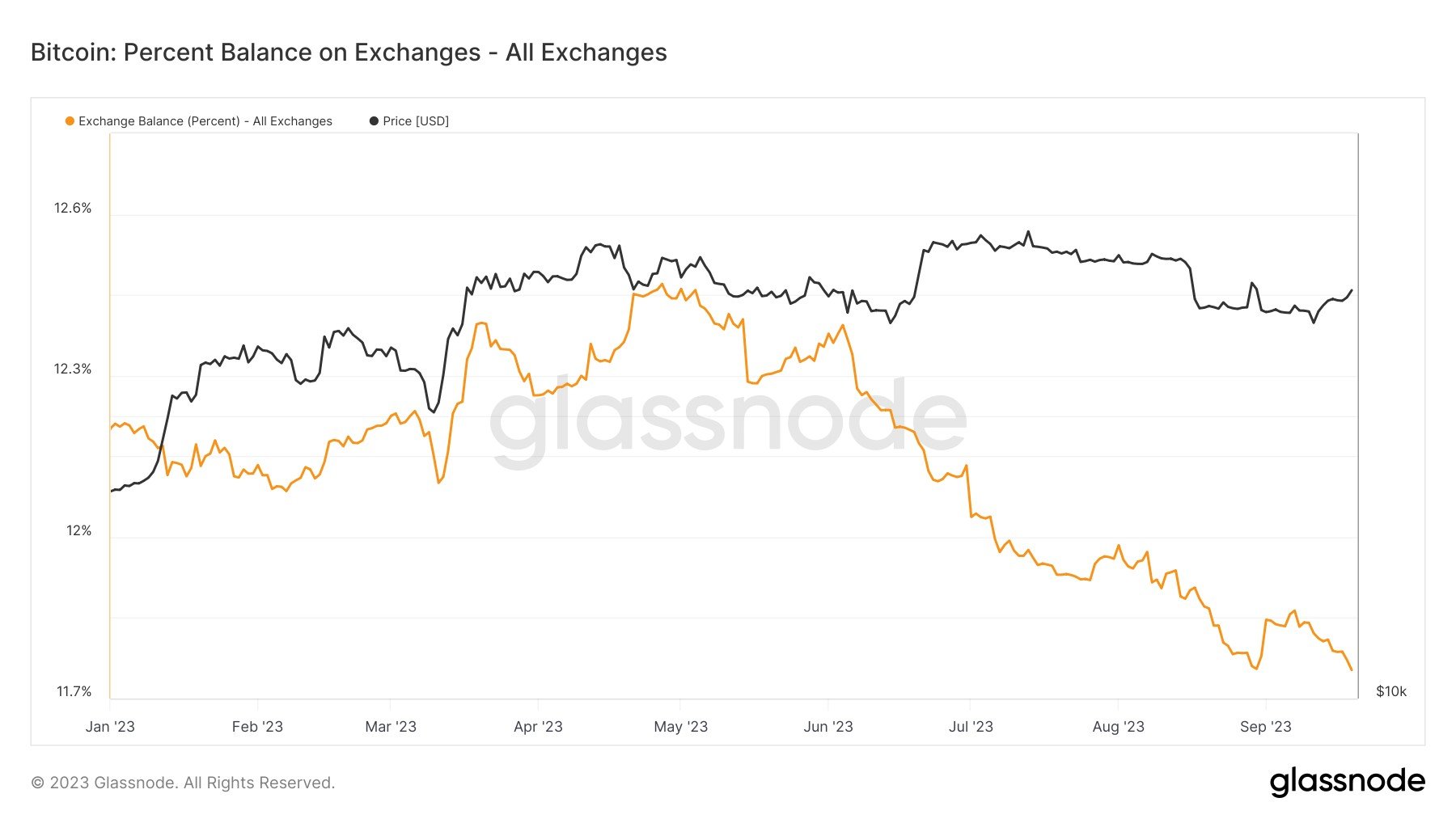

Bitcoin P.c Provide On Exchanges Has Dropped To 11.8%

As identified by an analyst in a submit on X, the BTC trade provide is again to its year-to-date (YTD) lows. The related metric right here is the “% stability on exchanges,” which retains observe of the whole share of the Bitcoin provide that’s at present sitting within the wallets of all centralized exchanges.

When the worth of this indicator goes up, it implies that the buyers are depositing a web quantity of the cryptocurrency into these platforms. As one of many most important explanation why buyers make such transfers is for promoting functions, this sort of pattern can carry potential bearish results for the coin.

Then again, the metric’s worth taking place implies the holders are shifting their cash away from these central entities into their self-custodial addresses. Usually, buyers who present this conduct plan to carry for prolonged durations, so such a pattern could possibly be bullish for the value in the long run.

Now, here’s a chart that exhibits the pattern within the Bitcoin % stability on exchanges because the begin of the yr 2023:

The worth of the metric appears to have been taking place in the course of the previous few months | Supply: @jimmyvs24 on X

As proven within the above graph, the Bitcoin % provide on exchanges had been going up in the course of the beginning months of the yr, as BTC had noticed its rally. These deposits have been doubtless being made by sellers trying to e book their income.

Since June, nevertheless, the provision on exchanges has adopted a pointy downtrend, implying that buyers have been consistently taking their cash out from these platforms.

Apparently, that is even if BTC had initially noticed an additional uptrend on this interval, suggesting that the accumulators had outweighed any revenue sellers who regarded to reap the benefits of the chance.

Earlier within the month of September, the indicator had reversed its pattern, as exchanges noticed web deposits of about 25,000 BTC. This rise couldn’t final for too lengthy, nevertheless, because the metric has come again down within the days since then.

At the moment, the Bitcoin % provide on exchanges has hit the 11.8% mark, which is the bottom worth noticed because the begin of the yr. Naturally, which means the prior rise has been utterly retraced.

It’s arduous to say what penalties these continued withdrawals might need for the cryptocurrency within the brief time period, as the web outflows previously few months haven’t been capable of save the asset from its drawdowns.

From the long-term perspective, although, provide repeatedly shifting towards self-custody is actually a constructive signal, because it results in the coin turning into extra decentralized.

Because the chaos of the bankruptcies of main platforms like 3AC and FTX taught us final yr, the less cash that sit on these central entities, the higher it’s for the soundness of the market.

BTC Worth

The Bitcoin rally has hit the brakes just lately because the cryptocurrency has been unable to search out any sustained break towards greater ranges. At current, the coin is buying and selling at $27,100.

Appears to be like like BTC remains to be floating above the $27,000 stage | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link