[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

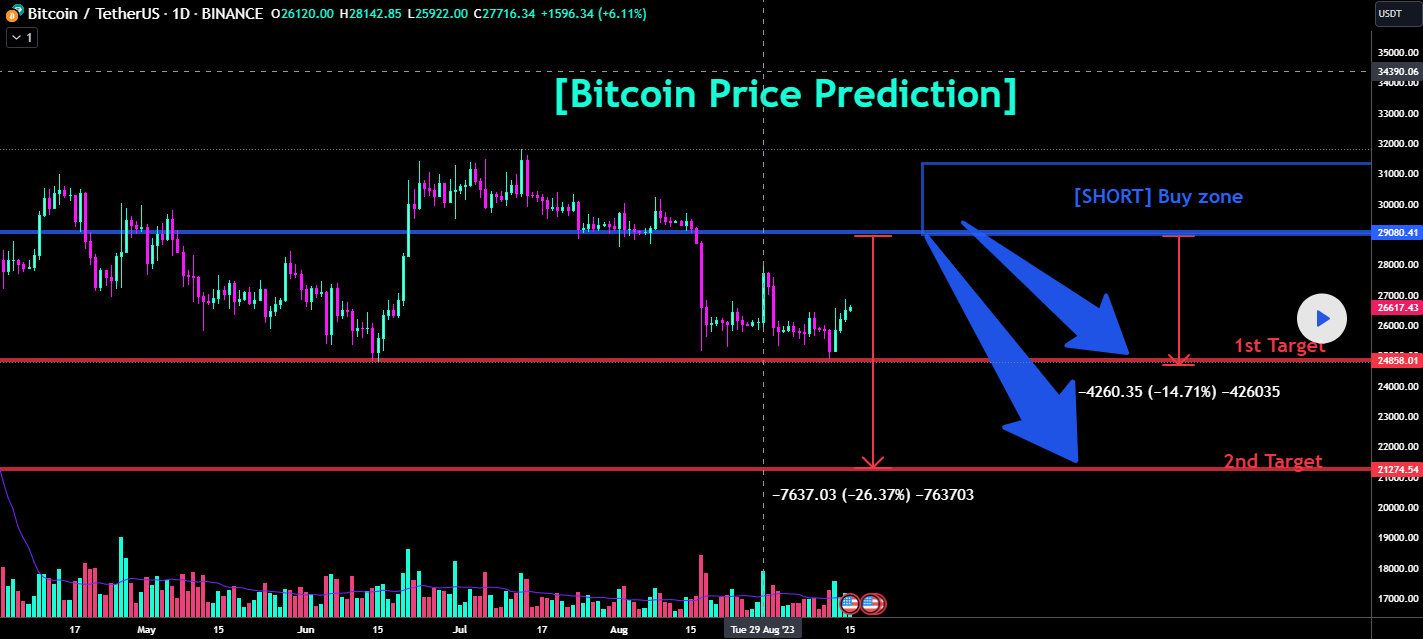

Bitcoin’s worth lately surged, permitting it to maneuver away from the $25k assist and return to a mid-$26k stage. It’s too early to say that the coin is beginning a major rally, however the final a number of days have seen bullish worth motion, which inspired extra patrons to return to Bitcoin.

On September 12, Bitcoin worth, which was at $25.2k on the time, out of the blue shot as much as face resistance at $25.82k. After struggling to breach it for a number of hours, Bitcoin lastly managed to do it. Instantly, it shot additional up, going previous the resistance at $26k and approaching the following one at $26.4k.

This fast surge triggered a worth rejection as soon as the coin’s worth began approaching the resistance, which was too sturdy then. BTC dropped again to $25.82k, solely to bounce up on September 13 and once more attempt to breach $26.4k.

The resistance as soon as once more rejected the value, though BTC managed to remain above the $26k stage this time. This allowed it to make a number of extra makes an attempt at progress and at last transcend $26.4k on September 14. This time, it encountered a barrier at $26.8k, and during the last 24 hours, Bitcoin worth has been busy making an attempt to breach this stage. To this point, it has been unsuccessful, however it has but to again down.

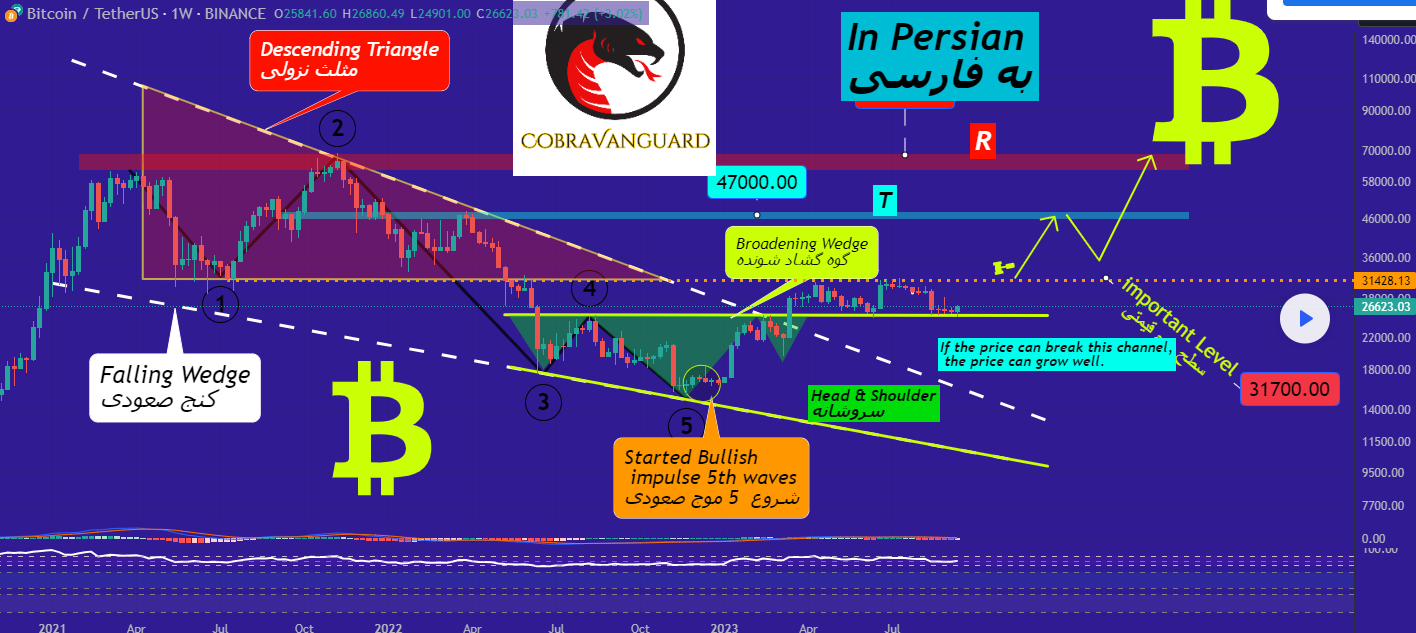

Some imagine the coin will see one other bullish wave pushing it previous this barrier and additional up — possibly even again to $30k, the peak it has not seen since mid-July.

Nonetheless, some analysts have differing views and even advise that that is the unsuitable time to go lengthy, as stop-losses are too lengthy.

BlackRock is likely to be shifting from Bitcoin to XRP

Whereas Bitcoin did see optimistic efficiency over the previous few days, there have been rumors within the crypto trade that carry some damaging improvement for the coin. One notably stands out is that BlackRock may flip to XRP fairly than persevering with to push BTC.

🚨RUMORS: Large Monetary Giants like “BlackRock” could also be reconsidering their stance on #Bitcoin and could also be eyeing alternate options like #XRP! 👀🔥 pic.twitter.com/88HgHmXj5v

— JackTheRippler ©️ (@RippleXrpie) September 14, 2023

It’s price noting that each one sources have identified that these are simply rumors, that are speculative and unconfirmed. Nonetheless, if the tales are correct, this might considerably impression the way forward for Bitcoin’s worth. The consultants name it “a shift in institutional confidence,” noting that establishments have gotten extra prepared to contemplate sustainable and environment friendly digital property.

🚨 BREAKING NEWS 🚨: Rumors are swirling that main monetary giants like BlackRock could also be reevaluating their stance on #Bitcoin and doubtlessly eyeing alternate options like #XRP. With billions at stake, the implications for the crypto market may very well be vital. As traders, we…

— WallStreetBulls (@w_thejazz) September 13, 2023

Is Deutsche Financial institution chargeable for latest surge?

Sudden shifts within the crypto market have a trigger, as developments not often change rapidly and drastically. In trying to find a possible motive for Bitcoin’s sudden transformation from bearish to bullish, analysts have identified the latest information from the Deutsche Financial institution.

The German lender lately revealed that it’ll launch custody providers for cryptos and tokenized property, providing them to institutional prospects. The transfer is available in partnership with Taurus, a Swiss fintech firm.

Deutsche Financial institution’s world head of securities providers, Paul Maley, mentioned: “Because the digital asset house is anticipated to embody trillions of {dollars} of property, it’s certain to be seen as one of many priorities for traders and companies alike. As such, custodians should begin adapting to assist their shoppers.”

Bitcoin BSC presale hits $2 million milestone

Solely days after elevating its first million, a Binance Sensible Chain-based undertaking, Bitcoin BSC (BTCBSC), reached its second million. The undertaking, which gives a BEP-20 model of Bitcoin, seeks to permit its patrons to purchase BTC the best way it was again in 2011 when its worth was solely $1.

Its supply has encountered colossal demand, and crypto customers rushed in to purchase the token, which prices solely $0.99. The presale will proceed till the tender cap of $3.96 million is reached. After that, the undertaking will begin providing staking providers, releasing rewards each 10 minutes.

Associated

Ends Quickly – Wall Road Memes

Early Entry Presale Reside Now

Established Neighborhood of Shares & Crypto Merchants

Featured on Cointelegraph, CoinMarketCap, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tier One Change Listings September 27

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link