[ad_1]

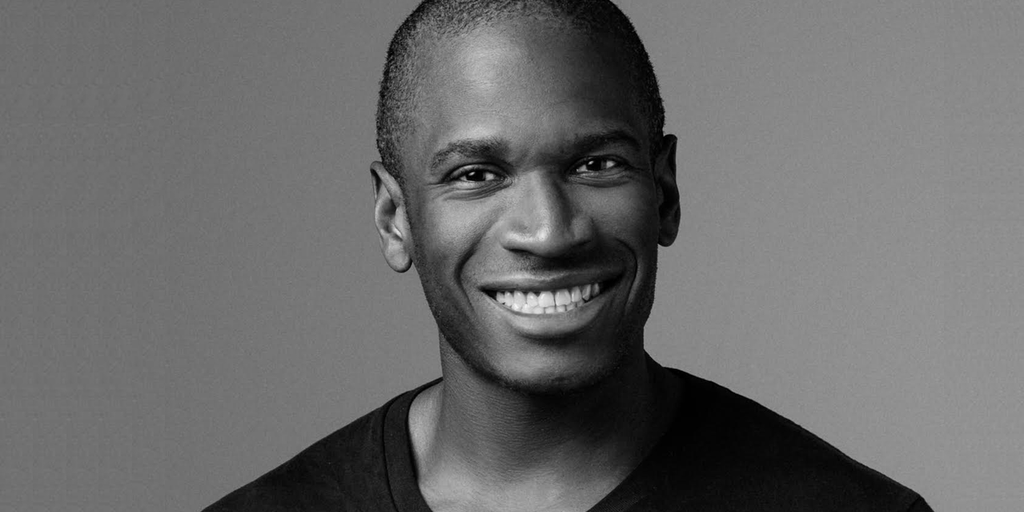

Bucking the standard knowledge about Bitcoin’s relationship with rates of interest, fashionable macro-analyst Arthur Hayes revealed a weblog put up arguing that such conventional financial logic will crumble beneath the U.S. authorities’s exorbitant quantity of debt.

“Central banks and governments are flailing about making an attempt to make use of the financial theories of yesteryear to fight the novel conditions of the current,” Hayes wrote on Monday.

Since final yr, the Federal Reserve has raised its benchmark price from 0.25% to five.25% in an try and carry inflation again all the way down to 2%. Although its efforts have confirmed profitable up to now, Hayes thinks inflation might show “sticky” going ahead, as nominal GDP progress exceeds authorities bond yields.

In accordance with Hayes’ estimates—based mostly on knowledge from the Atlanta Fed’s GDPNow forecast—nominal Q3 GDP progress stays at a “mind-bogglingly large” 9.4%, whereas the 2-year US Treasury yield is barely 5%.

“Standard economics says, because the Fed raised charges, progress in a really credit-sensitive economic system would falter,” Hayes wrote. This proved true for monetary asset markets like shares and Bitcoin, which cratered in 2022 and washed away capital positive factors tax receipts for the federal government, he stated.

But decrease tax income additionally meant increased authorities deficits, which have to be funded by promoting extra bonds to repay previous debt. For the U.S. authorities, meaning extra curiosity funds to the nation’s rich bondholders—that are exacerbated by the upper yield on such bonds in a high-rate surroundings.

“To sum up: when charges rise, the federal government will increase curiosity funds to the wealthy, the wealthy spend extra on companies, and GDP pumps much more,” Hayes defined.

As long as the economic system continues to increase at a sooner price than the federal government can pay out via its debt, Hayes believes bondholders might search yield in additional rewarding “threat property” like Bitcoin.

In the same essay final month, Hayes argued that Bitcoin would win within the face of a tightening Fed, whose strategies might inadvertently enhance the cash provide.

“If the Fed believes that to kill inflation it should each elevate rates of interest and scale back the dimensions of its steadiness sheet, then it’s reducing its nostril to spite its face,” he wrote on the time.

Analysts usually view decrease charges nearly as good for Bitcoin and different threat property, as low cost cash leaves room for buyers to take a position for probably increased returns. In June, Coinbase analysts revealed a report arguing that Bitcoin’s 4-year cycles could also be attributable to low-rate central financial institution coverage.

Hayes nonetheless doesn’t low cost the optimistic affect of low charges on Bitcoin’s value, describing the asset’s connection to central financial institution coverage as a “optimistic convex relationship.”

“Issues turn into non-linear—and typically binary—on the extremes,” Hayes concluded. “The U.S. and the worldwide economic system is at such an excessive.”

Keep on prime of crypto information, get every day updates in your inbox.

[ad_2]

Source link