[ad_1]

In a current collection of tweets, Vetle Lunde, Senior Analyst at K33 Analysis, delved deep into the potential ramifications of the US Bitcoin (BTC) spot ETFs. Lunde’s evaluation means that the broader market is perhaps considerably underestimating the transformative energy of those monetary devices.

Lunde’s assertion is rooted in 5 core causes. He started with a daring proclamation: “The market is mistaken – and dramatically underestimates the influence of US BTC ETFs (and ETH futures-based ETFs).”

Why The Market Is Mistaken On Bitcoin

Firstly, Lunde believes that the present local weather is ripe for the approval of US spot ETFs, suggesting that the chances have by no means been extra favorable. As NewsBTC reported, Bloomberg consultants Eric Balchunas and James Seyffart just lately raised their Bitcoin spot ETF approval odds following the Grayscale judgment to 75% this 12 months, 95% by the tip of 2024.

Secondly, Lunde identified that BTC worth has retraced to pre-BlackRock announcement ranges. The third purpose revolves across the potential competitors and the simultaneous launches of a number of US spot ETFs. Lunde anticipates that these, if authorized, may result in sturdy inflows, probably surpassing the preliminary buying and selling days of each BITO and Goal.

For context, he highlighted that Goal noticed inflows of 11,141 BTC, and in its wake, subsequent ETF launches in Canada resulted in a whopping 58,000 BTC value of inflows inside a mere 4 months. Given the vastness of the US market in comparison with Canada, the influx potential is significantly larger.

The fourth purpose Lunde introduced relies on historic information from the previous 4 years. He emphasised a noticeable correlation between sturdy BTC funding car inflows and appreciating BTC costs. This relationship turns into much more pronounced in periods of utmost inflows, which have traditionally contributed to important market uplifts.

The final essential level for Lunde is that on August 17 the market removed from extra leverage, as NewsBTC reported.

By The Numbers

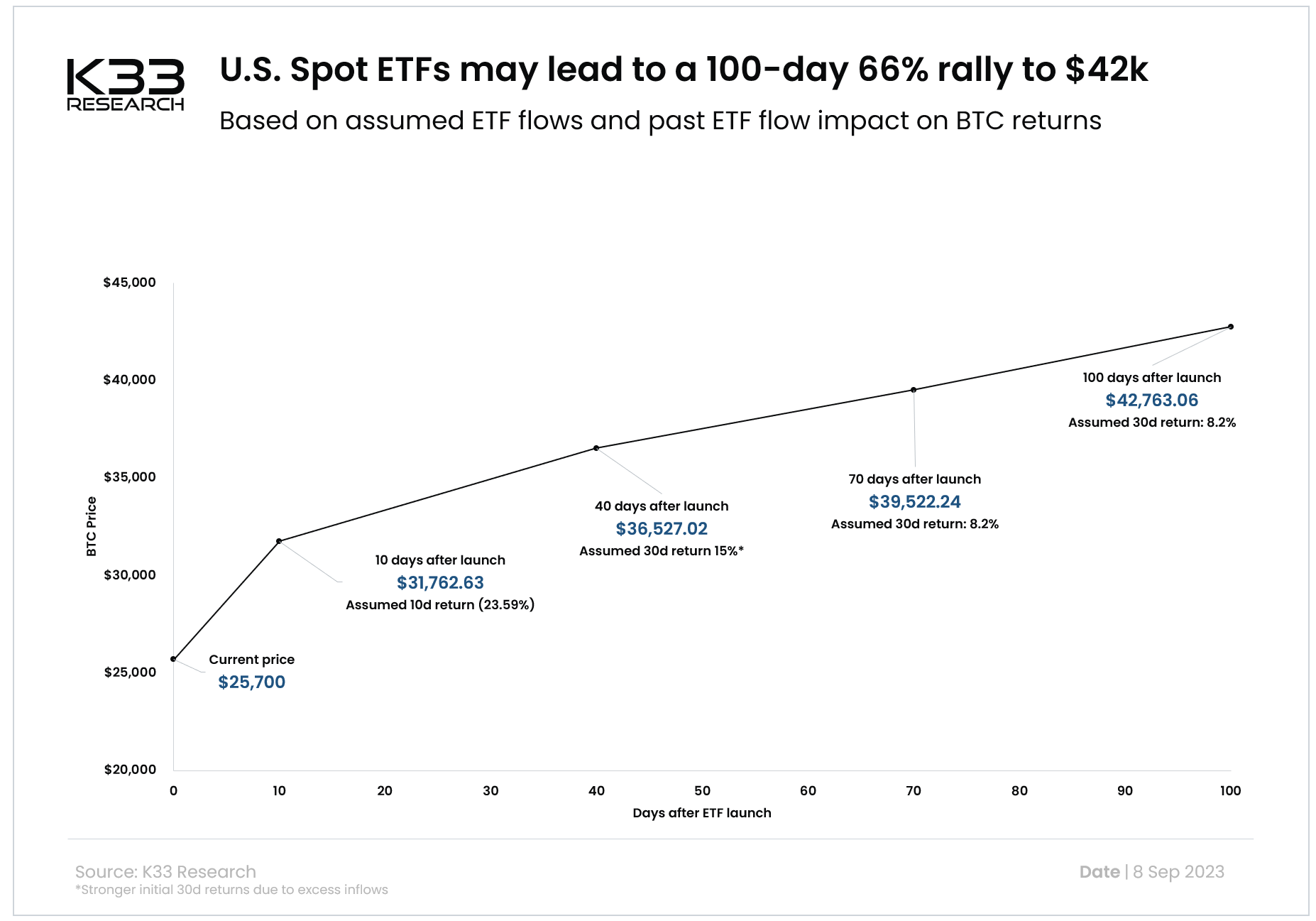

In conclusion, the analysis agency posits that US BTC spot ETFs may see at the very least 30,000 BTC value of inflows of their first 10 days. Over a span of 4 months, the mixed inflows into BTC funding autos may vary between 70,000 to 100,000 BTC, pushed by US spot ETFs and rising inflows to ETPs in different international locations.

Primarily based on these circulation assumptions and information from the previous 4 years, Lunde suggests a possible 66% BTC rally, focusing on a worth of $42,000. Nevertheless, he additionally cautioned that this projection relies on a “naïve assumption” and doesn’t account for different market-moving occasions.

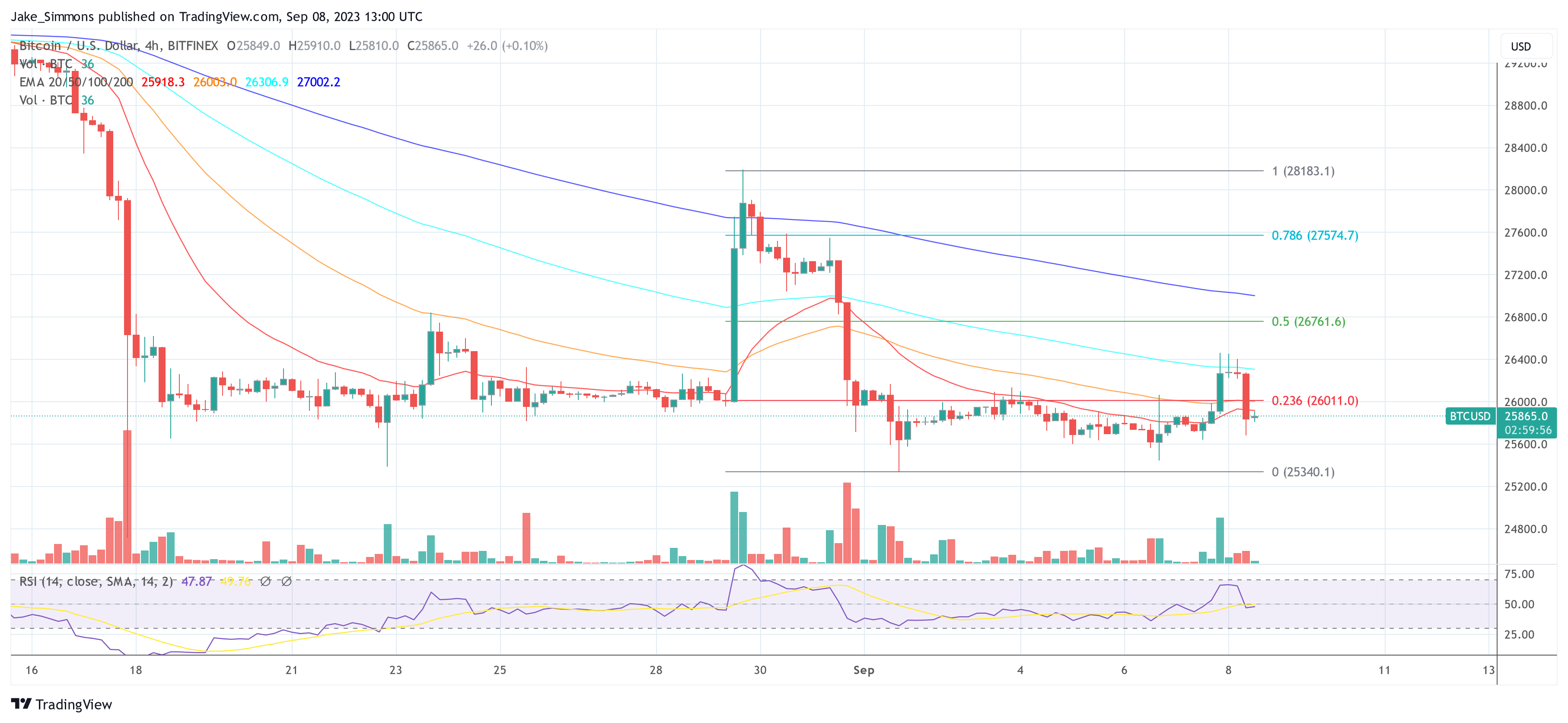

At press time, BTC traded at $25,865.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link