[ad_1]

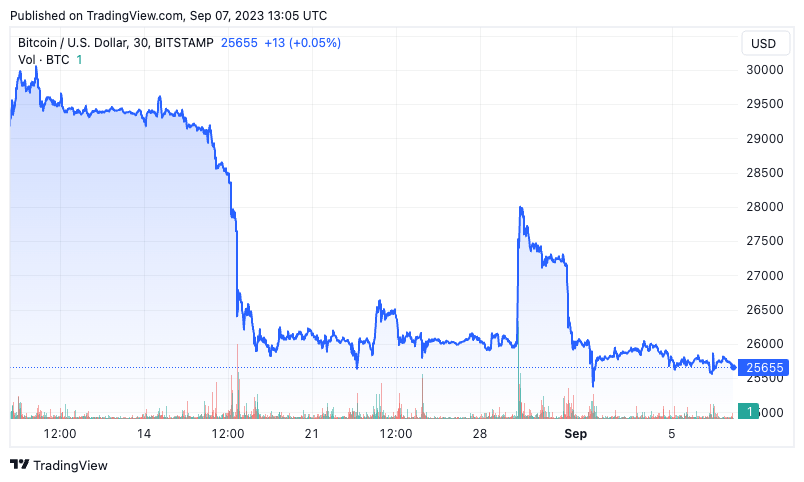

Bitcoin’s drop from $29,000 in mid-August has considerably modified market dynamics. Regardless of the short-lived soar to $27,000 following the information about Grayscale’s win in opposition to the SEC, Bitcoin continues to be hovering round $25,700.

A deeper dive into on-chain metrics reveals that this downward strain primarily comes from short-term holders offloading their belongings.

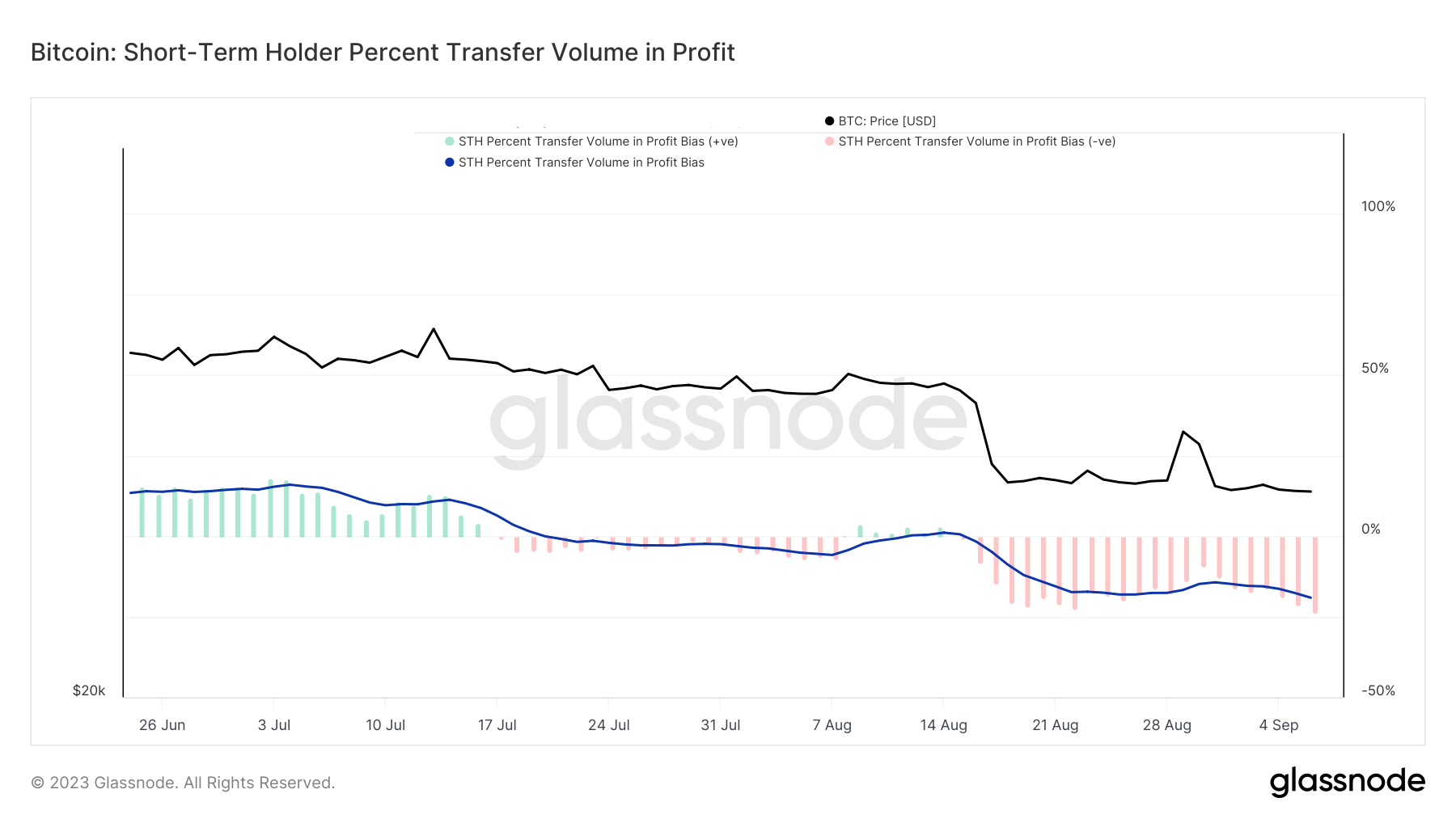

One of the telling metrics on this situation is the short-term holder p.c switch quantity in revenue. This metric affords insights into the bias of on-chain worth settled by short-term holders, both in revenue or loss.

A optimistic worth signifies that over 50% of the short-term holder switch quantity is in revenue, whereas a detrimental worth suggests the other, signaling that greater than half of the short-term holder switch quantity is in loss.

Information from Glassnode exhibits a dip within the STH switch quantity revenue correlating with Bitcoin’s decline from $29,400. As of Sep. 6, the STH switch quantity bias stood at –23.5 %, indicating that a good portion of the switch quantity from short-term holders was at a loss.

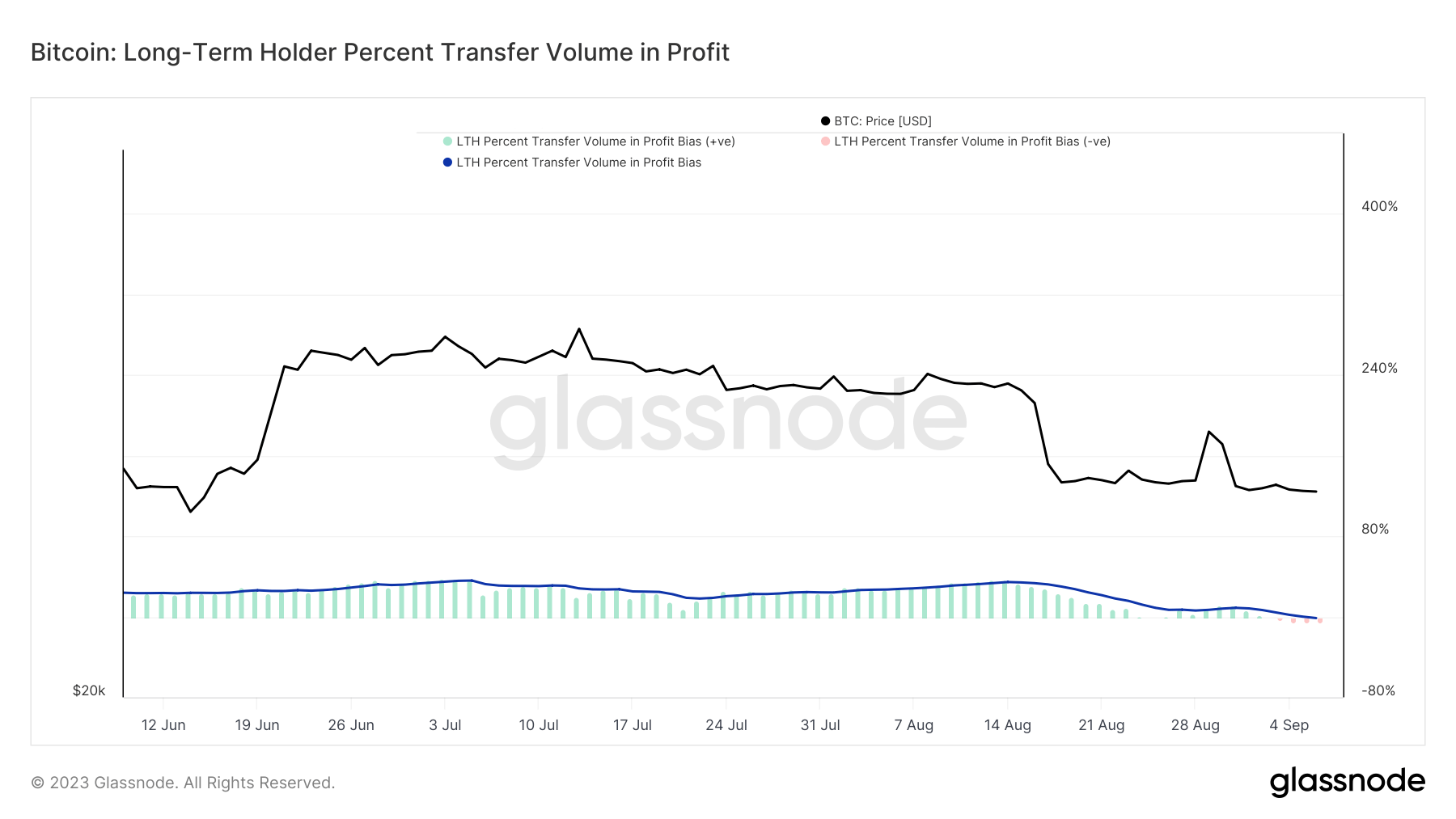

Contrastingly, long-term holders exhibit a extra resilient stance. Their metrics started to point out transfers in loss solely as of Sep. 3. By Sep. 6, the long-term holder p.c switch quantity bias was recorded at -5.5%, indicating that the majority long-term holders stay in revenue regardless of the market’s latest turbulence.

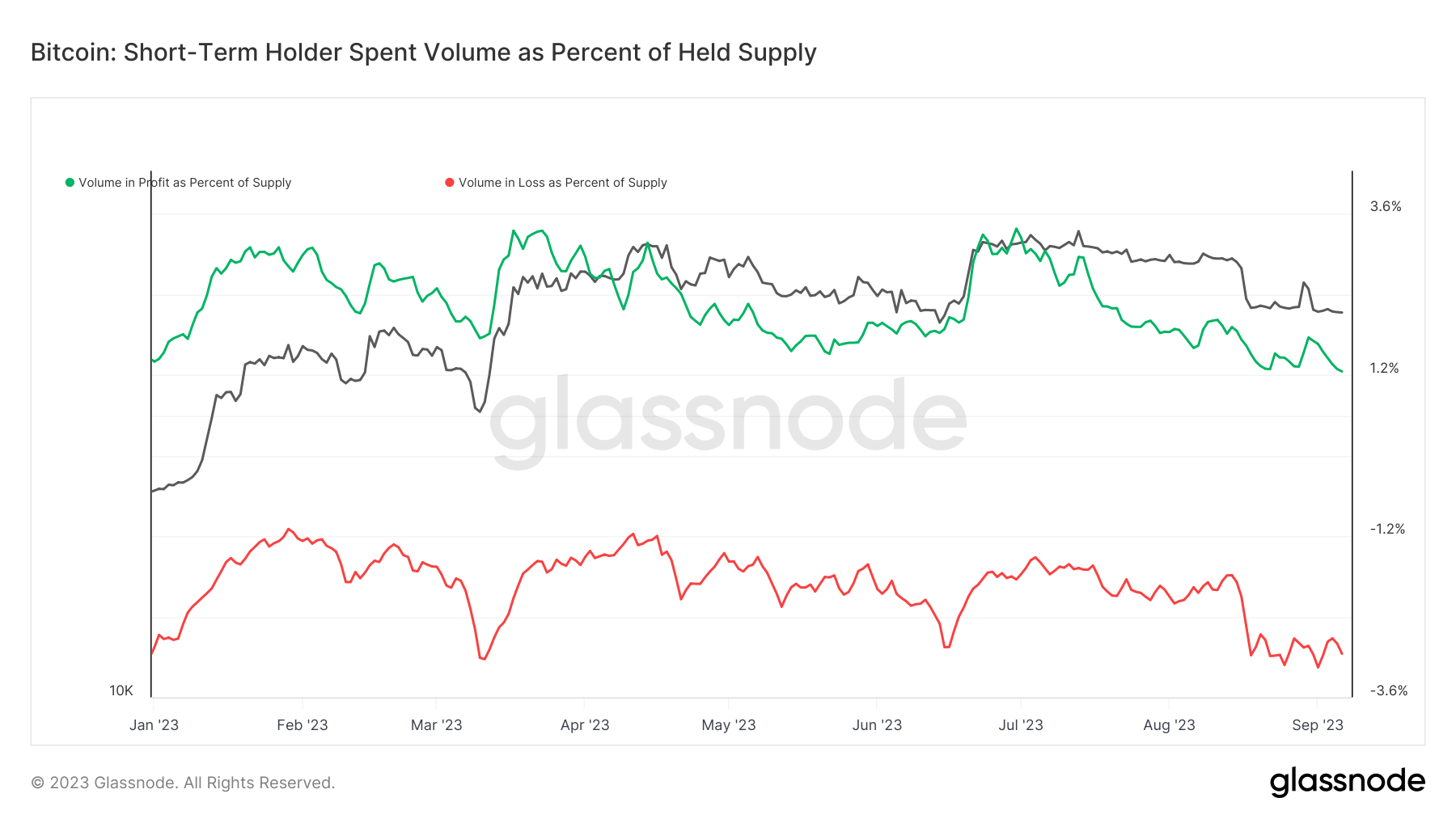

One other metric price noting is the short-term holder spent quantity as a share of held provide. This metric showcases the proportion of on-chain switch quantity by short-term holders relative to their whole maintained provide. Traditionally, vital actions on this metric have been related to high-volatility occasions. On Sept. 3, 3.1% of the full short-term holder provide transacted at a loss. The final time such a excessive share was noticed was in mid-March, correlating with Bitcoin’s value plummeting from $23,000 to $20,000.

The heightened promoting strain from short-term holders might point out a insecurity in Bitcoin’s short-term value trajectory. Nonetheless, the resilience proven by long-term holders suggests a continued perception in Bitcoin’s long-term worth.

The submit Brief-term holders bear the brunt of Bitcoin’s volatility appeared first on CryptoSlate.

[ad_2]

Source link